Biyapay.com Review — Exposing the Deceptive Tactics Behind a Digital Trap

Introdution

The Allure of Biyapay.com — A Digital Promise That Draws You In

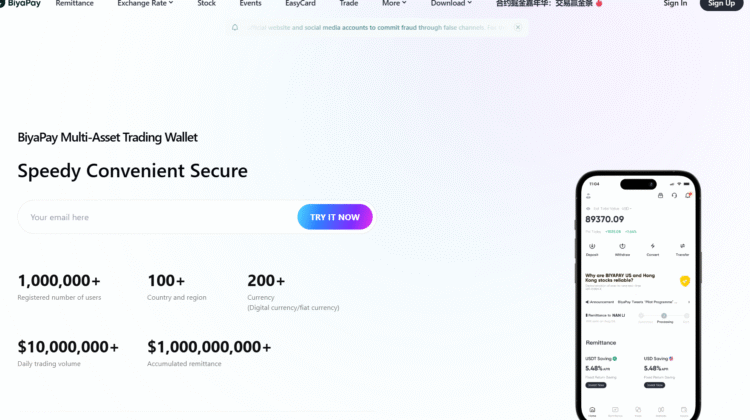

At first glance, Biyapay.com looks like a legitimate fintech or crypto trading service. Its website boasts sleek visuals, fast transaction claims, and slogans about “empowering global payments.” The presentation is smooth — high-tech branding, buzzwords like “blockchain innovation” and “financial freedom,” and testimonials that seem to show happy investors.

For newcomers seeking an easy way into digital trading or cross-border payments, Biyapay looks convincing. Its interface feels professional, and its marketing language radiates confidence. Yet behind the polished design lies a darker narrative: a pattern of deception, manipulation, and loss.

Multiple users describe nearly identical experiences — a quick sign-up process, initial satisfaction, and later, a devastating realization that the entire operation was designed to take their money.

The Setup — How Biyapay.com Hooks Its Victims

The scam typically begins with strategic digital advertising. Biyapay ads appear on social media platforms and message boards promising effortless earnings, smart crypto trading, or instant payment processing. Some users report being approached directly by individuals posing as financial advisors or account managers, often through WhatsApp, Telegram, or email.

The pitch is simple but effective:

“We use advanced AI to generate profits for our users.”

“You can start earning within hours — minimal risk, high return.”

Once someone expresses interest, they are swiftly guided to create an account. The representative — polite, confident, and seemingly knowledgeable — offers to walk them through every step.

A small deposit, usually around $200–$500, is requested to “activate the account.” Victims are reassured that their funds remain secure and that they can withdraw at any time. Within minutes, they’re staring at a professional-looking dashboard showing live charts, asset values, and “profit” numbers updating in real time.

The Illusion of Profit

The brilliance of scams like Biyapay.com lies in the illusion of control. Victims watch as their account balances rise steadily — a few dollars at first, then hundreds. They might even be allowed to make a small withdrawal, which further strengthens their trust.

What they don’t realize is that everything they’re seeing on the dashboard is digitally fabricated. No real trades occur. The system is programmed to simulate profitable activity, showing green numbers and rising graphs that create a sense of legitimacy.

Once that illusion takes hold, the manipulation escalates. Users receive calls or messages congratulating them on their “gains” and urging them to deposit more to “maximize profits.” They’re told they can double or triple returns by upgrading to higher tiers, joining VIP programs, or unlocking “exclusive AI-driven strategies.”

The Turning Point — When Things Go Wrong

Everything seems fine until the victim attempts to withdraw larger sums. This is when the tone of the operation changes completely.

Common scenarios include:

-

Unexpected fees: Users are told they must pay “processing charges,” “verification taxes,” or “release fees” before funds can be withdrawn.

-

Endless verification: Each withdrawal attempt triggers new documentation requests or unexplained account reviews.

-

Technical excuses: Representatives blame “blockchain congestion,” “system upgrades,” or “bank delays.”

-

Sudden silence: Customer support stops replying altogether, or the original contact vanishes.

Days turn into weeks, and victims realize they can no longer log in or access their accounts. The once-responsive team is gone, and the website may even disappear or redirect to a new domain.

Anatomy of the Biyapay.com Operation

Although each victim’s experience varies slightly, the underlying mechanism of Biyapay.com scam fits a clear and repeatable structure seen in many digital investment frauds.

-

Attraction: Enticing ads or outreach campaigns promise financial independence, often using trending keywords like crypto, AI, or forex.

-

Trust Building: Smooth communication from fake advisors, complete with professional jargon and friendly attitudes, makes users feel valued.

-

Deposit Phase: Victims are asked to deposit small amounts first, with visible fake profits to build confidence.

-

Expansion: Continuous pressure to invest more through bonuses or new “opportunities.”

-

Control: Once substantial money is deposited, communication becomes manipulative and withdrawals are blocked.

-

Disappearance: After multiple stalled withdrawals or growing complaints, the domain shuts down, and the operators move to a new name.

