Elthoequity.com Review : Red Flags

Introduction

In the world of online investing, many platforms promise big returns, personalized account management, and advanced tools. Elthoequity.com is one of the newer names that has been getting attention. On its face, it appears professional and modern — polished website, sleek design, claims of sophisticated trading tools. But beneath that exterior there are many troubling indicators that suggest it may be a deceptive operation. This review breaks down how Elthoequity.com appears to operate, what red flags emerge, and how potential investors might protect themselves.

First Impressions: Sleek Presentation, Vague Substance

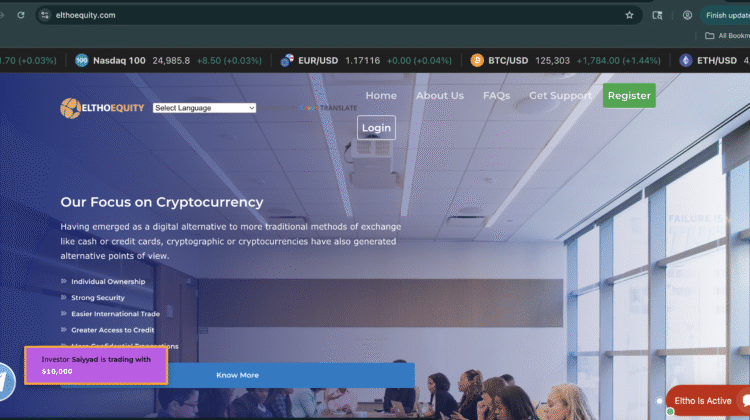

When you first land on Elthoequity.com site, what you notice is design quality. It often features modern graphics, interactive dashboards, quotes about innovative algorithmic trading, and references to “elite investor programs.” Marketing language is strong: phrases like “maximize your portfolio,” “consistent returns,” “secure trading,” and “personalized advisory” are front and center. The site may show testimonials, portraits of satisfied investors, “success stories,” and images that evoke trust — trophies, offices, stock charts.

This kind of polished exterior can be quite convincing, especially for people new to investing. However, a shiny website does not prove legitimacy. Always ask: Where is the proof? Who stands behind this? What regulation applies? Elthoequity.com gives little in response to those questions.

Regulation & Transparency: Key Omissions

One of the most disturbing gaps with Elthoequity.com is its lack of verifiable regulation. Legitimate brokers or investment firms are usually able to show:

-

A license from a recognized financial authority

-

Registration number and region of regulation

-

Physical address, detailed company information including named directors

Elthoequity.com, by contrast, makes sweeping claims such as “fully compliant” or “licensed in multiple jurisdictions” but fails to show any specific regulator names, no public license or registration number that can be checked, and minimal verifiable corporate detail. The “Team” / “About Us” section may list people but with no credible background information, no verifiable track records, and sometimes no photos or photos that appear generic or reused.

Transparency is essential in finance. When a platform lacks it, the risk of misconduct increases sharply.

How Elthoequity.com Likely Operates: Scam Mechanics

Based on patterns in similar operations and what users report, here’s a likely breakdown of how Elthoequity may function behind the scenes:

1. Marketing & Promise of High Returns

Elthoequity.com adverts tend to promise more than what realistic markets permit: stable returns regardless of market volatility, “guaranteed profit,” or returns that are unusually high. They may also emphasize low risk, minimal effort, or automated trading to reduce perceived barriers.

2. Easy Sign-Up & Initial Deposit

They often allow people to register quickly, with minimal verification initially, and encourage a first deposit that seems modest. That gives people confidence without a big leap.

3. Assigned “Account Manager” or “Personal Advisor”

After sign-up, clients are contacted by someone described as an advisor. This person may appear helpful and responsive. They may walk you through promised returns, show past “stats,” and encourage upgrading your account or depositing more money with promises of better returns.

4. Dashboard Showing Profits: Illusory Gains

A key tactic is showing “profits” in the dashboard soon after deposit. The user sees their account balance rising — sometimes steadily. These are often fake or manipulated numbers meant to build trust.

5. Upgrades and Larger Deposits

Once a user sees these gains, the account manager may push to deposit more, upgrade to a higher account tier, access exclusive strategies, or unlock “premium” features. The message is: invest more now to get much higher returns.

6. Withdrawal Delays or Barriers

When a request to withdraw arises, obstacles begin. These may show up as: demands for extra identity documents, compliance checks, “unlock fees,” taxes, “platform fee,” or needing to maintain minimum balances. Some of these may be plausible in regulated firms, but in this case they often appear vague, shifting, or contradictory.

7. Communication Break-downs & Disappearance

As larger amounts are deposited and withdrawals become imminent, support often becomes harder to reach. Emails unanswered, “advisors” disappear, phone numbers disconnected. Then the site sometimes disappears entirely or access is blocked.

Red Flags That Elthoequity.com Exhibits

Here are many warning signs that strongly suggest is not acting like a legitimate investment service:

-

No Verifiable Regulation: Claims without named regulator or registration number.

