Eneca.se Review : Fraudulent Crypto Investment Platform

Introduction

In the rapidly evolving world of online trading and cryptocurrency platforms, new services emerge every day, claiming to offer innovative tools, easy profits, and access to global markets. While many of these platforms are legitimate and regulated, a significant number are not — and Eneca.se has become one of the names frequently mentioned in discussions about scam operations. Under a polished veneer and enticing promises, Eneca.se exhibits multiple patterns commonly associated with fraudulent financial schemes.

This in-depth review will examine Eneca.se marketing claims, business structure, user experience, financial policies, and patterns of behavior that raise substantial red flags. The intention is to provide a clear, thorough analysis so readers can understand exactly why this platform has earned deep skepticism from those who have evaluated it critically.

What Eneca.se Claims to Be

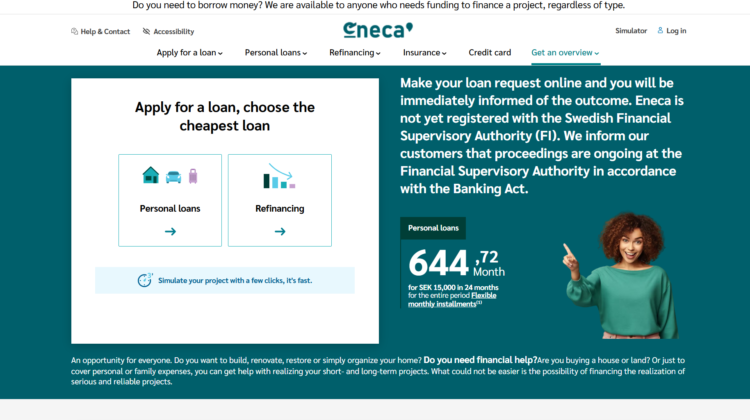

Eneca.se presents itself as an online investment and trading platform offering users access to:

-

Cryptocurrency trading

-

Forex and commodities markets

-

Automated trading tools

-

High-yield investment programs

-

Professional analytics and dashboards

The promotional messaging is designed to attract both newcomers to digital assets and seasoned traders who seek advanced tools. Terms such as “elite access,” “next-generation technology,” and “optimized returns” are used liberally, and the site’s design employs professional graphics and market visualizations that look similar to those used by legitimate financial firms.

But professional appearance does not equal legitimacy. As many scam platforms have proven, even polished interfaces can mask serious operational gaps and deceptive practices.

The First Big Red Flag: Lack of Transparent Corporate Identity

One of the basic requirements for any legitimate financial platform is corporate transparency — clear, verifiable information about who runs the platform and where it is legally based. Reputable companies openly disclose:

-

The legal name of the operating entity

-

Physical office address

-

Names and qualifications of executives

-

Jurisdiction of registration and operation

Eneca.se, however, provides little to no verifiable corporate information. Its public materials do not clearly identify the owners or leaders, and there is no reliably disclosed information about where the company is legally incorporated. This absence of basic corporate identity removes any sense of accountability: if and when users encounter problems, there is no clear entity to hold responsible.

In regulated financial environments, corporate transparency isn’t optional — it’s a requirement. By failing to provide this information, Eneca.se isolates itself from basic standards of accountability and trust.

Regulatory Silence and Lack of Compliance

Legitimate financial platforms — especially those handling trading and investment products — are typically subject to oversight or regulation by recognized authorities. These might include governmental agencies, financial conduct authorities, or national securities regulators. Platforms that are compliant with regulatory standards often display licensing details and oversight information prominently to reassure users.

Eneca.se, on the other hand, gives no credible indication of regulatory compliance or oversight by any recognized authority. Missing licensing disclosures means that users have no certainty that basic investor protection standards are in place, including requirements related to:

-

Segregation of client funds

-

Capital reserve requirements

-

Transparent reporting and audits

-

Dispute resolution processes

Without regulatory visibility, the platform functions in a legal gray zone — a condition that leaves users exposed to arbitrary rules and limited recourse if disputes arise.

Marketing That Emphasizes Returns, Not Risk

A common characteristic of fraudulent investment schemes is emphasizing high returns while minimizing or ignoring risk. In responsible investment platforms, marketing language emphasizes both potential gains and the risks associated with market participation.

Eneca.se promotional materials, however, are heavily oriented toward profit potential, with little to no balanced discussion of risk, volatility, or potential losses. Phrases like “optimized performance,” “exclusive earning potential,” and “advanced strategies” create an impression of effortless gains.

In reality, financial markets — especially crypto and leveraged instruments — are volatile and unpredictable. Any reputable platform must communicate both sides of the equation: potential reward and the corresponding risk.

By focusing almost exclusively on returns, Eneca.se messaging is more consistent with attractive sales copy than responsible investor communication.

Opaque Fee Structures and Hidden Conditions

Transparent fee disclosure is an essential aspect of legitimate financial services. Users should be able to easily understand:

-

Deposit and withdrawal fees

-

Transaction and commission charges

-

Minimum investment requirements

-

Conditions for accessing funds

-

Conditions tied to bonuses or promotions

Eneca.se fee and financial condition disclosures are either vague, incomplete, or buried in fine print that users don’t see until after they’ve created an account or deposited funds. This lack of clarity means users often enter the platform without knowing the true cost of using it.

