AvastBankLD.com Review : Unmasking a Suspicious Online Banking Operation

Introduction

Digital banking and online investing have made managing money easier than ever. With a few clicks, you can move funds, buy assets, or diversify a portfolio from the comfort of your home. But with that convenience comes a new generation of online financial impostors—sites that look and sound legitimate yet exist solely to exploit users.

One platform drawing attention for its questionable operations is AvastBankLD.com. Advertised as a “global digital bank and investment firm,” it claims to offer instant account creation, guaranteed returns, and crypto-integrated investment products. The interface appears modern, and its name deliberately evokes familiarity with a respected cybersecurity brand—creating a false sense of trust.

Beneath that surface polish, however, are multiple indicators that AvastBankLD.com fits the pattern of a high-risk or fraudulent online banking operation. This article dissects those warning signs in detail—so readers understand exactly how these schemes are constructed, what psychological tactics they employ, and how to recognize the same tricks elsewhere.

The Facade of Professionalism

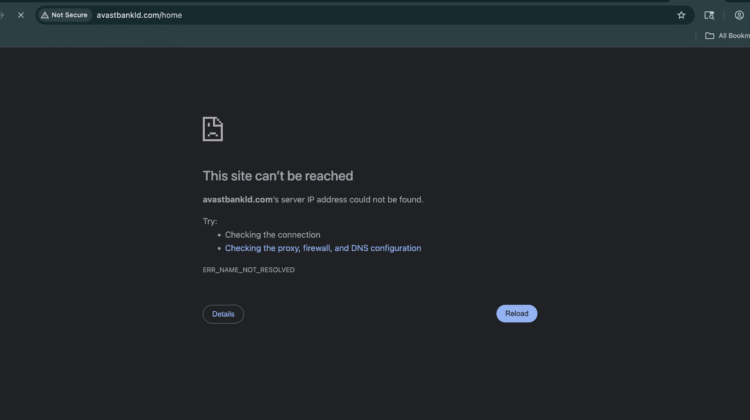

Visiting the AvastBankLD.com website for the first time, the user is greeted by sleek graphics, a login portal, and headlines promising “secured digital banking for the modern investor.” The layout mimics a genuine fintech dashboard, with tabs for personal banking, business accounts, investment portfolios, and even crypto custody services.

Yet, beyond the visuals, substance is missing. The so-called “About Us” section contains vague statements like “AvastBankLD is dedicated to client success through transparency and innovation.” Nowhere are there verifiable company registration numbers, executive profiles, or regulatory disclosures. There is no mention of a parent company, banking license, or oversight authority—information that real financial institutions are legally required to display prominently.

This absence of documentation is the first red flag. Professional branding can be purchased cheaply; regulatory authorization cannot.

The Promise of Effortless Wealth

The central marketing hook of AvastBankLD.com revolves around effortless profitability. Advertisements and site banners claim investors can “earn up to 10% weekly interest” or “multiply your capital through secure managed trading.”

Such claims are not just unrealistic—they are mathematically impossible in legitimate finance. No regulated bank or fund guarantees double-digit weekly or monthly profits without risk. Promising them outright is a textbook hallmark of a Ponzi-style or high-yield investment scam (HYIP).

In several cases reported on online forums, users described being told by “account managers” that profits were “insured by blockchain smart contracts,” a nonsensical phrase used to confuse newcomers with technical jargon. In reality, blockchain systems do not insure returns; they only record transactions.

How AvastBankLD.com Hooks Its Victims

Fraudulent online platforms like this one follow a predictable pattern built on emotional manipulation and incremental trust-building.

1. The Bait Phase

Victims often encounter AvastBankLD.com through pop-up ads, influencer videos, or unsolicited emails promoting a “new digital bank offering crypto savings accounts.” Clicking these ads leads to a professional-looking signup page requesting minimal personal data—just enough to begin outreach.

2. Personalized Contact

Within hours of registration, users typically receive a call or email from someone claiming to be a financial advisor. They sound polished, patient, and reassuring. These representatives are trained salespeople operating from call centers, not licensed bankers. Their job is to push an initial deposit, often as little as $250, to “activate your investment wallet.”

3. The Illusion of Early Success

Once the deposit is made, the platform dashboard updates to show “growing balances.” Users might even see fake transaction logs and trading charts implying profits are rolling in. This fabricated success is designed to build excitement and confidence.

The user’s so-called advisor calls back celebrating the “amazing performance,” then encourages a larger deposit—$1,000, $5,000, or more—promising VIP access and “priority withdrawal processing.”

4. Pressure and Escalation

As users invest more, the platform’s staff escalate their demands. Victims are told that to “unlock full withdrawal rights” they must upgrade their account, pay taxes upfront, or provide verification fees. The moment a user hesitates or requests a withdrawal, the communication tone shifts from friendly to manipulative or dismissive.

5. The Disappearance

Eventually, access to accounts becomes restricted. The website may stop responding or the so-called advisor vanishes. Attempts to recover funds meet silence or generic emails citing “technical maintenance.” The illusion collapses, revealing that the platform never engaged in genuine banking activity at all.

