AvastBankLD.com Review: Exposing Another Deceptive Online Banking Scheme

In the ever-evolving landscape of online finance, scam operations have become increasingly sophisticated. Fraudulent investment and banking platforms masquerade as legitimate institutions, exploiting the trust and hopes of individuals seeking financial growth. One such name that has recently come under scrutiny is AvastBankLD.com, a platform that falsely presents itself as a professional and secure financial service provider. However, beneath its polished website and appealing promises lies a carefully structured deception designed to exploit unsuspecting investors.

This detailed review explores how AvastBankLD operates, the red flags that expose it as a scam, the fabricated narratives it employs to lure victims, and the overall pattern of deceit that defines it.

The Alluring Facade of AvastBankLD.com

At first glance, AvastBankLD.com presents itself as a modern digital bank and investment firm. Its website appears sleek, well-organized, and professional. The branding conveys a sense of credibility, with terms like “regulated,” “licensed,” and “globally trusted” appearing throughout its homepage. The platform claims to provide various services, including online banking, wealth management, cryptocurrency investments, and personal financial consulting.

It emphasizes customer empowerment, claiming to help users “grow wealth safely” through cutting-edge financial technology. They assert that they operate under strict compliance with global banking standards, supposedly ensuring the safety of client deposits. However, when examined more closely, these claims quickly crumble under scrutiny.

False Licensing and Nonexistent Regulation

One of the most glaring red flags about AvastBankLD.com is its lack of genuine regulation. The company frequently cites random financial authorities and regulatory licenses that do not exist. Many of these so-called registration numbers or certificates are either forged or copied from unrelated legitimate institutions.

For instance, the platform might display a fabricated regulatory ID or falsely claim to be recognized by well-known financial bodies in Europe or the UK. When these claims are verified through actual financial registries, no record of AvastBankLD.com can be found. This clear falsification is a strong indicator that the entity operates outside of legal oversight — a hallmark of fraudulent operations.

Dubious Domain and Contact Details

Legitimate financial institutions take great care to maintain transparent and verifiable contact details. AvastBankLD.com, however, hides behind vague and unverifiable information. The website domain is typically newly registered — often less than a year old — and uses private registration to conceal the true owners.

Emails and phone numbers provided on the site frequently go unanswered or are routed through automated systems. The supposed corporate address is often fake, typically referencing a prestigious financial district such as London or Zurich, yet no physical evidence of the company exists at these locations. Simple online mapping searches or public record inquiries confirm that no business under the name “AvastBankLD” operates there.

The Hook: Too-Good-To-Be-True Offers

AvastBankLD.com draws victims through unrealistic promises of financial gain. Prospective investors are promised high-yield returns within impossibly short timeframes — often claiming up to 20% monthly profit or guaranteed weekly bonuses from automated trading or “exclusive digital portfolios.”

Such promises are mathematically and economically unsustainable. In the legitimate financial world, even the most sophisticated investment strategies cannot consistently deliver such high returns without immense risk. By preying on greed and financial insecurity, AvastBankLD.com entices users to deposit funds, assuring them of risk-free growth and consistent profits.

Manipulative Sales Tactics

Once a potential investor registers on the platform, they are immediately contacted by high-pressure sales representatives posing as financial advisors. These individuals often use professional titles such as “senior investment analyst” or “portfolio manager,” designed to instill confidence.

These agents employ aggressive persuasion techniques. They call repeatedly, often at odd hours, urging users to “act fast” before a supposed opportunity expires. Emotional triggers are used — promising financial freedom, early retirement, or family security — to create a sense of urgency. The victims are assured that their investments are safe and backed by insured systems, though none of these claims can be verified.

The Deposit Trap

After convincing users to open an account, AvastBankLD.com next step is securing an initial deposit. This is usually requested via cryptocurrency, credit card, or wire transfer — payment methods that are difficult to trace or reverse. Once the deposit is made, the user sees a balance reflected in their account dashboard, and fabricated profits begin appearing almost immediately.

The platform may show false trading charts or growth graphs to give the illusion that the investment is performing well. The victim, encouraged by these fake results, is persuaded to invest more.

Over time, additional requests for funds arise under the guise of “account upgrades,” “tax clearance fees,” or “withdrawal verification charges.” Each of these requests is another ploy to extract more money before the scammers disappear.

