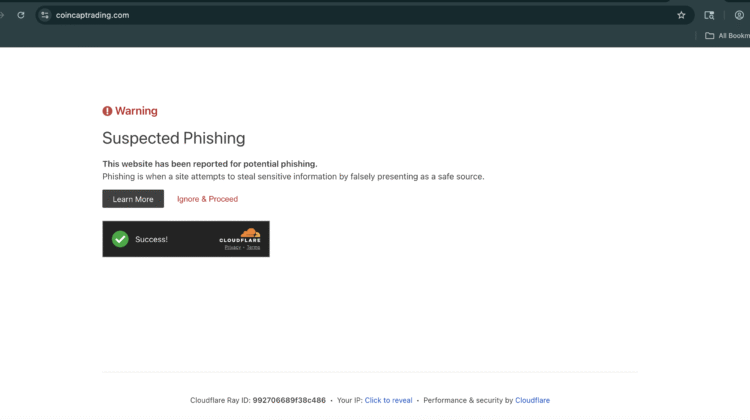

CoinCapTrading.com Review — Consumer Alert & Investigative Review

Introduction

First impression: professional design, persuasive promises

On first look CoinCapTrading.com may appear slick and convincing. Contemporary site design, trading dashboards, animated price charts, and phrases like “AI signal engine,” “institutional liquidity,” and “managed accounts” create an impression of competence. Sales copy often emphasizes speed, ease, and high returns — the kind of messaging that appeals to people who want quick exposure to crypto and forex markets.

A polished presentation can be persuasive, but design alone is not evidence of legitimacy. Many problematic platforms invest heavily in UX and marketing specifically to lower skepticism and accelerate deposits.

The recurring user narrative

Across multiple user reports and complaint threads (summarized here as patterns rather than legal findings), the experience with CoinCapTrading.com tends to follow the same sequence. Seeing the pattern helps you spot problems quickly.

-

Fast signup, immediate deposit options.

Accounts are created in minutes and multiple deposit routes are offered (card, bank transfer, sometimes crypto). The interface credits deposits quickly, which psychologically reinforces engagement. -

Personal outreach from an “account manager.”

Within hours a named advisor contacts you. They sound professional, explain “strategy,” and suggest an initial test deposit. Their early tone is friendly and instructional. -

Simulated or inflated early returns.

The dashboard often shows rapid gains. Minor withdrawal requests (a small sum) may be honored to demonstrate “legitimacy.” These early wins are pivotal: they build trust and push users to deposit larger sums. -

Pressure to upgrade or deposit more.

The advisor pushes “VIP tiers,” “premium signals,” or “institutional pools” requiring higher investment. Urgency language — limited seats, expiring windows — commonly appears to short-circuit deliberation. -

Withdrawal obstacles.

When users request significant withdrawals the story changes: new KYC demands, alleged “processing” or “tax” fees, or claims that funds are “locked in active trades.” Requests for more money to “activate” withdrawals are a particularly dangerous pattern. -

Slowing communication and disappearance.

If the client refuses further payments, support becomes slow, evasive, or unresponsive. In some reports the site goes offline or the brand reappears under a different name.

Taken together these steps — entice, build trust, extract, obstruct — match the operational profile many consumers associate with risky, unregulated trading operations. Again: this is a synthesis of user reports and not a judicial or regulatory finding.

Concrete red flags to verify before you deposit

Before funding CoinCapTrading.com or any similar platform, check these objective items. Finding one is worrying; finding several is a strong reason to pause.

-

Regulatory transparency: Is there a verifiable license listed, and does that license appear in the regulator’s online registry? Be skeptical if the platform offers vague regulator names or screenshots instead of searchable license numbers.

-

Clear corporate identity: Can you find the legal company name, incorporation number, and a physical address that checks out? Anonymous ownership or P.O. box addresses are warning signs.

-

Withdrawal policy: Read the terms describing withdrawal windows, fees, and conditions. Any clause that permits additional “release” fees or requires new deposits before paying you is suspicious.

