Minax.io Review : Polished Investment Mirage

Introduction

In an era where online investment platforms appear by the dozen, offering financial freedom through a few clicks, the line between legitimate trading services and fraudulent operations has never been thinner. Among the countless platforms that have recently surfaced, Minax.io stands out — not because of its success, but because of its deception.

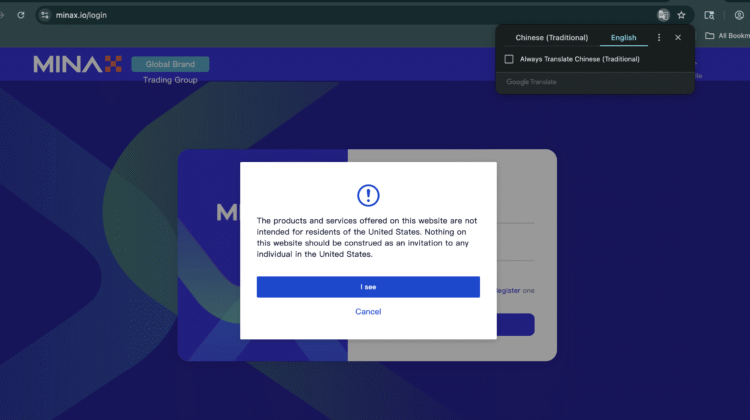

At first glance, Minax.io presents itself as a sophisticated and innovative investment hub. The website is sleek, the interface looks professional, and the promises are tempting: high-yield returns, advanced trading technologies, and expert financial management. Yet behind the glossy surface, Minax.io conceals a carefully orchestrated scam operation — one designed to manipulate, mislead, and ultimately defraud unsuspecting investors.

This comprehensive investigation breaks down the anatomy of the Minax.io scam — from its false image of credibility to the psychological strategies used to trap victims — exposing the illusion that countless investors have already fallen for.

The Illusion of a Trustworthy Investment Platform

Minax.io website, like many modern financial scams, is a masterclass in digital deception. Its layout imitates legitimate brokerage and asset management sites, complete with moving stock tickers, fake market graphs, and fabricated data feeds.

The company claims to specialize in cryptocurrency trading, forex investments, and passive income programs powered by “AI-driven analytics.” These buzzwords are strategically chosen — they sound futuristic and appealing to anyone eager to profit from modern finance.

Minax.io promotes itself as being “registered and fully compliant with international investment laws,” but those statements crumble under scrutiny. The registration details either point to shell companies or are entirely falsified. The so-called “license numbers” displayed on the site belong to unrelated entities, and no trace of Minax.io can be found in the databases of legitimate financial authorities.

Moreover, the site lists fake office addresses in major global cities — London, Zurich, and Singapore — giving the illusion of a multinational presence. When verified, these locations correspond to virtual offices or shared co-working spaces.

The goal of all this window dressing is simple: create just enough illusion of legitimacy to quiet any doubts in the minds of first-time visitors.

The First Contact: Hooking the Investor

Minax.io doesn’t wait for investors to stumble upon it organically. The platform’s operators actively seek victims through targeted online advertisements and aggressive marketing campaigns on social media.

These ads often feature exaggerated claims:

-

“Earn up to 30% monthly with no effort!”

-

“Start trading with our AI system and grow your wealth passively.”

-

“Join the world’s fastest-growing investment community.”

The links lead to Minax.io landing pages — highly polished and filled with fake testimonials, supposed success stories, and fabricated press mentions. Once a user enters their contact information, the real manipulation begins.

Within hours, a “representative” from Minax — often calling themselves a financial advisor or account manager — reaches out by phone or email. These individuals are trained professionals in persuasion and psychological manipulation. They sound confident, articulate, and reassuring, often referencing real economic events to appear knowledgeable.

Their first goal is simple: convince the target to make an initial deposit, usually between $250 and $500. They describe it as a “trial investment,” promising that profits will be visible within days and withdrawals can be made anytime.

The Deceptive Platform: Fake Profits, Real Losses

Once the victim deposits funds, they’re given access to Minax.io online trading dashboard — a fabricated environment designed to simulate real trading activity.

The interface mimics professional trading software, displaying fluctuating charts, open positions, and profit indicators. However, every figure on the screen is artificially generated. There is no real connection to any financial market; it’s all part of an elaborate illusion designed to make the investor believe their money is working and growing.

In the first few days, the victim’s balance often appears to rise dramatically. A $500 deposit might “grow” to $750 or $1,000 in a short time. These visible profits are not real — they’re scripted results controlled by the scammers.

This tactic plays on greed and excitement. Seeing instant returns, the investor begins to trust the system. They may even start recommending it to others. At this point, the “advisor” reappears, congratulating the investor on their “success” and encouraging them to increase their deposit to unlock “premium investment packages.”

Common upsell strategies include:

-

Promising access to “exclusive trading signals.”

-

Offering “partnership bonuses” for larger deposits.

-

Claiming that additional funds are needed to stabilize profits during “high volatility.”

Each explanation is tailored to sound convincing and professional.

