PinnacleGlobat.com Review — The Illusion of a Trusted Investment Platform

Introduction

In an era where online trading and digital investments have become the norm, thousands of platforms compete for investor attention — each promising the next big opportunity for wealth generation. However, for every legitimate trading firm, there are dozens of fraudulent ones hiding behind sleek websites and persuasive words. PinnacleGlobat.com is one such entity — a polished scam operation that preys on the hopes of individuals seeking financial independence.

This in-depth review examines the deceitful tactics of PinnacleGlobat, the structure of its scam, how it lures and manipulates investors, and the red flags that expose its fraudulent nature. Behind the illusion of professionalism lies a calculated machine designed to take money and vanish.

The Alluring Facade of Legitimacy

PinnacleGlobat.com website looks every bit the part of a reputable investment firm. Its design is modern, filled with crisp visuals, images of trading charts, and confident financial language. The homepage proudly displays words like “innovation,” “security,” and “performance,” suggesting a sophisticated global operation. There are mentions of “experienced fund managers,” “AI-driven trading algorithms,” and “transparent investment strategies.”

At a glance, it feels convincing — exactly how a legitimate broker or wealth management company might present itself. But this illusion begins to unravel when you dig deeper.

There is no verifiable company registration, no trace of executives or a corporate address that checks out. The supposed regulatory credentials are either completely absent or linked to forged or irrelevant documentation. The company’s “About” section offers vague statements, often copied from other scam sites, with no factual information to back them up.

This deceptive professional appearance is a hallmark of modern scams like PinnacleGlobat.com. The fraudsters behind it invest heavily in presentation because appearance buys credibility — and credibility opens wallets.

The First Point of Contact: How Victims Are Targeted

The scam begins with aggressive online advertising. PinnacleGlobat.com marketing campaigns often appear on social media, search engines, and even as sponsored content on financial blogs. The ads are bold, promising easy income and rapid returns:

-

“Earn profits daily with automated AI trading.”

-

“Start investing with just $250 and see results instantly.”

-

“Your gateway to financial freedom begins here.”

Clicking the ad leads to a landing page featuring staged testimonials and success stories from supposed investors who claim to have turned small deposits into life-changing sums. These stories are entirely fictional but crafted to sound genuine — complete with smiling stock photos and believable “reviews.”

After signing up with basic information, the victim’s contact details are quickly handed to a call center or “account manager” who initiates contact almost immediately.

The Hook: Small Investments, Big Promises

The initial phone call is friendly and professional. The representative speaks confidently about financial markets, uses technical jargon to sound knowledgeable, and assures the investor that the process is easy and risk-free. The caller emphasizes that many clients start small — usually around $250 — and quickly see results.

This small entry amount is deliberate. It’s low enough that potential victims don’t see much harm in trying. Once the deposit is made, the investor is given access to a “trading dashboard” — a carefully designed simulation that looks like real trading software.

Within hours or days, the balance starts to show profits. Trades appear to execute successfully, and charts move in the investor’s favor. The account manager celebrates the gains, encouraging the investor to “add more funds to maximize profits.”

These early wins are completely fabricated. The trading platform is not connected to any live market data; it’s a simulation designed to build trust and confidence. The investor, seeing profits accumulate, believes the system is working.

The Manipulation Game: Building Trust and Dependency

Once the victim believes in the platform, the tone shifts subtly. The account manager becomes more assertive, suggesting that now is the “perfect time” to increase the investment. They’ll say things like:

-

“The algorithm works best with larger capital.”

-

“You’re missing out on big opportunities by keeping your account small.”

-

“Our premium clients earn 10x what standard users do.”

The relationship becomes one of emotional dependence. The investor starts to trust the “advisor” — sometimes chatting daily or weekly. Every interaction reinforces the illusion that PinnacleGlobat.com is a real company managing genuine investments.

Scammers use psychological tactics — urgency, exclusivity, and familiarity — to trap victims deeper. They make investors feel part of something special, subtly manipulating them to ignore doubts.

The Turning Point: When Withdrawals Fail

The real nature of the scam becomes clear when the investor tries to withdraw funds. At first, small withdrawals might be allowed — perhaps $50 or $100 — to strengthen the illusion of legitimacy. Once larger withdrawals are requested, however, the process collapses into a web of excuses.

Victims are told they must:

-

Pay “processing” or “transfer” fees upfront.

-

Verify identity with additional documents.

-

Wait for “account review” or “compliance approval.”

-

Cover “taxes” or “liquidity charges” before funds can be released.

Every excuse is crafted to delay payment and encourage more deposits. Some victims are even tricked into paying supposed “release fees,” thinking they’re unlocking their profits — when in reality, they’re just sending more money to the scammers.

