AtlasTradeOption.com Review — A Detailed Consumer Alert

Introduction

The world of online investing has never been more accessible — or more dangerous. In the digital age, thousands of trading platforms promise effortless profits through forex, crypto, or stock market strategies. Unfortunately, many of these websites are designed less to help investors grow their wealth and more to separate them from it.

Among the names that have recently caught attention is AtlasTradeOption.com, a platform that has been appearing in online discussions for questionable practices and troubling reports. While not officially sanctioned as a scam by any financial authority, multiple user complaints, opaque business structures, and withdrawal problems suggest a strong need for caution.

This article takes an in-depth look at AtlasTradeOption.com, its business patterns, reported user experiences, and red flags, helping you understand how to recognize and avoid similar high-risk operations.

The Facade of Professionalism

AtlasTradeOption.com website is sleek and sophisticated. It features live trading dashboards, promotional videos, and claims of AI-powered investment systems. The design is meant to inspire confidence — modern, fast-loading, and filled with financial jargon that makes it sound legitimate.

Visitors are greeted with claims such as “guaranteed weekly profits,” “zero risk trading,” and “expertly managed portfolios.” These phrases are designed to appeal to newcomers who might not yet understand that no legitimate trading platform can promise consistent returns without risk.

At first glance, AtlasTradeOption.com gives the impression of being a serious financial company. The branding, the charts, and even the professional-sounding representatives can make it seem real. But behind this appearance lies a pattern of behavior that many users find deeply concerning.

Reported User Experiences

After analyzing multiple user accounts and online reports, a common sequence of events appears across investor experiences with AtlasTradeOption.

1. Effortless Registration and Immediate Deposit Options

The onboarding process is extremely simple — users are asked for basic personal information and can deposit money through credit cards, bank transfers, or cryptocurrency. The website’s quick deposit process creates a sense of excitement and immediacy, encouraging impulsive investment decisions.

2. Contact from “Account Managers”

Shortly after creating an account, most users report being contacted by a personal “account manager” or “financial advisor.” These individuals sound confident, well-trained, and professional. They often emphasize their market expertise and promise to help clients earn fast profits.

However, their real goal seems to be increasing deposits. They use psychological tactics — flattery, urgency, and technical talk — to persuade investors to deposit more money.

3. Early “Profits” and Partial Withdrawals

One of the most convincing tactics used by platforms like AtlasTradeOption is showing users early success. Investors log in to find their accounts showing significant profits, sometimes even doubling within days.

To strengthen trust, small withdrawals (usually less than $200) are often approved without issue. This success story cements the illusion that the platform is legitimate, prompting investors to commit much larger sums.

4. Escalating Deposit Pressure

Once a user’s confidence is built, the tone shifts. Account managers start promoting “exclusive opportunities” — higher-tier investment packages that supposedly deliver greater rewards. Phrases like “limited-time offer,” “VIP investor access,” or “private trading pool” are used to create fear of missing out (FOMO).

Users are told that larger deposits unlock features such as algorithmic trading, early cryptocurrency signals, or insider market data. These upsells are a hallmark of high-risk investment operations designed to maximize intake before problems arise.

5. Withdrawal Problems Begin

Trouble usually starts when investors try to withdraw larger sums. Some users are told their accounts are “under review” for compliance checks, while others are asked to pay additional taxes, verification fees, or “liquidity charges” to unlock their funds.

In many reported cases, once these additional payments are made, communication slows or stops altogether. Emails go unanswered, calls are ignored, and chat support disappears. Investors are left watching their “trading accounts” — often just digital dashboards — freeze without access to real funds.

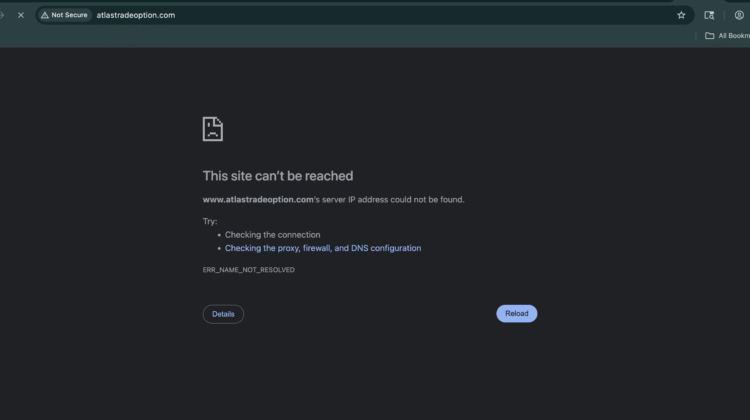

6. Website or Domain Changes

A final and common pattern involves the platform vanishing or rebranding. Complaints often appear just before the website goes offline, only for a nearly identical site to emerge weeks later under a new name with the same design and marketing claims.

