Hfgoldexchange.com Review : Fraudulent Investment Scheme

Introduction

In the crowded and often confusing world of online finance and cryptocurrency services, it’s all too common to encounter platforms that promise prosperity but deliver frustration, ambiguity, and loss. One name that has increasingly come under scrutiny from experienced investors and community watchdogs is Hfgoldexchange.com — a platform that markets itself as a cutting-edge exchange and wealth-building service. But beneath its promotional veneer lie troubling issues, opaque disclosures, and structural patterns that raise serious doubts about its legitimacy.

This review examines Hfgoldexchange.com from multiple angles: its claims, transparency (or lack thereof), operational inconsistencies, user experience signals, and warning indicators that seasoned investors look for when assessing a service’s trustworthiness. The goal is to help you see beyond the glossy marketing language and understand why many observers consider this platform high-risk and, in some cases, scam-like in its behavior.

1. First Impressions: Slick Interface, Shaky Foundations

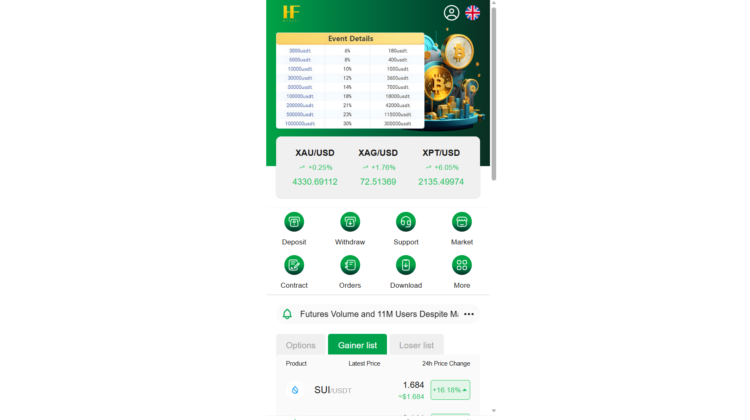

At first glance, Hfgoldexchange.com looks the part of a modern financial service. The platform uses professional design elements, confident language about global markets, and visuals that suggest significant technological capability. For many users, these first impressions can be persuasive — after all, aesthetics matter in an industry where trust is often established in a handful of seconds.

Unfortunately, a well-designed homepage should never be mistaken for proof of legitimacy. Many scam-oriented platforms invest heavily in visual appeal precisely to disguise the absence of tangible, verifiable operational substance. In the case of Hfgoldexchange.com, once the initial surface attraction wears off, a deeper look reveals a striking lack of concrete transparency — a foundational concern for anyone considering entrusting a platform with funds.

2. Regulation: A Missing Pillar of Credibility

One of the first things any prudent investor looks for in an online financial service is evidence of regulatory oversight. Established exchanges and investment platforms typically operate under the supervision of financial authorities that enforce standards for transparency, capital protection, anti-fraud measures, and dispute resolution.

In contrast, Hfgoldexchange.com does not clearly disclose any regulatory status with recognized financial authorities. There are no transparent license numbers, no named regulators, nor verifiable references to compliance frameworks. Instead, the platform uses general statements about “industry standards” or broad claims of “global reach,” without specifying under what jurisdiction it is registered or regulated.

This absence of verifiable oversight is not a minor omission. It means:

-

No independent authority is ensuring that the platform meets required financial safeguards

-

There’s no formal mechanism for oversight if users have serious disputes

-

There’s no standardized protection of user funds under a recognized legal framework

Regulation is not an optional luxury — it’s the backbone of legitimacy in financial services. Without it, users have no structural assurance that their capital is being handled under enforceable rules.

3. Corporate Identity: Who Is Behind Hfgoldexchange.com?

A related and equally troubling issue is the lack of clear corporate identity associated with Hfgoldexchange.com. Trustworthy financial platforms provide transparent information about their legal entity, including:

-

Registered business name and number

-

Physical headquarters address

-

Leadership team and executive bios

-

Jurisdiction of incorporation

None of these core details are presented in a verifiable way on Hfgoldexchange.com public materials. Instead, prospective users encounter broad marketing language but no concrete corporate disclosure that can be independently checked or validated.

Why does this matter?

Without a clear corporate entity:

-

It’s impossible to trace legal accountability

-

There’s no way to confirm that the platform is incorporated in a legitimate jurisdiction

-

Users cannot know who is responsible for compliance with financial laws

Platforms that avoid or hide basic corporate identity markers are often doing so to limit accountability and traceability — two qualities every reputable financial institution must possess.

4. Bold Profit Claims With No Verifiable Basis

Hfgoldexchange.com markets itself with phrases suggesting excellent returns, smart trading tools, and growth-oriented services. Such language is common in the financial sector — but the difference between legitimate platforms and high-risk ones lies in substance.

