BennetInvestment.com Review — Fake Investment Operation

Introduction

In the fast-growing world of online investing, fake platforms have become increasingly sophisticated, using sleek websites and professional marketing to deceive unsuspecting investors. One of the latest examples of such a scheme is BennetInvestment.com a fraudulent platform that poses as a legitimate investment and trading company. It promises impressive profits, professional portfolio management, and easy withdrawals — but beneath this polished surface lies a well-structured scam designed to steal money and disappear.

This review explores in detail how BennetInvestment operates, the red flags that expose its fraudulent nature, and the manipulative strategies it uses to exploit its victims.

1. The polished appearance — the illusion of legitimacy

BennetInvestment.com website and marketing materials are designed to build instant trust. On the surface, it appears to be a professional investment company offering opportunities in forex, stocks, crypto, and commodities. The homepage boasts about “global financial reach,” “experienced traders,” and “cutting-edge investment tools.”

It claims to help investors “achieve financial freedom” through managed accounts and automated trading systems. This presentation is meant to look modern and credible, complete with live market charts, testimonials, and supposed company certifications.

However, these elements are all part of an elaborate illusion. Every aspect of the platform — from its user interface to its customer support — is strategically designed to simulate legitimacy while hiding the truth: BennetInvestment.com has no real trading operation, no verified regulation, and no credible financial foundation.

2. The promise of effortless profits

The core of BennetInvestment.com scam lies in its exaggerated profit promises. The platform claims investors can earn anywhere from 10% to 25% in monthly returns, “guaranteed and risk-free.” In some promotions, they go even further, boasting about “zero-loss trading algorithms” and “AI-driven profit assurance.”

These claims are fundamentally impossible. In genuine financial markets, profit and risk are inseparable — no broker or investment manager can guarantee consistent high returns. By presenting risk-free investment opportunities, BennetInvestment immediately exposes its fraudulent intent.

Such unrealistic promises are crafted to attract beginners and individuals seeking quick wealth without deep market knowledge. The scammers exploit human optimism, using greed and trust as their tools.

3. How BennetInvestment.com recruits its victims

BennetInvestment.com doesn’t rely on investors finding it organically. The operation is highly aggressive in its recruitment approach. It uses:

-

Fake social media ads featuring fabricated success stories and screenshots of “happy investors.”

-

Email campaigns promising “exclusive trading opportunities” or “early access to profitable funds.”

-

Cold calls from supposed “financial consultants” offering free investment advice or portfolio reviews.

-

Affiliate marketing schemes where people unknowingly promote the scam for small commissions.

The scam typically begins when a user clicks on a misleading advertisement. They are directed to a professional-looking landing page asking for basic details — name, email, and phone number. Within hours, a “broker” or “account manager” calls, sounding well-trained and persuasive. This person’s goal is simple: to make the victim deposit money as quickly as possible.

4. The deceptive onboarding experience

Once an investor registers, BennetInvestment.com assigns them an “account manager.” This representative acts friendly, professional, and encouraging. They offer to guide the investor through every step of the process, creating the impression of personal attention.

The minimum deposit, usually around $250–$500, seems affordable and harmless. As soon as this deposit is made, the investor gains access to a sleek trading dashboard showing live charts, account balances, and supposed open positions.

It feels real. But it isn’t.

The trading platform is a carefully engineered simulation — the data you see is entirely fake. No actual trades are being executed. The dashboard’s numbers are controlled manually by the scammers to create the illusion of profits.

5. The illusion of success — how victims are tricked into reinvesting

Within days of depositing funds, investors see their “balance” growing rapidly. The fake trading system shows profits and closed trades, convincing the user that their investment is performing exceptionally well.

The assigned account manager congratulates the investor, praising their “smart decision” and encouraging them to deposit more to “maximize profits.” They might say:

-

“You’ve made 30% in your first week — imagine what $5,000 could do!”

-

“Our senior trading team is launching a premium investment round. You’re eligible if you upgrade your account.”

-

“Your portfolio is performing brilliantly; reinvest your profits for compounding growth.”

This stage is critical in the scam process. The victim, excited by apparent profits, gains trust in the system and often invests significantly larger sums — sometimes their savings or borrowed money.

6. The escalation — when the scam gets aggressive

Once the investor deposits larger amounts, the scammers intensify their manipulation. The account manager may involve “senior analysts” or “financial strategists” who claim to provide insider advice or access to exclusive markets.

Every interaction is designed to create urgency and pressure. The investor is told that opportunities are limited, or that market conditions demand immediate action. Statements like “act now or miss out” become common.

In many cases, the scammers even show fake profit reports, portfolio statements, or performance charts — all designed to maintain the illusion that everything is legitimate and profitable.

7. The withdrawal trap — the scam revealed

The first sign of trouble emerges when the investor tries to withdraw funds. At this point, BennetInvestment.com tone changes completely. Suddenly, the friendly account manager becomes evasive, slow to respond, or defensive.

Common excuses include:

-

“Your account isn’t verified yet — we’ll need additional documents.”

-

“You must pay a withdrawal processing fee or tax before we can release your funds.”

-

“Your profits are tied to open trades; closing them early would cause losses.”

-

“We’re currently upgrading our payment system. Please wait a few business days.”

In reality, the scammers have no intention of processing withdrawals. The goal is to stall long enough for victims to lose hope or to convince them to send even more money under false pretenses.

