AstraxExchange.com Review — A Thorough, No-Nonsense Scam Platform Exposed

Introduction

AstraxExchange.com (often styled AstraX Exchange) is one of those crypto-centric platforms that pops up with glossy marketing, promises of fast returns, and a sleek interface. That surface polish makes it tempting — but the public footprint behind the marketing raises multiple, serious red flags. This review pulls together the strongest, verifiable signals available in the public record (regulatory alerts, user reports, and independent trust checks), explains the patterns that matter, and lays out why AstraxExchange.com should be treated as high risk by anyone thinking of depositing money. I’m documenting observable facts and reasonable inferences — not making criminal accusations — but the combination of signals here is plainly concerning.

First impressions: slick presentation, thin paper trail

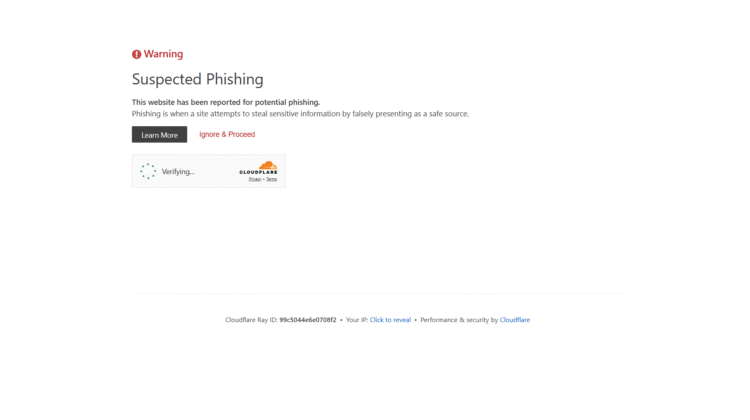

On first glance AstraxExchange.com looks modern: a polished homepage, product pages for spot and derivatives trading, and marketing language promising easy access to markets. That’s exactly the optics fraudsters prioritize: build trust quickly with design. But legitimacy depends on verifiable institutional facts — who runs the business, where it is registered, and under which regulator it operates. For AstraxExchange.com, those verifiable cornerstones are either missing, inconsistent, or actively flagged by consumer protection authorities and independent site-scanners.

The single most important signal: a regulator investor alert

One of the strongest public indicators that a platform is untrustworthy is an investor alert or warning from a securities regulator. AstraxExchange.com appears on at least one such public alert: a provincial securities or markets authority (the AMF in Québec) has publicly stated AstraxExchange.com is not registered or authorized to solicit investors in that jurisdiction. That kind of formal notice usually follows complaints or a regulator’s verification that license claims cannot be substantiated. When a recognized regulator puts a name on an alert list, treat that as a very serious warning.

Independent trust-scanners and review aggregators: troubling patterns

Several independent website-safety and reputation services give AstraxExchange.com low or mixed trust scores. Those services aggregate technical indicators — domain age, hosting metadata, WHOIS privacy, and past reports — and in Astrax’s case they highlight a recent domain history and other attributes associated with higher risk. On top of automated scoring, mainstream review sites show a small but problematic set of user reviews and complaints, often giving the brand a low Trustpilot score and multiple cautionary notes. These technical and crowd signals aren’t definitive on their own, but they reinforce the regulator’s public concern.

What users and social channels report

Across public forums, social posts, and video content there are multiple anecdotal reports alleging blocked withdrawals, demands for additional “processing” or “verification” fees before funds will be released, and accounts that appear responsive during deposit but unresponsive when users ask to cash out. Reddit threads and social media warnings appear alongside short YouTube videos and posts claiming similar experiences. Anecdotes don’t equal proof, but when user complaints cluster around the same operational behaviors — particularly withdrawal friction — they form a meaningful signal.

The common scam playbook and how AstraxExchange.com fits it

Experienced investigators of fraudulent crypto platforms tend to watch for a repeating set of behaviors. AstraxExchange.com aligns with multiple items on that checklist:

• Recent domain and hidden WHOIS data. New domains or privacy-protected registrations are common in transient scam operations.

• Unverified or absent regulatory registration. Legitimate exchanges that serve retail customers typically have clear regulatory disclosures you can check. Astrax is explicitly called out as unregistered in at least one jurisdiction.

• Positive façade, problematic operational traces. Glossy marketing while independent checks and user comments show withdrawal problems.

• Third-party warnings and low trust scores. Multiple independent scanners and aggregator sites rate the platform as poor or flagged.

When you see multiple items from that list together, the overall probability that you’ll experience operational problems (at minimum) rises sharply.

Mixed or positive signals — why they don’t cancel the warning signs

You will find some pages and reviews that describe AstraxExchange.com positively, and the platform itself posts claims about security practices and product offerings. These positive claims are common and can be legitimate in isolation: small exchanges do exist that look competent. The problem here is not that there are positive claims — it’s that those claims are not currently backed by verifiable oversight (licence entries, long domain history, third-party audits) and there are explicit public alerts and repeated user complaints. Regulators, trust-scanners, and user reports are stronger signals than self-published marketing and a handful of short positive testimonials.

Tactical behaviors to watch in communications

Based on the patterns seen across many problematic platforms, be alert to these tactics if you’re contacted by or researching AstraxExchange.com:

• Rapid pressure to deposit (“limited time offers,” “exclusive fund access”)

• Requests to use nonstandard payment channels or third-party processors for deposits or withdrawals

• Changes to withdrawal terms after you’ve funded an account (sudden “processing fees” or verification hurdles)

• Support that’s responsive during deposit but slow/unresponsive for withdrawal queries

These are behavioral indicators — not legal proof — but they have repeatedly shown up in consumer complaints about risky trading and exchange operations.

Why polished UX is not a substitute for regulation

Design and user experience are easy to buy; regulatory oversight, bank relationships, audited reserves, and legal accountability are not. Scammers prioritize interfaces that project legitimacy because it increases conversion. A legitimate exchange will pair good UX with clear, independently verifiable institutional facts: registered business entities, license numbers you can confirm on regulator sites, transparent custody arrangements, and public compliance attestations. AstraxExchange.com currently lacks that verified institutional backbone in the public record.

The practical verdict

Taken together — a regulator investor alert saying the platform is not authorized to solicit investors in at least one jurisdiction, low/mixed scores from independent reputation services, and multiple user complaints centered on withdrawal friction — the public evidence supports a single practical conclusion: AstraxExchange.com is high risk and should be treated with extreme caution. That is a risk-management judgment based on observable public signals, not an assertion of criminality. If you are approached with this brand, the safest presumption is that capital deposited may be difficult to retrieve, and that the platform does not operate under the protections you’d expect from a regulated exchange.

What to demand before you touch a platform like this

If someone is still considering AstraxExchange.com despite all the red flags, insist on independently verifiable documentation first: a registration entry on an official regulator’s public register (not just a license number posted on a webpage), audited cold-wallet custody evidence, and verifiable banking relationships. Without those things, you are accepting an elevated probability of operational failure or fraud.

Conclusion: Report AstraxExchange.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, AstraxExchange.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through AstraxExchange.com , extreme caution is advised.