-

Hidden Ownership and Anonymous Domain Registration: The domain is registered privately; no public name or verifiable address.

-

Guaranteed or Fixed Returns: Promises of returns that are stable, high, or “risk-free.” Real markets are volatile.

-

Pressure to Deposit More / Upgrade Accounts: Frequent upsell by advisors to invest more in special tiers.

-

Fake Performance Data: Dashboard profits that are too consistent, unrealistic, or not aligned with market movements.

-

Withdrawal Conditions That Appear Late: Suddenly new fees or rules appear only when someone requests withdrawal.

-

Lack of Independent or Critical Reviews: Most online feedback is either from people who haven’t tried withdrawing, or from glowing “testimonials” without verifiable identity.

-

Use of Crypto or Non-Reversible Payment Methods: Asking for payments via cryptocurrency or other irreversible channels increases risk.

-

Vague Legal / Terms & Conditions: Legal section that is hard to understand, vague about dispute resolution, missing key sections on risk disclosure.

-

Frequent “Success” Imagery & Emotional Selling: Use of images, video clips, social proof pushing urgency and emotion rather than facts.

When many of these appear together, the risk is very high.

Psychological Strategies Employed

Elthoequity.com uses several psychological levers common in investment scams:

-

Fear of Missing Out (FOMO): Suggesting exclusive windows, limited spots, time-sensitive offers.

-

Authority Illusion: Claiming expert advisors, using financial jargon, showing charts and stats to appear legit.

-

Trust via Small Wins: Early small profit displays, to build belief and get people to commit more.

-

Commitment Bias / Sunk Cost Fallacy: Once you’ve invested some, you are more likely to go deeper to avoid feeling the loss.

-

Reciprocity: Maybe offering bonus, or seeming to “help you” early on, to build personal rapport and loyalty.

What Victims Report: Patterns & Complaints

While there is no guarantee every case proves fraud, many people report nearly the same kinds of experiences with platforms like Elthoequity.com:

-

Being shown profits in dashboards but actual withdrawal requests either fail or are delayed indefinitely.

-

Being asked for extra fees at the last minute (taxes, verification, service fees) just before withdrawal.

-

Accounts or access being frozen or blocked after large deposits.

-

Contact persons (advisors) becoming unresponsive, or support vanishing entirely.

-

Emotional distress, regret, and financial loss when promised earnings never materialize in usable funds.

These stories are typical in many risky platforms, and Elthoequity.com seems to fit many of those descriptors.

Comparison to Known Scam Templates

Elthoequity shares many features with previously exposed scams:

-

Young, privately-registered domain hiding ownership.

-

Dashboard profit displays that cannot be cross-verified.

-

Withdrawal obstacles appearing only after significant investment.

-

Selling “premium” tiers or VIP levels as hooks.

-

Heavy reliance on marketing rather than financial disclosures (audits, verified trading history, transparent financials).

These align with known patterns used by fraudulent operations to sustain the illusion long enough to extract large sums.

What Would a Legitimate Platform Do Differently?

To contrast, here are what trustworthy, regulated investment or trading platforms typically provide — and which Elthoequity.com does not reliably appear to offer:

-

Publicly verifiable license or regulatory oversight.

-

Named management team with visible credentials.

-

Transparent, unambiguous terms & conditions, with clear withdrawal policies.

-

Independent audit reports or third-party verified statements.

-

Deposit and withdrawal histories confirmed by multiple users.

-

Multiple, trusted payment methods including regulated banking channels.

-

Customer support that responds clearly and promptly even when money is to be returned.

When a platform lacks many of those, risk is elevated.

Risks of Engaging with Elthoequity

If someone invests based on trust in Elthoequity.com without doing due diligence, the risks are substantial:

-

Losing invested capital, especially if withdrawals are blocked or conditions slip.

-

Discovering that purported profits are not real or not transferable.

-

Exposure of personal identification or financial information to possibly unregulated or malicious actors.

-

Emotional and financial stress, particularly if funds were borrowed or not easily replaced.

-

Finding oneself with no recourse, because the platform is not regulated, support disappears, or the entity is anonymous.

Final Thoughts

Elthoequity.com presents many of the hallmarks of a high-risk, potentially fraudulent investment operation. From the lack of verifiable licensing and ownership to the psychological tactics, opaque withdrawal policies, and likely manipulated gains, the weight of indicators suggest serious concerns.

While not every new investment site is a scam, the combination of red flags here is too strong to ignore. For anyone considering Elthoequity.com, the appropriate mindset is extreme caution. Always verify independently, start small (if at all), and demand transparency.

In the online investing world, trust must be earned openly — not claimed by polished graphics and empty promises. Elthoequity.com so far appears to make many claims without the backup evidence necessary to justify trust. Until it can show credible regulation, verifiable results, named management, and consistent user experiences of successful withdrawals, it remains a risky proposition.

Conclusion: Report Elthoequity.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Elthoequity.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Elthoequity.com , extreme caution is advised.