When a platform promises high returns, responsible services back those claims up with:

-

Transparent methodology explanations

-

Historical performance data audited by trusted third parties

-

Clear risk disclosures outlining potential losses

-

Concrete explanations of how profits are generated

Hfgoldexchange.com public messaging does not include verifiable performance statistics or transparent explanations of its trading methodology. Instead, it leans heavily on promotional language without measurable evidence.

This raises a key question: If a platform truly delivers strong performance, why not share documented results? In reputable finance, proof of performance is a competitive advantage — not a liability.

5. Fee Structure: Opaque and Hard to Verify

Clear fee disclosures are a baseline requirement for any financial or trading platform. Investors need to understand:

-

Trading fees

-

Deposit and withdrawal costs

-

Conversion or spread charges

-

Maintenance or inactivity fees

Hfgoldexchange.com public information on fees is ambiguous at best. Instead of straightforward, itemized costs, users encounter generalized statements about “competitive pricing” or “market-friendly costs.”

This creates several problems:

-

Users cannot easily calculate net returns after fees

-

There’s no clear basis for comparing Hfgoldexchange.com costs to competitor platforms

-

Hidden or unclear fees can erode profits quickly

Investment professionals often say: If you can’t see the cost structure, you are paying too much. Lack of fee transparency is a strong signal that users should approach with caution.

6. Customer Support: Unresponsive and Unhelpful

One of the key ways to distinguish trustworthy platforms from high-risk ones is the quality of customer support. Legitimate financial services offer multiple channels — phone, email, live chat, help desks — staffed by trained professionals who can assist users with account issues, verification questions, and transaction troubles.

Hfgoldexchange.com communication infrastructure appears very limited. Users report:

-

Slow or no response from support channels

-

Vague or templated replies

-

Lack of escalation paths for complex issues

-

No verified phone support or live assistance

This pattern suggests a lack of operational investment in real customer support — a core expectation for any platform handling financial assets.

When problems occur — and they do, even on legitimate platforms — users need reliable support. The absence of strong support structures raises questions about how effectively the platform can resolve critical issues.

7. Deposits and Withdrawals: Confusion and Unclear Terms

One of the most essential aspects of a financial platform is how deposits and withdrawals are handled. Responsible services provide explicit documentation about:

-

Accepted payment methods

-

Withdrawal processing times

-

Verification requirements

-

Fees associated with transactions

On Hfgoldexchange.com, these details are either buried in fine print or presented ambiguously. Users have difficulty finding clear statements on:

-

How long it takes to withdraw funds

-

What conditions must be met before withdrawal

-

Whether there are additional charges or minimums

This opacity erodes confidence, because any time you can’t easily understand how to access your own money, the platform has a structural problem.

Users should be able to locate and understand deposit and withdrawal policies without having to hunt through unclear terms or contact support.

8. Data Security and Privacy: Inadequate Public Disclosure

Handling user data — including personal identification and financial details — involves significant responsibility. Credible platforms publish detailed privacy statements and security policies outlining:

-

Encryption standards

-

Data storage mechanisms

-

Third-party vendor use

-

Breach notification procedures

Hfgoldexchange.com publicly available policies on data security are minimal. There is no comprehensive explanation of how your sensitive information is protected from unauthorized access or misuse. Without a clearly articulated security framework, users are left guessing about how safe their data really is.

In today’s cybersecurity landscape, security by design is essential — and lack of transparency in this area is a major red flag.

9. Red Flags Every Investor Should Know

Here’s a clear list of the most concerning warning signs associated with Hfgoldexchange.com:

-

No verifiable regulatory oversight

-

Opaque corporate identity and legal accountability

-

Bold promises with no transparent methodology

-

Lack of clear fee disclosures

-

Limited or ineffective customer support

-

Ambiguous deposit and withdrawal policies

-

Insufficient data security documentation

-

Sparse, mixed, or unverified user reputation

-

Heavy marketing language with little factual backing

Each of these alone would justify caution. Taken together, they form a pattern frequently associated with high-risk financial services that avoid transparency and accountability.

End Note : A Platform That Fails Fundamental Credibility Tests

Investing — especially in digital assets, foreign exchange, or leveraged products — carries inherent risk. But a platform itself should not be a source of unnecessary risk through opacity, ambiguity, or avoidable structural weaknesses.

Hfgoldexchange.com fails many of the basic criteria that define trustworthy financial services:

-

Regulatory proof

-

Corporate transparency

-

Clear operational documentation

-

Transparent fees

-

Accessible support

-

Data security clarity

-

Consistent user reputation

These are not optional niceties. They are baseline expectations any investor should require before committing their money.

Conclusion: Report Hfgoldexchange.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Hfgoldexchange.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Hfgoldexchange.com , extreme caution is advised.