This pattern demonstrates that Biyapay was not designed to facilitate trading or payments at all — it was constructed to simulate legitimacy long enough to drain users’ deposits.

Corporate Shadows — No Transparency, No Oversight

When researching Biyapay.com background, another major red flag emerges: corporate ambiguity.

The platform offers little to no verifiable information about who runs it, where it is based, or which financial authorities (if any) regulate it. Addresses listed on the website often trace to random office buildings or vacant lots. Contact numbers go unanswered or redirect to automated lines.

There are no identifiable executives, founders, or company registration details publicly available. For a service handling client funds, this level of opacity is inexcusable and deeply suspicious.

Moreover, there is no evidence of Biyapay.com being licensed by any recognized financial regulator — a crucial requirement for any entity offering investment or money transfer services. Without regulation, there is no accountability, no investor protection, and no legal framework governing client funds.

Emotional Manipulation — The Human Side of the Scam

Financial scams don’t succeed solely through technology; they succeed through psychology.

Biyapay.com representatives are reportedly skilled at reading emotions and exploiting vulnerabilities. They build relationships that feel personal — congratulating victims on “smart decisions,” asking about their families, and using empathy to gain trust.

Once the emotional bond is established, subtle manipulation begins:

-

Flattery: “You’re one of our most promising investors.”

-

Urgency: “This opportunity won’t be available tomorrow.”

-

Fear of Missing Out: “Others are making huge profits right now — don’t stop now.”

-

Reassurance: “We’ve never had a client lose money; just follow our strategy.”

Each tactic is designed to override logic and encourage impulsive financial decisions. Victims often ignore warning signs because they’ve been emotionally conditioned to believe in the person behind the screen.

The Aftermath — Financial and Psychological Damage

When the reality sets in, victims experience more than financial loss. Many describe feeling embarrassed, angry, and betrayed. Some lose their savings, while others damage relationships with family members who warned them early on.

Scams like Biyapay often lead to deep emotional fallout. Victims question their own judgment, struggle with trust, and may even experience anxiety or depression. The emotional toll can linger long after the financial damage is done.

Familiar Patterns Across Rebranded Platforms

What makes Biyapay.com particularly dangerous is that it doesn’t operate in isolation. Once exposed, such platforms are often rebranded under new names with slight design or logo changes. The same scripts, tactics, and even staff may reappear behind a different domain.

This cyclical structure allows scammers to continue exploiting new groups of investors. Each time a site shuts down, it resurfaces elsewhere with fresh promises and a new brand identity.

The pattern is global, and Biyapay.com fits neatly within this evolving ecosystem of online fraud — highly adaptable, data-driven, and ruthless in execution.

Recognizing the Red Flags — Protecting Yourself from Similar Scams

While Biyapay.com operation is an example of deception at scale, it provides valuable lessons for spotting similar frauds. Below are critical red flags every investor should remember:

-

Unrealistic Guarantees: Any platform claiming consistent, risk-free profits is lying. Financial markets are volatile, and no system can eliminate loss.

-

Vague or Hidden Ownership: Always verify who owns and operates the service. Anonymous management equals immediate risk.

-

No Regulatory License: A legitimate investment or payment platform must be registered with a known financial authority.

-

Pressure to Deposit More: Genuine brokers never push clients to add more funds urgently.

-

Upfront Withdrawal Fees: No regulated company demands extra payments to release your own money.

-

Unverified Contact Information: Fake addresses, dead phone lines, or generic email accounts are signs of fraud.

-

Fake Testimonials: Repeated, overly enthusiastic reviews with identical wording indicate reputation manipulation.

The Broader Lesson — A Digital Mirage

Biyapay.com story highlights a crucial reality of the online financial age: sophisticated design does not equal legitimacy. Scammers now replicate the appearance of professional financial institutions with startling precision — complete with dashboards, mobile apps, and marketing campaigns.

The trap lies not in the technology but in the psychology it exploits: hope, greed, trust, and fear. The operators behind Biyapay.com appear to understand these emotions intimately, using them as tools to extract money from unsuspecting individuals worldwide.

End Note — What Biyapay.com Teaches About Modern Scams

Biyapay.com stands as a stark example of how modern online fraud has evolved beyond clumsy phishing emails and fake lottery wins. Today’s scams are strategically engineered ecosystems, blending design, manipulation, and marketing to appear legitimate for just long enough to defraud their victims.

From its professional interface to its persuasive “advisors,” Biyapay.com was crafted not to facilitate trading or payments but to simulate success and capture deposits. Every interaction — every email, dashboard update, and congratulatory message — was part of the illusion.

The story of Biyapay.com is not just about one platform; it’s about the growing sophistication of global digital scams. It reminds us that due diligence, skepticism, and verification remain the most powerful tools any investor can possess.

In an age where financial trust can be fabricated with a few lines of code, the lesson is simple but vital: believe data, not promises — and never mistake appearance for authenticity.

Conclusion: Report Biyapay.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Biyapay.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Biyapay.com , extreme caution is advised.