Major Red Flags

Based on user experiences and professional analysis, several red flags make AtlasTradeOption.com a high-risk platform.

1. Unrealistic Promises

Any platform guaranteeing fixed daily or weekly profits is immediately suspicious. Genuine investments always carry risk; legitimate brokers make this clear upfront.

2. Lack of Regulation

AtlasTradeOption.com website does not provide verifiable regulatory information. Legitimate brokers are required to display their license numbers, the authority that issued them, and details for complaint procedures.

When platforms claim to be “registered” but provide no documentation, it’s a significant warning sign.

3. Anonymous Company Ownership

A legitimate financial service should disclose its corporate identity — full company name, directors, and office address. AtlasTradeOption’s website provides vague details, often citing offshore jurisdictions known for light regulatory oversight.

This anonymity makes it nearly impossible for investors to know who they are dealing with.

4. High-Pressure Deposit Tactics

Many users report feeling rushed into making larger deposits. The tone of communication shifts from supportive to urgent, emphasizing that opportunities are time-sensitive.

This tactic is designed to override rational thinking and push impulsive financial decisions.

5. Complex Withdrawal Barriers

When companies start adding “extra fees” or “tax prepayments” for withdrawals, it’s a telltale sign of deception. Legitimate brokers never require separate payments to release funds — such fees are always deducted from account balances directly.

6. Untraceable Payments

Platforms encouraging deposits via cryptocurrency or obscure payment gateways should be treated with extreme caution. Once funds are transferred this way, they are almost impossible to retrieve.

Psychological Manipulation

Understanding how platforms like AtlasTradeOption.com manipulate users helps reveal why even experienced investors fall victim.

-

Authority illusion: They use professional websites, charts, and confident “experts” to appear legitimate.

-

Social proof: Fake testimonials and supposed investor success stories give the illusion of popularity.

-

Reciprocity: Small withdrawal approvals create a false sense of trust.

-

FOMO: Constant reminders of “limited opportunities” or “fast-closing investment rounds” exploit emotional decision-making.

Recognizing these tactics can help you stay grounded when confronted with high-pressure sales language.

How to Protect Yourself

If you have interacted with AtlasTradeOption.com or similar platforms, the following steps can help reduce risk:

-

Stop sending additional funds immediately. Even if the platform claims you need to deposit more to unlock withdrawals, do not comply.

-

Document everything. Keep emails, chat transcripts, screenshots, and transaction receipts.

-

Notify your bank or card provider. Explain that you suspect you’ve been misled; they may assist in blocking future charges or initiating a dispute.

-

Secure personal data. Change passwords and monitor for unauthorized access to financial accounts.

-

Report the incident. File a report with local authorities or financial regulators. This helps track patterns and warn others.

While recovery may be difficult, early reporting strengthens official investigations and raises awareness about similar schemes.

Why Unregulated Platforms Persist

The rise of cryptocurrency and globalized finance allows high-risk platforms to operate across borders, avoiding traditional regulation. They often register in jurisdictions where oversight is weak or nonexistent.

These entities rely on the fact that most users do not verify regulatory licenses before investing. With professional websites and convincing marketing, it’s easy to appear legitimate to an unsuspecting audience.

Additionally, because deposits often occur via untraceable methods, such as crypto transfers, scammers can disappear without leaving a financial paper trail.

Safer Investing Habits

To avoid falling into traps like AtlasTradeOption.com, adopt these safer investment habits:

-

Verify all claims. Check official regulator databases (such as FCA, ASIC, or SEC) for active licenses.

-

Start small. Always test withdrawals with small amounts before committing significant funds.

-

Avoid untraceable payments. Use credit cards or regulated payment processors that offer dispute protection.

-

Research independently. Look for multiple reviews, complaints, and warnings before signing up.

-

Be skeptical of urgency. Real investment opportunities do not vanish overnight.

End Note

AtlasTradeOption.com exemplifies the risks of dealing with unverified online trading platforms. While its website may appear polished and professional, repeated user complaints suggest patterns of high-pressure deposits, withdrawal barriers, and opaque operations.

There is no concrete evidence of legitimate trading activity or verified regulation — only persuasive marketing and simulation-based dashboards. These are classic hallmarks of online investment schemes designed to mislead investors rather than manage funds transparently.

In today’s digital world, the most effective defense is education and skepticism. Always verify before investing, document everything, and avoid platforms that promise effortless profits.

True investing requires transparency, regulation, and time — qualities that AtlasTradeOption.com, by multiple accounts, does not seem to uphold.

Conclusion: Report AtlasTradeOption.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, AtlasTradeOption.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through AtlasTradeOption.com , extreme caution is advised.