-

Payment method emphasis: Platforms that strongly encourage cryptocurrency or untraceable transfer routes increase risk — those payments are hard or impossible to reverse.

-

High-pressure sales behavior: Persistent calls, “limited-time” pressure, and constant urgings to upgrade are sales tactics, not fiduciary advice.

-

Guaranteed returns: Promises of guaranteed returns, risk-free trading, or unusually high fixed profits are unrealistic. Real trading involves losses as well as gains.

-

Consistent withdrawal complaints elsewhere: If you find multiple independent reports of blocked withdrawals, take them seriously — patterns across sources are meaningful.

Why these tactics are effective

Understanding the psychology helps explain why reasonable people fall for these offers:

-

Authority cues: Professional-sounding advisors and polished dashboards create perceived expertise.

-

Reciprocity: Processing a small withdrawal makes the user feel indebted and more trusting.

-

Escalation of commitment: Small initial deposits make larger follow-ups feel rational — people want to justify prior choices.

-

Fear of missing out (FOMO): Limited-time language short-circuits careful research and encourages impulsive deposits.

Recognizing those levers makes it easier to pause and reassess.

Immediate steps if you’ve deposited funds

If you’ve already funded CoinCapTrading.com and are seeing problems, act quickly. Time often matters for chargebacks, recalls, and freezing intermediary accounts.

-

Stop sending money immediately. Do not comply with demands for “release” or “tax” payments. Those are commonly used to extract more funds.

-

Preserve everything. Save screenshots of dashboards, emails, chat logs, advisor names and phone numbers, receipts, bank statements, and transaction IDs. These are essential evidence.

-

Contact your bank or card issuer now. Explain the situation and ask about chargebacks or payment disputes. Credit card and some bank transfers may be reversible if reported promptly.

-

Notify any intermediary (exchange, wallet, payment provider). If you used a crypto exchange or payment service, open a support ticket and ask if the recipient can be frozen or traced.

-

Change your passwords and secure accounts. If you reused login details or shared documentation, update passwords and enable two-factor authentication elsewhere.

-

File a police report. Local law enforcement reports create an official record; banks and regulators frequently request them for investigations.

-

Report to financial regulators and consumer protection agencies. Even if recovery isn’t guaranteed, official complaints help authorities detect and act against recurring operations.

-

Be cautious with “recovery services.” Unsolicited offers to get your money back in exchange for up-front fees are commonly secondary scams.

Longer-term recovery and prevention tips

-

Collect structured records. Organize evidence in a single folder (screenshots, emails, receipts, police report number). This speeds disputes and legal consultations.

-

Seek professional advice for large losses. For significant sums, a lawyer experienced in financial fraud can evaluate civil avenues and liaise with international partners.

-

Coordinate with other victims. If you can find others with the same experience, collective complaints attract more attention from regulators and media.

-

Use payment methods with recourse. In future, prefer credit cards or reputable payment processors that allow disputes, rather than irreversible crypto or wire transfers.

-

Test with small amounts. For any new platform, deposit a modest amount, trade, and withdraw to confirm the process before scaling up.

Final thoughts — skepticism is a financial skill

CoinCapTrading.com website may look authoritative, and an assigned “advisor” can sound convincing — but repeatedly reported patterns (fast onboarding, simulated early gains, upsell pressure, and withdrawal friction) are the exact behaviors that make many consumers report losses. This article aggregates those patterns to give you an actionable checklist and recovery roadmap.

If you’re researching CoinCapTrading.com or any new trading service, verify licenses directly with regulators, demand clear corporate details, test withdrawals with minimal funds, and never rush a deposit under pressure. Healthy skepticism is not paranoia — it is a practical skill that protects your money and privacy in an online world where presentation and persuasion are easily manufactured.

Conclusion: Report CoinCapTrading.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, CoinCapTrading.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through CoinCapTrading.com , extreme caution is advised.