Withdrawal Difficulties and Excuses

The clearest indication that AvastBankLD.com is a scam emerges when victims attempt to withdraw their funds. Despite seeing large sums in their accounts, users quickly discover that withdrawals are impossible.

The platform begins inventing obstacles:

-

“Your account must be verified before withdrawal.”

-

“You need to pay a security or conversion fee.”

-

“The payment system is temporarily under maintenance.”

In some cases, users are even told to deposit more money to “unlock” their funds — another layer of deception to prolong the scam. Once the scammers sense that a victim can no longer be exploited, they cut all communication, block the account, or shut down the website entirely.

Fake Reviews and Online Manipulation

To appear legitimate, AvastBankLD.com floods the internet with fake positive reviews. These fabricated testimonials, usually posted on low-credibility websites or social media platforms, describe unrealistic success stories.

Phrases like “I doubled my income in a month” or “Best online bank ever” are common. However, a closer look reveals that many of these reviews are written in similar language, with repeated grammatical patterns — clear signs of automated or outsourced content creation.

In contrast, genuine victims often report their experiences on independent review sites, detailing how they lost money and received no assistance from the company.

The Pattern of Deception

AvastBankLD.com follows a pattern common to many online financial scams:

-

Attraction: Professional-looking website and irresistible profit promises.

-

Engagement: Friendly, persuasive agents who build trust.

-

Investment: Initial small deposits followed by demands for larger sums.

-

Manipulation: Fake profits and misleading account dashboards.

-

Obstruction: Withdrawal blocks and excuses.

-

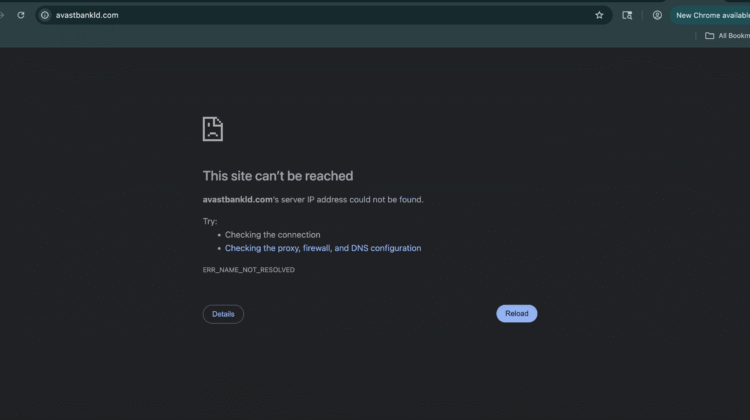

Abandonment: Disappearance of support and eventual website shutdown.

This cycle repeats under different domain names. Once AvastBankLD.com becomes exposed, the operators often rebrand and launch under a new name with similar design and promises — perpetuating the scam.

Unmasking the True Intention

Every feature of AvastBankLD.com operation — from the falsified credentials to the fake profits — points to one objective: financial exploitation. The scheme is not built to provide financial services but to extract deposits from users under false pretenses.

No actual trading, banking, or investment takes place behind the scenes. The so-called “profits” displayed are mere digital entries meant to deceive. The moment the victim’s money is transferred, it is gone — rerouted through untraceable channels to offshore accounts controlled by the scammers.

Final Thoughts

AvastBankLD.com represents yet another example of the growing wave of online investment fraud that preys on trust, ambition, and desperation. Its well-crafted website, confident tone, and fabricated financial data create an illusion of legitimacy that is easily believable to the untrained eye.

However, beneath this illusion lies a calculated strategy of deceit — a system built to steal from individuals under the disguise of opportunity. Every red flag, from fake regulation claims to withdrawal blockages, exposes the true nature of this operation.

In the end, AvastBankLD.com serves as a reminder that not all online financial opportunities are genuine. Investors should always verify the authenticity of any financial institution before depositing funds, check its regulatory status through official financial authorities, and approach all promises of “guaranteed profit” with deep skepticism.

What appears as a chance for financial freedom with AvastBankLD.com is, in reality, a trap designed to destroy trust and drain the savings of innocent people — one false promise at a time.

Conclusion: Report AvastBankLD.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, AvastBankLD.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through AvastBankLD.com , extreme caution is advised.