The Psychological Manipulation

The operators behind Minax.io are skilled in exploiting human psychology. Their strategies rely heavily on three emotional triggers: trust, urgency, and fear.

-

Trust:

The “advisor” maintains regular contact with the victim, often calling multiple times a week. They speak with confidence and empathy, creating the illusion of a genuine financial partnership. This relationship disarms the victim, making them more susceptible to requests for additional deposits. -

Urgency:

The scammers frequently claim that a special investment opportunity is about to expire or that market conditions require immediate action. This creates a false sense of pressure, pushing the investor to act impulsively. -

Fear:

When victims hesitate to invest more, the advisor may introduce fake losses or suggest that partial withdrawal could jeopardize their account. Fear of losing the initial investment drives many victims to comply with whatever the “advisor” recommends.

These tactics are psychologically potent, especially for those who are inexperienced with trading or finance.

The Collapse: Withdrawal Denials and Disappearance

The illusion collapses when the victim attempts to withdraw their funds. Initially, small withdrawal requests may be approved to maintain trust. But when the investor tries to cash out a larger amount, the deception begins to unravel.

Suddenly, the company introduces new “requirements.” Victims are told they must pay taxes, verification fees, or transaction costs before their funds can be released.

Typical excuses include:

-

“Your profits are held under review due to compliance checks.”

-

“You must first pay a withdrawal clearance fee.”

-

“Your trading account has not reached the minimum withdrawal threshold.”

Each explanation sounds plausible at first, but the goal is always the same — to extract more money. Once the victim refuses or starts expressing doubt, communication rapidly deteriorates. Emails go unanswered, phone lines are disconnected, and eventually, the victim’s access to their account is blocked.

The once-bustling platform becomes a digital ghost town. The fake profits vanish, leaving only the memory of an investment that never truly existed.

The Machinery Behind Minax.io

The Minax.io operation follows a systematic structure seen across many fraudulent investment platforms. Each phase of the scam is designed to maximize profits while minimizing risk for the perpetrators.

-

Lead Generation – The operation uses digital marketing, fake press releases, and social media ads to lure potential investors.

-

Conversion Teams – Offshore call centers staffed by trained “account managers” convert leads into paying victims.

-

Platform Simulation – A custom-built fake trading platform displays fabricated data and simulated returns.

-

Retention Tactics – Victims are encouraged to deposit more funds, often under the pretext of accessing better trading conditions.

-

Exit and Rebrand – Once enough victims complain or authorities take notice, the domain is abandoned and replaced with a new brand using the same software template.

This rotating business model allows the operators behind Minax.io to continuously reappear under different names, targeting new investors while staying one step ahead of detection.

The Red Flags Exposing Minax.io

A close examination reveals several unmistakable warning signs:

-

No Verifiable Regulation – Minax.io claims to be licensed but does not appear in any legitimate financial registry.

-

Anonymous Team – No identifiable executives, analysts, or corporate structure.

-

Fake Address – The listed office locations correspond to virtual or unoccupied spaces.

-

Guaranteed Profits – Real trading involves risk; guaranteed returns are always a lie.

-

Crypto-Only Deposits – Payments in Bitcoin or Tether ensure that once funds are sent, they cannot be recovered.

-

Unrealistic Marketing – Overly polished testimonials, identical across multiple scam sites, betray the lack of authenticity.

Each of these elements alone would be concerning — together, they form an unmistakable pattern of fraud.

The Human Cost of Deception

Behind every lost dollar lies a human story — one of trust, hope, and betrayal. Victims of Minax.io range from young investors testing online trading for the first time to retirees seeking to grow their savings.

Many describe feeling humiliated after realizing they were manipulated. The emotional toll of being deceived by what seemed like a legitimate financial advisor is profound. For some, it’s not just about the money — it’s the loss of confidence, the sleepless nights, and the self-doubt that follow.

Scammers like those behind Minax.io exploit this vulnerability with calculated precision, leaving deep emotional scars that linger long after the financial loss.

The Bigger Picture

Minax.io is not an isolated entity; it’s part of a much broader ecosystem of fraudulent investment operations. These scams often share identical templates — the same web design, the same fake testimonials, and even the same call center personnel — recycled under new names as soon as exposure threatens the brand.

By recognizing these patterns, one can begin to see how deeply interconnected these scams are. They thrive on the same psychological manipulation, the same technical illusions, and the same cycle of deceit.

End Note

Minax.io represents the dark side of digital finance — a mirror reflecting how easily innovation can be twisted into exploitation. It is a carefully engineered illusion, using technology, persuasion, and psychology to transform trust into profit.

From fake trading dashboards to scripted “advisors,” every detail of Minax was crafted not to generate wealth for its clients, but to extract it from them.

What makes Minax.io particularly dangerous is not just its sophistication, but its familiarity. It looks, feels, and sounds like countless legitimate platforms — which is precisely why it succeeds.

In the end, Minax.io isn’t just a scam; it’s a symbol of modern financial deception. It stands as a reminder that behind even the most convincing façade of professionalism, there can lie a machine built solely for theft — running quietly until the illusion finally breaks.

Conclusion: Report Minax.io Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Minax.io raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Minax.io , extreme caution is advised.