XproMarkets.com Review : Investment Scam

XproMarkets.com Scam Review: Exposing the Fraud Behind the Facade of a “Global Trading Platform”

In the fast-growing world of online investments and forex trading, many new platforms appear every month promising life-changing profits and expert guidance. Unfortunately, not all of them are what they seem. Among the latest fraudulent platforms to emerge is XproMarkets.com, a name that has rapidly gained attention — not for its success, but for its deception.

While the company markets itself as a reputable trading platform offering cutting-edge technology and professional financial management, deeper investigation reveals a well-crafted scam designed to exploit unsuspecting investors. This detailed review uncovers the manipulative methods, fake promises, and psychological tactics that make XproMarkets.com a prime example of an online trading fraud.

1. The First Impression – A Glossy Mask of Professionalism

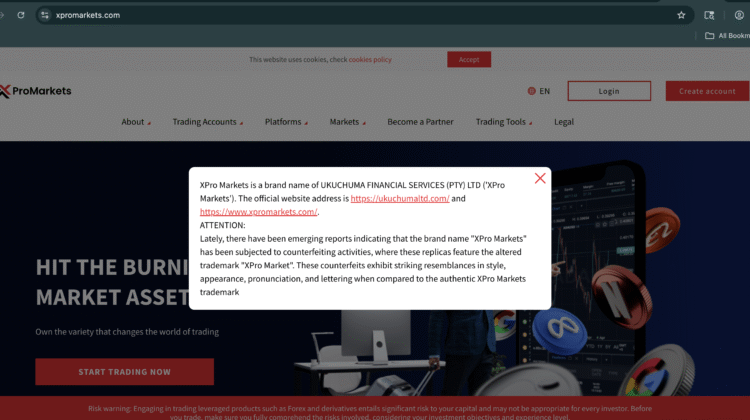

At first glance, XproMarkets.com appears convincing. Its website features sleek graphics, live charts, and claims of offering forex, stocks, and cryptocurrency trading with advanced analytical tools. It presents itself as a “trusted global broker” providing transparent trading conditions, expert guidance, and secure investments.

However, appearances are deceiving. Behind this professional-looking website lies a fabricated operation that mirrors dozens of other online scams. Everything from the logos to the website language is crafted to project legitimacy — yet when examined closely, there are immediate signs of fraud.

For example, the company boasts about having “over 15 years of experience,” but the domain registration records show that the website was created only recently. Similarly, while the platform claims to have global offices, the addresses provided are either non-existent or belong to shared office buildings that have no link to the alleged company.

2. The False Claims of Regulation and Licensing

A legitimate trading platform must operate under the supervision of a recognized financial authority. These include regulators such as the FCA in the United Kingdom, FINMA in Switzerland, or CySEC in Cyprus. Regulated brokers are required to meet strict transparency, capital adequacy, and consumer protection standards.

XproMarkets.com, however, provides no proof of regulatory approval. It often claims to be “compliant with international standards” or “operating under EU financial directives,” yet never lists a valid license number or regulatory body.

When checked against databases of major regulators, there is no record of XproMarkets.com or any related entity. This is a massive red flag. Operating without regulation means the platform can do whatever it wants with clients’ funds, without any legal consequences. There are no safeguards, no independent audits, and no consumer protection — which means any investor’s money is effectively gone the moment it’s deposited.

3. The Bait: Aggressive Marketing and Unrealistic Promises

Scammers like those behind XproMarkets.com understand that emotion drives investment decisions. They rely on social media ads, fabricated news articles, and flashy success stories to lure in unsuspecting individuals.

Typical ads promote the idea of “financial freedom” through simple investments, often showing fake screenshots of people turning small deposits into thousands of dollars. These ads are strategically placed on platforms like Facebook, YouTube, or TikTok, often accompanied by videos of supposed “clients” giving glowing testimonials.

Once someone clicks the ad or fills out a registration form, they are contacted almost immediately by an “account manager” or “financial advisor.” These individuals are not legitimate brokers — they are skilled salespeople trained to manipulate emotions. Their main goal is to get the target to make an initial deposit as quickly as possible.

The sales pitch always includes exaggerated guarantees:

-

“We can double your investment in weeks.”

-

“Our trading algorithms never lose.”

-

“This is a limited-time opportunity before our new partnership goes public.”

These are classic lines used to create a false sense of urgency and pressure the victim into sending money before they have time to think critically.

4. The Deposit Phase – How They Take Your Money

Once the investor agrees, they are guided through the deposit process. XproMarkets.com accepts credit cards, bank transfers, and most notably, cryptocurrency. Cryptocurrency transactions are especially favored by scammers because they are untraceable and irreversible.

After the initial deposit — often ranging between $250 and $1000 — the victim gains access to what looks like a functioning trading dashboard. This interface displays charts, account balances, and live price movements. But here’s the deception: none of it is real.

The dashboard is a fabricated trading simulator. It is designed to show small profits initially, giving the impression that the trades are successful. The fake profits make victims believe the system works, leading them to deposit more money.