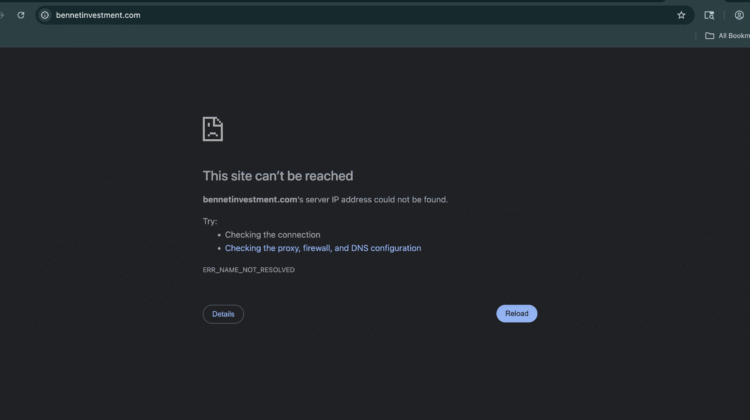

If victims persist or threaten to report the company, communication often stops entirely. The website may suddenly go offline, and all contact numbers become inactive.

8. The regulatory red flags

A quick review of BennetInvestment.com background reveals multiple inconsistencies. The company claims to be “regulated” and “licensed” under financial authorities, but provides no verifiable registration number or certificate. When checked against official databases, no record of such a firm exists.

Additionally, the “corporate address” listed on the website often points to a fake or unrelated location — sometimes an office building that has nothing to do with the company. The domain itself is typically registered anonymously and is only a few months old.

These details are clear indicators of a scam operation. Legitimate investment companies always provide verifiable regulatory information, physical office details, and transparent ownership structures. BennetInvestment hides behind anonymity, a hallmark of financial fraud.

9. Payment methods designed to conceal theft

BennetInvestment.com encourages deposits through payment methods that are difficult or impossible to reverse. While it might display credit card logos on its homepage, those options often fail during checkout. Instead, the investor is redirected toward:

-

Cryptocurrency wallets,

-

Offshore wire transfers, or

-

Third-party payment processors.

These methods are deliberately chosen because they leave little trace and prevent chargebacks. Once funds are sent, recovering them becomes virtually impossible.

10. The human manipulation behind the scam

What makes BennetInvestment.com particularly cruel is the psychological manipulation it employs. The scammers build emotional connections with their victims. They offer constant encouragement, share fake stories of other investors’ success, and make victims feel special for being “invited” to invest.

Once trust is established, they use guilt and fear to keep the victim from withdrawing:

-

“If you withdraw now, you’ll miss out on doubling your profits.”

-

“We trusted you with this premium opportunity — don’t back out now.”

-

“Our trading team has already opened positions for your account; canceling now will cause a loss.”

This manipulation can lead victims to continue investing even when they suspect something is wrong.

11. Disappearing acts and rebranding

When BennetInvestment.com starts to attract complaints online, the scammers typically take down the website and vanish. Within weeks or months, the same operators reappear under a new name, using the same design and tactics but with a fresh domain.

This cycle of rebranding allows them to continue deceiving investors while avoiding detection and accountability.

12. The aftermath for victims

Victims of BennetInvestment.com face both financial and emotional devastation. Many lose life savings, emergency funds, or retirement money. Beyond financial loss, the emotional toll is severe — feelings of shame, anger, and betrayal are common.

Some victims stop trusting any investment platform afterward, while others are re-targeted by fake “recovery agents” who promise to help retrieve lost funds for an upfront fee — another layer of fraud in the aftermath of the first.

13. How BennetInvestment.com mirrors other fraudulent brokers

BennetInvestment.com follows the exact same pattern as countless other online investment scams:

-

Lure with big promises.

-

Impress with a professional-looking platform.

-

Show fake profits to build trust.

-

Convince victims to reinvest.

-

Block withdrawals with excuses.

-

Disappear when exposed.

Every step is carefully planned to maximize the money stolen before the scam collapses.

14. Lessons and final analysis

In the end, BennetInvestment.com is nothing more than a cleverly disguised online scam. It offers no real investment service, no legitimate trading, and no protection for investors. Its entire operation revolves around deception — from fake profits to manipulative representatives.

The platform exploits trust and greed, making victims believe they are participating in a legitimate financial venture while draining their funds behind the scenes.

If a company guarantees profits, hides its regulatory status, or discourages withdrawals, it is a clear warning sign. Real investment platforms are transparent, regulated, and never promise risk-free gains.

15. End Note — BennetInvestment.com is a calculated financial fraud

BennetInvestment.com is a textbook example of an online investment scam. It presents itself as a trustworthy trading firm but operates with no regulation, no transparency, and no legitimate trading activity. The promises of easy wealth and zero risk are nothing more than bait to attract deposits.

Through fake dashboards, false profits, and psychological manipulation, BennetInvestment.com deceives investors into giving up larger and larger sums, only to vanish when withdrawal requests begin.

The platform’s sophistication doesn’t make it legitimate — it only makes it more dangerous. Behind the polished marketing lies a well-organized fraud designed to exploit ambition, trust, and financial vulnerability.

Conclusion: Report BennetInvestment.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, BennetInvestment.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through BennetInvestment.com, extreme caution is advised.