Divine-Group.io Exposed — What Reported Users Say

Introduction

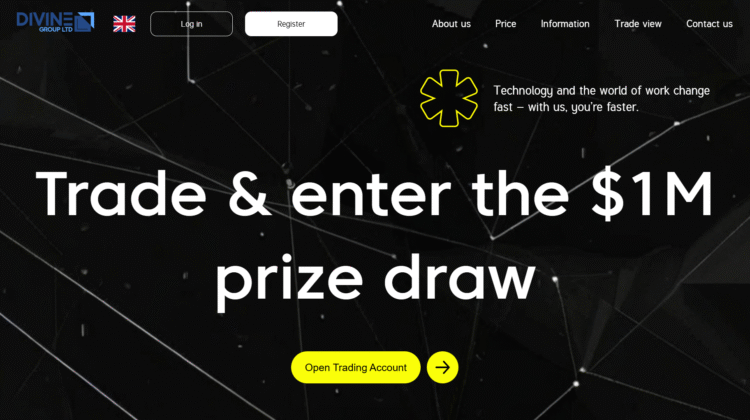

“Divine-Group.io” is an imprecise label — several different organisations and websites worldwide use “Divine” in their name (some legitimate workplaces, some consumer services, and some trading-oriented sites). That overlap creates an immediate verification burden: a single headline like “Divine-Group.io is a scam” can be misleading because different domains and businesses may be entirely unrelated. Because of that ambiguity, readers should always treat allegations as specific to a named domain or entity rather than the brand label in general.

That caveat noted, there are repeated public signals tied to trading/investment offerings with the “Divine” name which warrant close scrutiny. These signals include: formal regulator warnings about unauthorised operations, automated trust-ratings that assign very low scores, and multiple user-facing reports describing withdrawal difficulties and sudden changes to terms.

What people are reporting (recurring themes)

Across consumer complaint boards, site-scan services and community posts, several consistent complaint patterns are visible:

• Withdrawal problems and delays. Multiple reports describe users who say their withdrawal requests were repeatedly delayed or blocked — sometimes after an initial period showing “profits” in the account. These reports frequently mention additional unexpected fees or newly announced “processing requirements” that appear only at withdrawal time.

• Low automated trust score for the domain. Website-reputation services that analyse domain age, WHOIS transparency, traffic signals and linked complaints have assigned very low trust scores to certain “divine-” trading domains, marking them as suspicious or high-risk. Low trust ratings are not proof of fraud on their own, but they are a strong technical indicator that further verification is needed.

• Regulatory cautions / unauthorised firm notices. At least one financial regulator has published a public warning about a “Divine”-branded trading service that is not authorised to carry out regulated investment activities in the regulator’s jurisdiction. Such warnings commonly indicate the regulator has observed the firm marketing to consumers in that jurisdiction without proper authorisation.

• Community reports and historical alerts. Beyond modern complaint boards, older scam-alert writeups and community threads exist that associate “Divine” names with suspicious operations; these add to the pattern of repeated concerns, although they may concern different legal entities or earlier incarnations of sites.

Why these patterns matter (what they typically indicate)

Taken together the patterns above typically align with a few common problematic operational behaviours:

-

Opaque legal & regulatory status. Legitimate investment firms normally display verifiable licences or registration numbers and make it easy for customers to confirm those numbers with the regulator. When a firm is explicitly listed as “unauthorised” or you cannot find a credible licence, that’s a primary red flag.

-

New domains + hidden ownership. Fraudulent operations often cycle domains and hide WHOIS ownership to avoid traceability; automated trust tools pick up the technical signal. A very low trust score from a domain-scanner is a strong reason to dig deeper.

-

Up-front marketing followed by withdrawal friction. The model of showing early gains to build trust, then creating novel withdrawal hurdles or “new fees” is a recurrent method used in many fraudulent investment schemes. Multiple user accounts reporting the same sequence — initial gains, pressure to deposit more, then blocked withdrawals — is a dangerous pattern.

Concrete red flags to look for on any “Divine” site you encounter

When assessing a site using the Divine brand (or similar), watch for these specific items:

-

Regulator mismatch or missing licence — claim of regulation with no verifiable licence number and no record on the regulator’s public register is a major red flag.

-

Very new domain or privacy-protected WHOIS — youthful, private domain registrations are suspicious in a financial services context.

-

High guaranteed returns or “risk-free” language — any promise of guaranteed or unusually high returns is implausible and should be treated as suspect.

-

Complex withdrawal preconditions that appear only at cash-out — newly introduced “taxes”, “insurance fees”, or “processing fees” that were not disclosed prior to deposit.

-

Multiple independent negative reports — consistency across unrelated community platforms (forums, review sites, regulator lists) strengthens the credibility of complaints.

How to interpret regulator warnings and trust-tool scores

Regulators publish warnings when a firm is suspected of operating without authorisation or when there is a pattern of consumer harm. A regulator’s public page noting an entity is unauthorised is not the same as a court judgment, but it should be treated as a serious consumer protection signal — particularly when it is paired with low technical trust scores and consistent user complaints.

Practical verification checklist

If you still want to investigate any specific “Divine”-branded site, confirm at least the following before making any financial commitment:

-

The exact domain name and the legal entity behind it (don’t rely on brand phrases).

-

A verifiable regulator licence number and the regulator’s register entry.

-

Independent website trust score and domain age/WHOIS details.

-

Multiple independent user reports corroborating successful withdrawals (not just screenshots of rising balances).

Bottom line (conservative assessment)

Multiple public indicators — regulator warnings about unauthorised activity, automated scans assigning very low trust to certain divine-branded trading domains, and repeated user reports of withdrawal difficulties — together create a serious risk profile for trading/investment offerings operating under the “Divine” name. While brand names can refer to different legal entities and each domain must be assessed individually, the weight of signals recommends extreme caution: treat such offers as very high risk and verify every factual claim before committing funds.

Conclusion: Report Divine-Group.io Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Divine-Group.io raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Divine-Group.io , extreme caution is advised.