Carrendorgroup.com Review : Fraudulent Investment Platform

Introduction

In today’s digital economy, new investment platforms, online marketplaces, and financial service providers appear with remarkable speed. Some present fresh opportunities, while others spark uncertainty, confusion, or skepticism. One platform that has drawn online discussions, questions, and user-reported concerns is Carrendorgroup.com. For many people encountering the name for the first time, the platform can appear polished and promising. But once you begin to examine the details more closely, the picture becomes far less clear.

This deep-dive review explores why Carrendorgroup.com raises numerous red flags, the types of patterns users have associated with questionable online platforms, and what any cautious consumer should look for when evaluating a website that feels unfamiliar or uncertain. This blog does not claim that Carrendorgroup.com has committed fraudulent acts; instead, it highlights the warning signs users have reported or observed when attempting to understand the platform.

If you’ve stumbled upon Carrendorgroup.com while searching for financial tools, investment opportunities, or other online services, this article will help you navigate your evaluation with a critical and informed perspective.

1. The First Impression Problem: Slick Surface, Sparse Substance

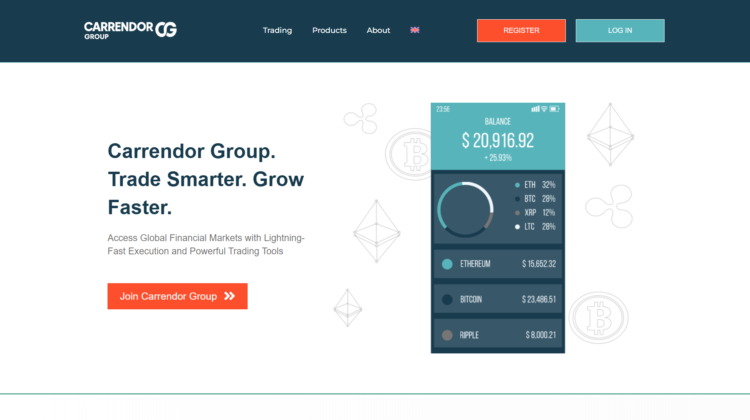

Many people encountering Carrendorgroup.com for the first time describe the same reaction: a clean interface with very little real clarity. The website presents itself with authoritative tone and seemingly professional branding. Yet, once you begin clicking around, the content often feels generic or vague, especially in areas where transparency is crucial.

Common issues noted by cautious users include:

-

Generalized descriptions of services without specifics on how those services function

-

Broad promises of performance or opportunity, but little concrete explanation

-

Limited information about company history, identity, or founding background

While a sleek design can be appealing, a platform offering investment-related or financial services typically provides robust explanations, disclosures, and documentation. Sparse information is often seen as a red flag, not necessarily because it indicates wrongdoing, but because legitimate businesses know transparency builds trust—and they usually embrace it.

2. The Company Identity Gap: Who Is Behind Carrendorgroup.com?

One of the most frequently cited concerns regarding Carrendorgroup.com is the uncertainty surrounding the company’s identity. When evaluating any financial or quasi-financial online service, consumers generally expect:

-

A verifiable registered business

-

Clear leadership information

-

A physical office location

-

Regulatory disclosures (when applicable)

-

Background information on founders or executives

With Carrendorgroup.com, many users report difficulty identifying any firm, verifiable details about the company’s origins or the people who run it. The platform’s “About” information tends to rely on vague language rather than concrete names, credentials, or trackable corporate history.

A lack of identifiable leadership is one of the strongest indicators that a platform should be approached with heightened caution. Legitimate companies—especially those handling user funds or personal information—almost always provide clear ownership details. When such information is missing or obscured, it raises questions that prudent users should not ignore.

3. The Communication Breakdown: Limited or Inconsistent Support

Another commonly observed issue is communication inconsistency. Reports from individuals attempting to interact with Carrendorgroup.com often mention:

-

Delayed or non-existent responses

-

Support answers that feel automated or scripted

-

Difficulty getting clear explanations about transactions or account details

-

Vague reassurances without definitive resolution

Effective customer support is a hallmark of reputable online services. In contrast, poorly responsive or evasive communication can signal that a platform is unwilling—or unable—to provide straightforward assistance. When a service handles financial or sensitive personal information, reliable customer service becomes even more important.

The communication patterns associated with Carrendorgroup.com fall into a category many users recognize from platforms that ultimately fail to deliver on their promises or disappear after accumulating deposits or fees. Again, this does not prove intent, but it does illustrate why many individuals describe feeling uncomfortable continuing their engagement.

