BittMarket.com Review — Consumer Alert and Warning Signs

Introduction

The rise of online trading platforms has opened unprecedented access to global financial markets. Cryptocurrencies, forex, commodities, and stocks are now accessible with just a few clicks. Alongside legitimate brokers, however, a growing number of platforms employ slick marketing and sophisticated interfaces to attract investors, while employing tactics that put deposits at risk.

One such platform that has drawn attention in various online discussions is BittMarket.com. While there are no official regulatory rulings labeling it as a scam, multiple reports from users highlight patterns of concern, including difficulties with withdrawals, high-pressure sales tactics, and questionable transparency.

This article serves as a comprehensive consumer alert for BittMarket.com. It outlines red flags, reports from users, common operational patterns, and practical steps for protecting your finances.

The Appearance of Legitimacy

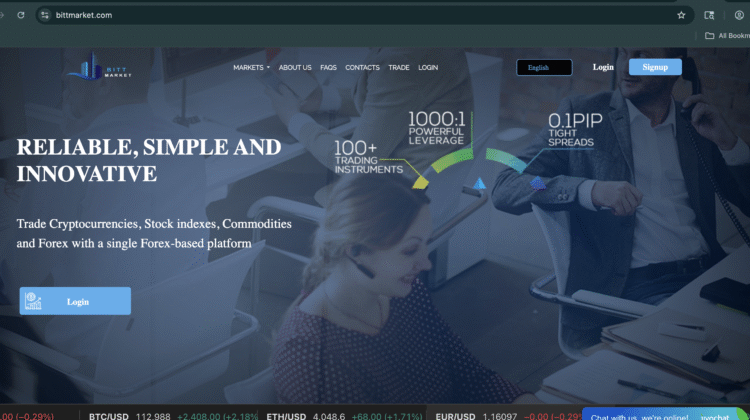

BittMarket.com presents itself as a modern, professional investment platform. Its website features sleek dashboards, animated charts, and marketing language highlighting AI-driven trading, blockchain-based security, and high returns.

The platform emphasizes speed, convenience, and personalized account management, which can be very persuasive to new investors. Testimonials and purported success stories are often displayed, reinforcing the illusion of legitimacy.

However, a professional website does not guarantee safe or transparent operations. Many platforms with polished appearances have been shown to use psychological tactics, obfuscation, and misleading metrics to encourage deposits. Users report that BittMarket’s interface shows gains and active trades that may not reflect actual market activity, a technique commonly used to build trust.

Reported User Experience Patterns

Based on multiple reports and anecdotal evidence, interactions with BittMarket.com often follow a recognizable sequence:

1. Easy onboarding and initial deposit

Users typically report a frictionless signup process. Registration forms require only basic information, and the platform supports multiple deposit methods, including credit cards, wire transfers, and cryptocurrency. Deposits are usually credited immediately, giving a sense of instant access to trading.

2. Personalized contact from “account managers”

After registration, investors often receive calls or messages from a so-called “account manager” or “financial advisor.” These representatives appear professional, using technical jargon and confident explanations to build trust. They promise high returns and encourage users to invest larger amounts to maximize profit potential.

3. Initial gains and small withdrawals

Many users notice early gains on their dashboard. In some cases, small withdrawal requests are processed successfully, reinforcing the perception that the platform is legitimate. This stage is a classic tactic used to increase investor confidence and encourage further deposits.

4. Escalating deposit requests

Once trust is established, users report being urged to deposit larger sums to access “premium trading features,” “VIP accounts,” or “exclusive investment cycles.” The urgency and exclusivity create a psychological push, often prompting investors to commit more funds than they initially intended.

5. Withdrawal issues

Problems reportedly begin when investors attempt to withdraw larger amounts. Users describe being asked for additional documentation, supposed tax payments, or processing fees. Some report repeated delays, partial payments, or complete account freezes. Communication from support often slows or stops entirely.

6. Website disappearance or rebranding

Some users report that after multiple complaints, the website goes offline temporarily or rebrands under a new domain name. This tactic is consistent with other high-risk online trading operations seeking to avoid scrutiny and continue operations under a new identity.