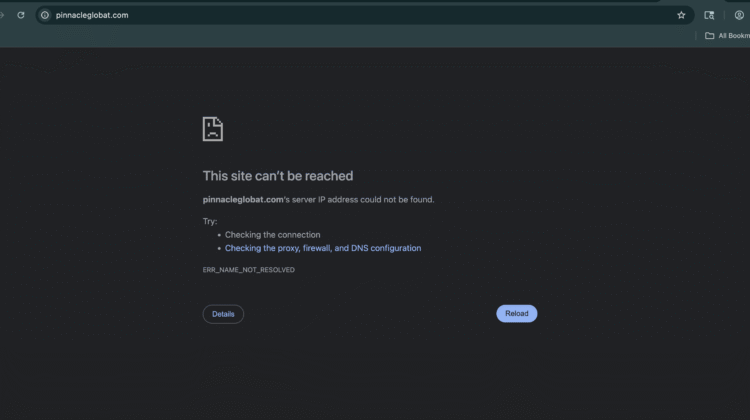

When resistance grows or communication breaks down, the scammers cut off contact entirely. Emails bounce, phone numbers stop working, and the website eventually disappears.

The Pattern Behind PinnacleGlobat.com

PinnacleGlobat.com isn’t a one-off scheme. It’s part of a larger pattern of fraudulent “investment platforms” that appear, operate for a few months, then vanish — only to reemerge under new names. The structure is modular and professional:

-

Website template: Built from pre-designed layouts reused across scams.

-

Call center operation: Teams trained to manipulate, flatter, and pressure investors.

-

Fake trading software: Simulated dashboards designed to show fabricated profits.

-

Offshore payment channels: Funds are routed through untraceable intermediaries.

-

Rebranding cycle: Once exposed, they reappear with new branding, logos, and URLs.

The people behind these operations are skilled fraudsters who know how to sound credible, how to exploit emotion, and how to vanish without a trace once the scam has run its course.

The Red Flags That Expose the Fraud

Even the most polished scam leaves clues. PinnacleGlobat.com shows several warning signs that clearly mark it as fraudulent:

-

No regulatory license: A legitimate investment firm must be registered with recognized authorities. PinnacleGlobat provides none.

-

Fake or missing company address: Any physical location listed is often fabricated or linked to unrelated businesses.

-

Anonymous management: No verifiable team members, executives, or financial experts.

-

Unrealistic promises: “Guaranteed profits” or “risk-free trading” are classic red flags.

-

Pressure tactics: Calls that urge immediate deposits or upgrades.

-

Hidden withdrawal conditions: Legitimate brokers do not invent new fees for accessing your own money.

-

Recycled content: Website text and testimonials appear across other scam platforms.

Spotting even two or three of these signals is usually enough to confirm that a platform like PinnacleGlobat is not legitimate.

The Human Cost of the Scam

Behind every fake account and vanished website are real people who lose money — and often much more than that. Victims of PinnacleGlobat.com experience more than financial loss; they suffer psychological distress, embarrassment, and broken trust.

Some victims lose life savings or retirement funds, convinced they were finally securing their financial future. Others, trying to recoup losses, double down and deposit more, only to fall deeper into debt. The emotional aftermath — shame, guilt, and anger — often prevents victims from seeking help or even admitting what happened.

Scams like PinnacleGlobat.com thrive in that silence, relying on victims’ reluctance to come forward.

A Web of Deception: The Technology Behind the Scam

PinnacleGlobat.com operators use sophisticated digital infrastructure to maintain their illusion. Their website employs high-quality SSL certificates to appear secure, live chat systems to mimic legitimate customer service, and cloned backend trading dashboards that imitate those used by real brokers.

The scam also exploits cryptocurrency transfers and unregulated payment gateways, ensuring transactions are irreversible. Once the funds are moved, tracking them becomes nearly impossible.

The combination of digital professionalism and financial obfuscation makes scams like PinnacleGlobat especially dangerous — they seem modern and credible while operating entirely outside the law.

Why Scams Like PinnacleGlobat.com Keep Succeeding

The success of PinnacleGlobat.com and similar scams lies in understanding human behavior. They don’t just sell investments — they sell dreams. They target people who want security, independence, or a chance to escape financial stress.

These scammers exploit optimism, crafting stories of success and community that make people feel part of something transformative. The illusion is powerful because it doesn’t rely on logic — it relies on emotion.

Until potential investors learn to approach online opportunities with skepticism, platforms like PinnacleGlobat will continue to find victims.

Final Thoughts

PinnacleGlobat.com stands as another example of how modern scams disguise themselves under the language of innovation and opportunity. Everything about its operation — from its refined website to its persuasive representatives — is designed to manipulate trust and extract money.

It presents itself as a bridge to financial growth but operates as a trap. Once an investor deposits funds, they are drawn into a web of lies that ends with lost money, severed communication, and a vanished company.

In the end, PinnacleGlobat.com is not an investment firm, not a trading platform, and certainly not a partner in financial success. It is a sophisticated scam built on deception, manipulation, and greed — a stark reminder that in the digital financial world, appearance is never proof of legitimacy.

Conclusion: Report PinnacleGlobat.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, PinnacleGlobat.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through PinnacleGlobat.com , extreme caution is advised.