4. The Transparency Issue: Missing Legal, Regulatory, and Compliance Details

Well-established financial platforms typically include:

-

Clear compliance statements

-

Terms and conditions with explicit operational mechanisms

-

Regulatory affiliations, licensing numbers, or oversight bodies (where necessary)

-

Risk disclosures

For Carrendorgroup.com, users often observe that key compliance details are missing or generically written, offering little reassurance that the platform operates within any recognized regulatory framework. In industries involving investments, trading, or money movement, regulatory oversight isn’t merely bureaucratic—it’s an essential safeguard.

The absence of clear regulatory information is a profound concern. Even platforms that operate in loosely regulated sectors typically provide something: at least a company registration, corporate address, or operational jurisdiction. When these details are incomplete or hard to verify, users are left without the context needed to determine the platform’s legitimacy.

5. Unrealistic or Unsubstantiated Claims

Some versions of the Carrendorgroup.com platform messaging use language characteristic of high-risk—or high-uncertainty—services, including:

-

Promises of unusually high returns

-

Guarantees of performance

-

Claims of proprietary strategies that are not explained

-

Assurances that “anyone can earn” or “profits are easy”

Statements like these often appear in promotional material for platforms that rely more on persuasion than operational substance. While bold marketing doesn’t automatically indicate wrongdoing, it does necessitate careful scrutiny.

A credible financial platform generally emphasizes risk, clarity, and realistic expectations. Overly confident promises, especially without accompanying disclaimers, are traditionally interpreted as an indicator that caution is warranted.

6. User-Reported Difficulties and Recurring Experiences

Scattered online discussions mention users who encountered challenges such as:

-

Difficulty withdrawing funds

-

Requests for unexpected additional payments or fees

-

Sudden changes in account status

-

Inconsistent explanations from support

-

Confusion about transaction history or reporting

These accounts cannot be fully verified, and they vary from user to user. However, recurring patterns of similar concerns often motivate others to proceed cautiously. Whether the platform is poorly managed, intentionally obscure, or simply unstable is unclear—yet for most consumers, the practical outcome is the same: uncertainty and risk.

When multiple individuals express comparable doubts, it’s a sign that prospective users should thoroughly evaluate the platform before committing personal information or finances.

7. Lack of Independent Verification or Credible External Presence

One of the strongest indicators of legitimacy is external visibility. Credible financial platforms typically appear in:

-

Industry databases

-

Business directories

-

Professional social networks

-

Independent reviews with verifiable authors

-

News mentions

Carrendorgroup.com, however, appears to lack a robust external footprint in areas typically associated with verifiable credibility. This is not definitive proof of misconduct, but it contributes to the perception that the company’s operations are isolated from broader recognition or oversight.

When a platform is difficult to trace outside its own website, consumers are left without the third-party validation that helps confirm whether a business is genuine or reputable.

8. The Risk Profile: Why Carrendorgroup.com Feels Dangerous to Many Users

Considering all the factors outlined above, many users categorize Carrendorgroup.com as high-risk. This categorization does not accuse the platform of illegal behavior; rather, it reflects the multiple uncertainties, gaps, and inconsistencies surrounding it. These unresolved questions create an environment where users do not feel protected or informed.

A high-risk platform typically exhibits:

-

Low transparency

-

Poor communication

-

Unclear company identity

-

Dubious or unverified claims

-

Limited regulatory presence

-

Difficulty verifying legitimacy through external sources

Carrendorgroup.com fits this pattern in many respects, based on user observations and publicly visible information.

End Note : A Platform Surrounded by Red Flags

Carrendorgroup.com, as it appears today, presents far more uncertainty than assurance. From limited transparency to difficulty verifying basic company details, users exploring the platform often encounter multiple friction points that undermine confidence. While none of these elements alone confirms misconduct, the overall pattern places Carrendorgroup.com firmly in the category of platforms consumers should approach with extreme caution.

In an online world filled with both opportunity and danger, informed skepticism remains one of the most powerful tools at your disposal. Whether you’re evaluating Carrendorgroup.com or any other unfamiliar digital service, trust is something earned—not assumed—and a platform unwilling or unable to provide clarity should never receive unquestioned confidence.

Conclusion: Report Carrendorgroup.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Carrendorgroup.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Carrendorgroup.com , extreme caution is advised.