Key Warning Signs

There are several red flags that investors should be aware of when evaluating any online trading platform:

-

Guaranteed or unrealistic returns: Profits are never guaranteed in real-world trading. Any claim of consistent, risk-free earnings should be treated with caution.

-

High-pressure sales tactics: Repeated calls, urgency claims, or “limited time offers” are signs of manipulation.

-

Unverifiable regulation: Verify licensing through official regulatory bodies. Lack of verifiable licenses or offshore registrations with no transparency is concerning.

-

Ambiguous ownership: Companies that do not disclose directors, physical offices, or registered corporate information should be treated with skepticism.

-

Complex withdrawal rules: Requests for extra fees, taxes, or verification before releasing funds are warning signals.

-

Unusual payment methods: Cryptocurrency, gift cards, or third-party wallet transfers are difficult to reverse and are commonly used in deceptive schemes.

-

Overly personal engagement: Excessive messaging, friendly rapport, and constant encouragement to invest more are often manipulative.

Spotting multiple red flags simultaneously should be treated as a serious caution.

The Psychology Behind Platforms Like BittMarket.com

Fraudulent platforms often exploit natural human psychology. Understanding these tactics can help investors avoid falling into traps:

-

Authority bias: Professional-sounding representatives and dashboards create false trust.

-

Social proof: Testimonials and supposed success stories influence investor decisions.

-

Escalation of commitment: Early small investments make investors more likely to deposit additional funds.

-

Fear of missing out (FOMO): Urgency and exclusivity create hasty, ill-considered decisions.

By recognizing these tactics, investors can pause and evaluate offers more critically.

Steps to Protect Yourself

If you are considering BittMarket.com or have already made deposits, take proactive steps to reduce risk:

-

Stop additional deposits: Never send more funds if you suspect issues.

-

Document all activity: Save emails, screenshots, receipts, chat logs, and transaction IDs.

-

Contact your payment provider: Notify banks or payment services about suspicious activity. Credit card chargebacks or payment disputes may be possible.

-

Secure your accounts: Update passwords, enable two-factor authentication, and monitor personal information.

-

Report to authorities: File complaints with local law enforcement or cybercrime units.

-

Notify regulators or consumer protection agencies: Even if funds cannot be immediately recovered, reporting helps prevent future victims.

-

Avoid third-party “recovery” offers: Many services claiming to recover lost funds are scams themselves. Verify credentials thoroughly before engaging with anyone.

Recovery Warnings

After losing money, victims may be contacted by services claiming to be able to recover funds for a fee. Users should treat such offers with extreme caution:

-

These services often ask for upfront payment or personal information.

-

Many are operated by the same networks responsible for the original platform.

-

Only work with verified legal or regulatory authorities for fund recovery.

Being cautious with recovery attempts is critical to avoiding further financial loss.

Building Safer Investment Habits

Long-term investor safety requires vigilance, research, and discipline:

-

Check regulation: Always verify licenses through official government or financial authority databases.

-

Research user experiences: Look for multiple independent reports or complaints.

-

Start small: Test deposits and withdrawals before committing larger sums.

-

Avoid untraceable payments: Stick to methods that allow dispute or chargeback.

-

Educate yourself: Learn basic trading principles and how to spot high-risk platforms.

-

Trust your instincts: If something feels rushed, opaque, or too good to be true, walk away.

End Note

BittMarket.com, based on reported experiences, shows multiple behaviors that warrant caution: smooth initial onboarding, persuasive account managers, escalating deposit requests, and repeated withdrawal obstacles. While no legal accusation is made here, the patterns align with high-risk online trading practices that have affected many investors.

Investors should prioritize verification, research, and skepticism before engaging with any trading platform. Always remember: real investments are transparent, regulated, and cannot guarantee risk-free profits.

Taking these steps and recognizing the warning signs can protect your finances, preserve your personal information, and prevent you from falling victim to the tactics used by platforms similar to BittMarket.com.

Conclusion: Report BittMarket.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs,BittMarket.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through BittMarket.com, extreme caution is advised.