LianhuaZhengquan.cn Scam — The Fake Investment Firm Masquerading as a Licensed Broker

Introduction

In recent years, a new wave of online investment scams has emerged that look increasingly professional. Unlike the obvious “get-rich-quick” websites of the past, these operations build elaborate facades of legitimacy — complete with Chinese-language documentation, corporate branding, and slick trading dashboards. One such operation, LianhuaZhengquan.cn, has gained notoriety for preying on investors across Asia and beyond under the disguise of a legitimate securities trading company.

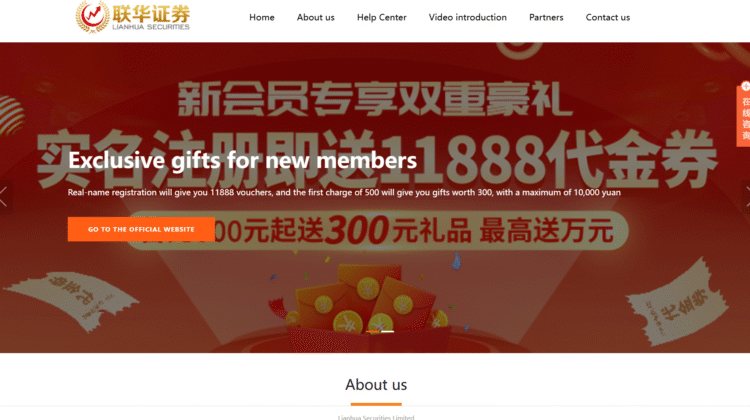

At first glance, LianhuaZhengquan.cn seems respectable. The name itself — “Zhengquan” meaning securities in Chinese — suggests regulatory affiliation or ties to a licensed brokerage. Its websites and mobile applications appear polished, often mimicking real financial institutions down to the smallest detail. But beneath this professional veneer lies a sophisticated deception scheme designed to separate victims from their savings.

This article breaks down how the LianhuaZhengquan.cn scam operates, the warning signs that expose its fraudulent structure, and the tactics its promoters use to manipulate trust.

1. The Face of Credibility — How the Scam Poses as a Real Broker

LianhuaZhengquan.cn presents itself as a full-service brokerage offering access to stock trading, futures, forex, and cryptocurrency. Its marketing materials describe a “licensed securities platform” with “years of experience serving global investors.” Websites and app pages display corporate addresses in Hong Kong, Singapore, or mainland China, along with professional-looking registration numbers that, on inspection, correspond to unrelated or nonexistent entities.

From the user’s perspective, everything feels genuine at the start. The company’s app mimics legitimate brokerage interfaces — charts update in real time, order books display live trades, and balance summaries fluctuate to simulate authentic market activity. Customer support representatives communicate fluently and professionally, often in multiple languages. All of this is engineered to cultivate confidence during the onboarding process.

The deception is calculated: the scammers know that appearance equals credibility. By crafting a convincing illusion of a licensed financial service, they lower the victim’s natural skepticism and create a believable environment in which large deposits feel safe.

2. The Lure — Promises of Access, Efficiency, and Insider Knowledge

The typical recruitment funnel begins through social media ads, messaging-app groups, or “investment communities” hosted on platforms like Telegram or WeChat. Promoters portray LianhuaZhengquan.cn as a sophisticated broker that offers advantages unavailable through ordinary channels — preferential access to stock listings, algorithmic trading tools, or AI-driven recommendations that supposedly outperform traditional funds.

Common claims include:

-

“Direct trading access to Hong Kong and U.S. markets.”

-

“Exclusive IPO allocations for preferred clients.”

-

“Guaranteed monthly returns through quantitative strategies.”

Some promoters even claim that the company is a subsidiary or affiliate of a real, licensed securities firm with a similar name — another layer of deception meant to confuse potential investors.

These marketing lines exploit a widespread belief among retail traders that insider access or AI tools can guarantee profits. The fraudsters know this psychological weak spot and use it ruthlessly to generate deposits.

3. Anatomy of the Operation — How LianhuaZhengquan.cn Cons the Investor

Despite cosmetic differences from case to case, most victims of LianhuaZhengquan.cn describe an almost identical pattern of deception.

Step 1: Grooming and Relationship Building

Victims are often contacted by individuals posing as financial advisors, analysts, or sometimes casual acquaintances who “share a trading tip.” In some cases, the scam begins as a romantic or friendly conversation that gradually introduces the “investment opportunity.” Over weeks or months, trust is built through consistent communication, profit screenshots, and seemingly genuine advice.

Step 2: Account Setup and Initial Deposit

Once convinced, the victim is directed to create an account on the official-looking LianhuaZhengquan.cn website or app. The interface looks legitimate — complete with registration forms, verification processes, and dashboards showing “live” market data. The first deposit, often modest, is encouraged to “test the system.” Within days, the account balance appears to grow, creating excitement and confidence.

Step 3: Artificial Profits and Further Deposits

The apparent profits displayed are entirely fabricated by the scam’s backend system. The fake platform simply inflates the numbers in the user dashboard. The victim believes their trades are performing well and is encouraged to deposit more funds to “increase leverage” or “unlock premium accounts.” This is the crucial phase where the scam extracts the largest sums.

Step 4: The Withdrawal Trap

Eventually, the victim attempts to withdraw funds. At first, small withdrawals may be approved to reinforce the illusion of legitimacy. However, larger withdrawals trigger a series of invented obstacles — “tax clearance,” “security verification,” or “transfer fees.” Victims are told to pay these fees before funds can be released, but once paid, the money disappears and communication ceases. The fake website or app may even go offline within days.