As time goes on, the so-called “account managers” continue to call or email, urging victims to “upgrade their accounts” or “invest more to access premium features.” The psychological manipulation is relentless, often using persuasion, flattery, and fear of missing out to make investors commit larger amounts.

5. The Fake Profit Stage – Keeping the Illusion Alive

For weeks or even months, investors may see their account balance growing steadily. The scammers will often congratulate them for their “success” and encourage them to add more funds to “maximize profits.”

At this stage, the fraudsters may even allow a small withdrawal, such as $50 or $100, to strengthen trust. Victims start believing they are dealing with a legitimate platform. They may even recommend the platform to friends and family, unknowingly bringing more people into the scam.

But the illusion never lasts. As soon as investors attempt to withdraw a larger sum, the situation changes drastically.

6. The Withdrawal Trap – Where the Deception Unravels

When victims try to withdraw their profits, XproMarkets.com introduces a new set of “requirements.” They may be told that their account is not fully verified, that taxes must be paid before funds can be released, or that additional deposits are required to “activate withdrawal permissions.”

Every excuse is carefully constructed to sound technical and legitimate. Victims who comply and send more money soon realize they’ve made a mistake — because no matter what they do, the funds never arrive.

Eventually, communication stops altogether. Emails bounce back, customer support becomes unresponsive, and the “account manager” disappears. The trading dashboard might even get deactivated or show all trades as losses, giving the impression that the investor’s money was lost through “market volatility.” In truth, the funds were stolen from the start.

7. The Fake Online Presence

To maintain their image, XproMarkets.com floods the internet with fake reviews and promotional articles. These pieces often describe the platform as “the best broker for beginners” or “a safe investment option for 2025.”

These reviews are typically found on low-quality websites created solely for marketing scams. They feature generic phrases like “I made $10,000 in a month!” or “Customer service is fantastic!” with no verifiable proof.

At the same time, legitimate complaints from real victims are either suppressed or buried under fake positive feedback. This manipulation of online reputation is a deliberate tactic to mislead potential investors conducting basic research.

8. Anonymous Ownership and Fake Addresses

One of the most alarming aspects of XproMarkets.com is its lack of transparency regarding ownership. The company provides no information about its founders, executive team, or even an official corporate registration. The names of supposed employees are fake, and any photographs on the site are usually stock images.

The addresses listed on the platform are often fake or belong to unrelated businesses. Some victims who attempted to visit the listed offices reported finding no trace of the company at those locations. This is a strong indicator that XproMarketsL is not a real trading institution but a shell operation run by hidden scammers.

9. The Rebranding Cycle – How They Stay Ahead of Exposure

Once scams like XproMarkets.com attract too much negative attention, they don’t disappear — they simply rebrand. The operators shut down the website, move the domain to another name, and launch a new platform with minor design changes.

The same scammers may contact previous victims pretending to be from a “recovery agency,” promising to help retrieve lost funds — another layer of deceit. In reality, it’s the same team attempting to scam the victim again.

This constant cycle of rebranding helps them stay one step ahead of law enforcement and public exposure, while continuing to prey on new investors.

10. Red Flags That Define XproMarkets.com as a Scam

Even for inexperienced traders, several warning signs make it clear that XproMarkets.com is not legitimate:

-

No regulation or licensing information from any recognized authority.

-

Anonymous ownership, with no real individuals behind the company.

-

Unverifiable business addresses that lead nowhere.

-

Unrealistic promises of guaranteed or rapid profits.

-

Pressure tactics to deposit more money.

-

Withdrawal delays or denials, often with fake reasons.

-

Fake testimonials flooding social media and review sites.

-

Use of cryptocurrency payments to prevent chargebacks or refunds.

These are all hallmarks of a scam operation, not a real trading platform.

11. The Psychological Toll on Victims

The consequences of falling for XproMarkets.com extend far beyond financial loss. Victims often experience shame, anxiety, and loss of confidence. Many report being emotionally manipulated into trusting the scammers, only to feel humiliated afterward.

Some victims are even re-targeted by other fraud rings that buy stolen data from XproMarkets.com operators. These follow-up scams may claim to offer “legal help” or “fund recovery,” only to exploit victims further.

12. End Note

XproMarkets.com stands as a stark example of how modern financial scams exploit technology and trust to deceive people worldwide. Every element of the platform — from its fake trading dashboard to its fabricated success stories — is part of an elaborate illusion designed to separate investors from their money.

The operation hides behind anonymity, false regulation claims, and psychological manipulation, leaving a trail of victims who believed they were investing in legitimate trading opportunities.

The truth is clear: XproMarkets.com is not a trading platform — it is a scam. It exists solely to steal funds and vanish once enough people have been deceived.

In an era where online investments are increasingly common, platforms like this serve as a warning. Investors must remain vigilant, skeptical of grand promises, and cautious about where they place their trust. Because in the world of unregulated online trading, the illusion of success can cost more than money — it can cost peace of mind.

Conclusion: Report XproMarkets.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, XproMarkets.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through XproMarkets.com, extreme caution is advised.