The Anatomy of the Scam

Each phase of this operation exploits predictable human responses: trust in authority, greed, and fear of missing out.AvastBankLD.com uses several deliberate techniques:

-

Mimicking Established Brands: The name “AvastBankLD” appears designed to echo a real cybersecurity brand, hoping users associate it with legitimacy.

-

Fabricated Credentials: Fake registration numbers or pseudo-regulatory logos are often displayed on the site footer. Clicking them leads nowhere.

-

Fake Testimonials: The “reviews” section features stock photos with invented names and generic praise like “They changed my life!”

-

Unverifiable Contact Details: The support email often bounces back, and listed phone numbers either ring endlessly or connect to scripted call centers.

-

Dynamic Web Hosting: Fraudulent domains are typically hosted on transient servers, allowing the operators to delete and recreate them under new names within days.

These signals collectively identify the platform as untrustworthy.

The Emotional Engineering Behind It

Fraudulent brokers rely not only on deception but on manipulating their victims’ psychology. The staff at operations like AvastBankLD.com use specific conversational techniques:

-

Authority Bias: They present themselves as financial professionals, often claiming “ten years of market experience” or “partnerships with major banks.”

-

Scarcity Pressure: Investors are told that “enrollment ends soon” or that “a limited investment window” is closing, triggering impulsive decisions.

-

Consistency Traps: Once a person invests once, the scammers praise their “smart move,” making them feel committed to continue.

-

Reciprocity: Small fake “profits” shown early create gratitude—leading victims to trust further.

-

Fear of Missing Out: Success stories are fabricated to imply everyone else is profiting, pushing the target to act quickly.

These manipulation tactics transform rational people into emotionally driven decision-makers.

The Legal and Structural Gaps

Unlike registered banks, AvastBankLD.com appears to lack any verifiable corporate structure. Searches in major financial regulatory databases yield no licenses under that name. The platform’s domain registration is private, hiding the owners’ identities.

The website frequently lists an address in London or Zurich—common choices for fake prestige—but the locations correspond to unrelated buildings or shared office spaces.

Moreover, legitimate banks must comply with “Know Your Customer” (KYC) and anti-money-laundering regulations. Fraudulent sites twist this requirement: they demand copies of IDs and selfies not for compliance, but to collect personal data that could later be exploited or sold.

Recycled Blueprints: One Scam, Many Names

Investigators and cybersecurity researchers have noticed that AvastBankLD.com design and language mirror dozens of other suspicious financial platforms. The same paragraphs of text, images, and promises appear across sites with different brand names—strong evidence of a network operating under multiple aliases.

This rotation strategy protects the operators. Once complaints accumulate and authorities begin noticing one domain, they simply switch branding and start anew under a fresh identity. Victims who search for “AvastBankLD.com reviews” weeks later may find only inactive pages or rebranded clones, obscuring the original scam’s trail.

Warning Signs to Watch For

From studying AvastBankLD.com behavior, several key warning signs emerge—applicable to any online financial service:

-

Unrealistic Profit Guarantees – Any promise of fixed, high, short-term returns is fraudulent.

-

No Regulatory Identification – Real banks display license numbers and regulators’ names.

-

Vague Company Information – Empty “About Us” sections and untraceable addresses.

-

Pressure to Deposit Quickly – Real institutions don’t cold-call or rush clients.

-

Evasive Withdrawal Procedures – Delays, extra “fees,” or sudden account freezes signal danger.

-

Copy-Paste Websites – Identical designs across multiple domains indicate a coordinated scam.

-

Fake Endorsements – Logos of major news outlets or celebrities used without permission.

Spotting even two or three of these signs should trigger extreme caution.

The Human Cost

Beyond financial losses, victims often experience deep emotional distress. The sense of betrayal is intensified because these scams exploit personal trust rather than brute force. Some individuals borrow or liquidate savings to invest, believing they are securing their future. When the deception surfaces, they’re left with shame, anger, and mistrust of all online financial services.

Understanding that this manipulation is systemic—not personal failure—is crucial. Operations like AvastBankLD.com are professional psychological machines built to exploit human optimism.

Protecting Yourself and Others

Before entrusting money to any digital platform:

-

Research Thoroughly: Look for independent reviews, regulatory listings, and physical addresses.

-

Cross-Verify: Check that the license number shown actually matches a record on a government site.

-

Test Transactions: Try small withdrawals before scaling up.

-

Beware of Name Mimicry: Fraudulent firms often use names similar to reputable institutions to confuse investors.

-

Educate Friends and Family: Share verified information about how these scams operate—awareness is the strongest defense.

End Note

AvastBankLD.com presents itself as a sophisticated digital banking and investment solution, but its structure, promises, and operations align with a broader pattern of fraudulent online financial schemes. Every element—from anonymous ownership and fabricated returns to manipulative customer contact—suggests it functions not as a bank, but as a confidence operation dressed in fintech clothing.

The lesson is broader than one name or domain: whenever a platform promises safety, luxury, and profit with no risk or regulation, it deserves immediate skepticism. Behind every polished web interface may lurk a team of social engineers targeting human trust, not financial success.

Conclusion: Report AvastBankLD.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, AvastBankLD.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through AvastBankLD.com , extreme caution is advised.