Step 5: Disappearance and Rebranding

Once enough complaints or chargeback attempts accumulate, the scammers vanish. They dismantle the existing domain, shut down contact channels, and reappear under a new name with a slightly altered interface. Because the operation is digital and international, tracing the culprits becomes nearly impossible.

4. Red Flags That Expose the Scam

Despite the sophistication of LianhuaZhengquan.cn presentation, its structure reveals numerous warning signs recognizable to the trained eye.

a. Fake Licensing Information

The company often lists regulatory registration numbers that belong to unrelated, legitimate firms. Victims who attempt to verify the license discover inconsistencies or invalid records. Legitimate brokers display verifiable information directly linked to public databases of financial authorities.

b. Hidden Ownership and Contact Details

The platform provides vague corporate addresses, often tied to virtual office spaces or shell companies. The absence of genuine corporate registration documents is a major indicator that the entity lacks real operational presence.

c. Pressure to Deposit Quickly

Scammers push a sense of urgency: “This IPO closes in 48 hours!” or “AI trading signals are time-sensitive.” Legitimate investment companies never pressure clients into instant deposits.

d. Irregular Communication Channels

Instead of official corporate emails or phone lines, representatives use encrypted messaging apps and private chat channels. Once payments are made, these channels vanish or block the victim entirely.

e. Lack of Independent Verification

No third-party audits, legal disclaimers, or customer protections are available. Everything from account balances to market data is generated internally, meaning there’s no verifiable connection to real financial markets.

5. The Emotional Engineering Behind the Scheme

LianhuaZhengquan.cn fraudsters are skilled at emotional manipulation. They understand that most victims are not naive but hopeful — seeking better returns in a volatile economy. The scam operates as much on psychology as on technology.

-

Trust: Scammers build rapport over time through friendly conversations or expert-sounding advice.

-

Greed: Artificial profits on dashboards fuel the illusion that greater investments equal exponential returns.

-

Fear of Missing Out: Victims are told opportunities are fleeting — if they hesitate, they’ll lose access.

-

Shame: Once victims realize the deception, embarrassment prevents many from reporting their losses, allowing the cycle to continue.

The scheme thrives because it exploits normal human emotions — hope, trust, and ambition — rather than purely technical ignorance.

6. Broader Implications — The Growing Sophistication of Fake Brokers

The LianhuaZhengquan.cn case illustrates how online investment scams have evolved beyond crude phishing attempts. Today’s operators replicate the exact interfaces of genuine brokers, integrate with real market APIs for live price feeds, and even mimic compliance forms to appear authentic.

These scams are also transnational. Many originate from organized networks that operate call centers and payment gateways spanning multiple jurisdictions. Funds deposited by victims are laundered through layered transactions across cryptocurrencies, prepaid cards, and offshore accounts, making recovery nearly impossible.

Moreover, the LianhuaZhengquan.cn brand demonstrates a troubling trend: scammers increasingly target bilingual or regional audiences. By using Chinese characters, localized marketing, and cultural references, they exploit communities that may have limited access to official regulatory resources in their own language.

7. How to Identify Future Copycat Operations

LianhuaZhengquan.cn is not unique; it’s part of a broader ecosystem of cloned brokerage scams. Recognizing certain behavioral and structural traits can prevent future losses.

-

Verify the License Directly: Always check the official database of the claimed regulator. Real brokers list their license numbers publicly, and verification takes minutes.

-

Cross-Check Contact Information: If all contact channels route through messaging apps rather than corporate communication systems, assume risk.

-

Examine Payment Methods: Reputable brokers use regulated banking systems. Requests for cryptocurrency or third-party wallet transfers are an immediate red flag.

-

Research Domain History: Newly created websites with no track record or reviews often indicate temporary scam operations.

-

Beware of Guaranteed Returns: Any entity that guarantees fixed or rapid profits is lying — financial markets do not operate on certainty.

8. The Human Cost Behind the Scam

While the numbers are alarming, the human impact is worse. Many victims of LianhuaZhengquan.cn are retirees, small business owners, or young professionals chasing the dream of financial freedom. For them, losses are not abstract; they represent life savings, college funds, or medical expenses.

Some victims describe the psychological aftermath as more damaging than the financial hit — sleepless nights, self-blame, and loss of trust in online financial services. These consequences ripple outward, undermining confidence in legitimate investment technology as well.

9. The Legacy of Deception

Even as LianhuaZhengquan.cn domains disappear, its model persists. Each rebranded clone refines the template — better graphics, smoother apps, more convincing representatives. The name might change, but the deception remains identical: fake profits, blocked withdrawals, and vanished funds.

The broader lesson is timeless: professionalism in presentation does not equal legitimacy. Scammers understand that trust can be manufactured through design, language, and behavior. Recognizing this truth is the first defense against their manipulation.

End Note : The Real Face Behind the Digital Curtain

LianhuaZhengquan.cn story is not simply about one fraudulent platform — it is a reflection of how easily digital technology can be weaponized to exploit ambition and trust. The scam’s operators built an illusion of corporate credibility strong enough to fool thousands, yet every piece of that illusion was engineered for theft.

For investors, the essential takeaway is caution. The line between authentic financial innovation and elaborate fraud grows thinner every year. Names like LianhuaZhengquan.cn may sound official, but appearance alone can be fabricated. Until a platform demonstrates verifiable regulation, transparency, and accountability, skepticism is not cynicism — it’s protection.

Conclusion: Report LianhuaZhengquan.cn Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, LianhuaZhengquan.cn raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through LianhuaZhengquan.cn , extreme caution is advised.