When fees and conditions surface only after funds have been deposited, this creates an informational imbalance where the platform maintains control over critical details that should be transparent from the start.

This type of opaque financial policy is a hallmark of platforms that aren’t operating with a user-first mindset — and in many scam operations, it becomes a mechanism to extract money while limiting user understanding of the terms.

Customer Support Behavior That Raises Questions

Customer support is another critical area where Eneca.se operations appear inconsistent with legitimate financial services. In reliable platforms, support teams are responsive across all stages of the user journey — from on-boarding and education to actual financial support when it comes to deposits, trades, and withdrawals.

Complaints about Eneca.se support indicate a troubling pattern:

-

Prompt responses during account setup and initial inquiries

-

Support becomes slow, evasive, or generic when financial questions arise

-

Withdrawal or fee inquiries yield unclear, copy-paste, or delayed replies

-

No consistent escalation path for complex problems

This inconsistent support behavior suggests that support may be structured to encourage users to join and fund accounts, but not to assist them in managing or retrieving their funds. A platform with integrity treats support as ongoing, not selective.

Withdrawal Barriers and Conditional Access

One of the most serious issues reported by users is difficulty accessing funds once they have been deposited — a recurring theme in platforms under suspicion of fraudulent operation.

In many cases, users report:

-

Requests for additional documentation not previously disclosed

-

New requirements that appear only when a withdrawal is attempted

-

Sudden changes to fee policies or minimum withdrawal conditions

-

Unclear or shifting timelines for processing withdrawal requests

In regulated and legitimate services, withdrawal conditions are clearly disclosed up front, along with timelines and verification requirements. Users should never encounter unexpected conditions at the point of withdrawal that weren’t communicated ahead of time.

These kinds of barriers often emerge in systems where control over user funds is prioritized by the platform, rather than transparent access for the user.

Pressure to Deposit More Capital

Another disturbing pattern associated with Eneca.se is the constant encouragement to upgrade account levels or deposit more capital in order to “unlock better returns” or “access premium features.” Users describe aggressive messaging such as:

-

Deposit X amount to access tiered benefits

-

Higher deposits yield greater performance

-

Limited-time offers contingent on additional funds

While upselling is normal in many businesses, in financial services it should be accompanied by clear disclosures about terms, risks, and independent verification of benefits. Platforms that nudge users toward deeper financial commitment without transparent, balanced explanation are often prioritizing deposit growth over user welfare.

This type of persuasion leans on psychology rather than sound financial advice — and it is a strategy frequently seen in fraudulent schemes.

Lack of Independent Verification or Audit

Trustworthy financial platforms generally undergo independent audits, security reviews, or third-party compliance checks — and they make these results public to reassure users.

Eneca.se, by contrast, does not provide any verifiable evidence of independent security audits or operational audits. Without external validation, users have no assurance that:

-

Funds are held in secure institutions

-

Trading mechanisms are legitimate and not simulated

-

Reported balances reflect actual assets

-

Reported performance results are verified

The absence of independent verification means that all information about the platform’s integrity must be taken on trust alone — a condition that is unacceptable in financial services.

Recurring Patterns Found in Scam Platforms

When comparing Eneca.se to platforms that have been widely investigated as scams, the following recurring themes emerge:

🚩 Opaque corporate identity

No clear leaders, no legal registration info, no accountable entity.

🚩 Lack of credible regulatory oversight

No visible evidence of compliance with recognized authorities.

🚩 High emphasis on returns without risk context

Marketing highlights profit potential without balanced risk disclosure.

🚩 Vague or hidden fees and conditions

Terms and costs emerge only after users engage financially.

🚩 Poor or evasive customer support

Support fades when financial issues are raised.

🚩 Unexpected withdrawal barriers

Conditions change at the point users attempt to access funds.

🚩 Pressure to deposit more funds

Messaging pushes increased deposits without clear justification.

🚩 No independent audit or third-party verification

Users must trust internal metrics that aren’t externally validated.

Taken together, these patterns create a profile that is difficult to reconcile with legitimate financial services.

Why These Concerns Matter

In any financial endeavor — whether traditional investing, forex, or cryptocurrencies — users deserve:

-

Transparency about how the platform operates

-

Clear disclosure of fees, terms, and risks

-

Credible oversight and accountability

-

Consistent customer support

-

Predictable access to deposited funds

When a platform fails to provide these basics, trust evaporates. Without trust and verification, users are left holding representations rather than real financial instruments — a situation that opens the door to loss, frustration, and exploitation.

Final Assessment: A Platform Worth Questioning

After a thorough review of Eneca.se claims, behaviors, and operational characteristics, the platform exhibits numerous traits that are consistent with scam or fraudulent investment operations. From the absence of foundational transparency to opaque financial terms and problematic customer engagement, these issues form a pattern that should give any careful investor pause.

In the world of online finance — especially where cryptocurrencies and global markets intersect — performing due diligence is not an optional step, it’s essential. Platforms that obscure essential information, complicate access to funds, or prioritize promotional language over accountability do not meet the basic standards expected of services handling financial assets.

Eneca.se operational profile raises significant questions about its credibility, integrity, and suitability as a vehicle for investment. For anyone exploring online financial platforms, recognizing these warning signs can mean the difference between informed engagement and unnecessary risk.

Conclusion: Report Eneca.se Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Eneca.se raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Eneca.se, extreme caution is advised.