Biyapay.com Review : Deceptive Payment Platform

Introduction

In the ever-evolving digital economy, online payment systems have become an integral part of global financial transactions. From e-commerce and freelance work to peer-to-peer transfers and cryptocurrency exchanges, people increasingly rely on online payment platforms to move money quickly and securely. Unfortunately, this dependency has opened the door to countless fraudulent operations masquerading as legitimate fintech companies.

Among the most deceptive of these is Biyapay.com, a name that has been circulating across online communities as yet another example of a sophisticated financial scam. At first glance, Biyapay.com markets itself as a trusted payment gateway and investment platform, boasting cutting-edge technology and seamless transactions. However, behind its polished image lies a carefully constructed scheme designed to defraud users and vanish without a trace once it has extracted enough money.

This blog explores the inner workings of the Biyapay.com scam — its methods, psychological tactics, false credibility, and the devastating impact it leaves behind.

The Facade of Legitimacy

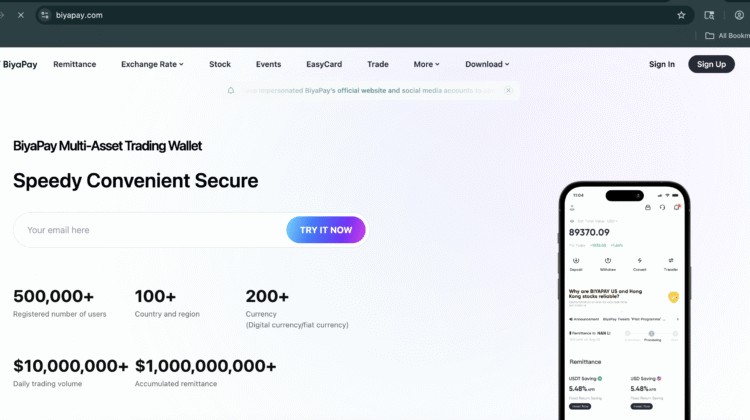

Biyapay.com entire strategy begins with one goal: appear legitimate. Its website is sleek, modern, and professional, complete with digital illustrations, mock statistics, and flashy buzzwords like “secure blockchain integration” and “instant cross-border transfers.” The language mimics that of genuine fintech firms, giving users the illusion of safety and sophistication.

The site claims that Biyapay.com operates as a “global financial gateway” enabling users to transfer, exchange, and store digital and fiat currencies. It supposedly offers low transaction fees, multi-currency support, and integration with cryptocurrency wallets.

However, everything about this presentation is fabricated. The company provides no verifiable registration details, no real office address, and no licensing information from any recognized financial authority. Even the “customer service” phone numbers and email addresses listed on the website often lead nowhere.

A deeper examination of its content reveals inconsistencies — recycled descriptions, grammatical errors, and even duplicated sections from other known scam platforms. These clues suggest that Biyapay.com was not built from scratch but cloned from a template used in multiple fraudulent operations.

The Onboarding Trap

Biyapay.com scam begins with targeted advertising and online promotions. Potential victims encounter its name through pop-up ads, fake social media reviews, or partnerships with fraudulent “investment influencers.” These ads highlight supposed testimonials and profit screenshots that are entirely fabricated.

When users click on the advertisement or link, they are directed to the Biyapay.com homepage, where they are encouraged to register for free. The registration process appears simple and professional, requiring basic personal details — name, email, phone number — followed by a verification step.

But this verification is a trap. Once a user registers, their personal information is stored for exploitation. In many cases, the scammers sell the data to other fraudulent networks or use it to pressure the user into depositing funds.

Soon after signing up, the victim receives an email or phone call from a representative claiming to be from Biyapay.com“financial department” or “client success team.” These so-called representatives are expertly trained in persuasion, using polished scripts and psychological manipulation to gain trust.

The Promise of High Returns

To entice victims, Biyapay.com markets itself not only as a payment gateway but also as an investment platform. The representatives claim that users can earn substantial returns by staking funds within Biyapay.com “automated trading pool” or “digital asset growth system.”

They often reference vague technical jargon — such as “AI-based trading algorithms,” “blockchain arbitrage,” and “smart contract profit distribution” — to sound sophisticated and knowledgeable. Victims are told that they can start earning passive income with minimal effort, and that early investors are already making impressive profits.

The minimum deposit is often set low — around $200 to $500 — to reduce hesitation. Victims see this as a small risk worth taking, especially after being assured of guaranteed returns. The representative might even promise to personally “guide” them through the process.

Once the deposit is made, the user’s account dashboard immediately displays fabricated profits. The numbers rise daily, giving the illusion of growth and success. The interface even includes graphs, transaction histories, and market charts that simulate real trading activity.

In truth, no actual trading or financial activity is taking place. Everything is an illusion crafted to manipulate trust and encourage more deposits.

The Illusion of Success

As the victim continues to see fake profits accumulate, Biyapay.com team becomes more aggressive. The so-called account manager contacts the user regularly, congratulating them on their “investment success.” They suggest that increasing the deposit could unlock even higher returns or access to “premium accounts.”

These conversations are meticulously planned psychological traps. The representative may say things like:

-

“You’re doing incredibly well — our top investors are now doubling their returns with the next tier.”

-

“The market is in a rare opportunity window; if you invest now, your capital could grow by 300% in a month.”

-

“We’re reserving spots for elite investors, and I’d like to include you on that list.”

Such statements create a sense of urgency and exclusivity, pushing victims to commit more funds quickly.

To reinforce trust, the platform sometimes allows small withdrawals early in the process — a few dollars or minor “profit” payouts — to convince users that their money is real and accessible. But once larger amounts are requested, everything changes.

The Withdrawal Deception

The turning point in the Biyapay.com scam occurs when victims attempt to withdraw significant funds. Suddenly, the process becomes complicated. Excuses appear out of nowhere — “pending verification,” “system maintenance,” or “account review.”

Soon, the account manager claims that in order to complete the withdrawal, the user must pay certain fees upfront:

-

“Tax clearance fees” allegedly required by international regulators.

-

“Transfer verification deposits” supposedly needed to confirm identity.

-

“Service or network fees” that must be paid before releasing funds.

Each of these is fabricated. Once these additional payments are made, the victim receives no money. The scammers then continue demanding more payments under new pretexts.

When the victim grows suspicious or refuses to pay further, communication abruptly stops. The account may be frozen, access blocked, and the website might even disappear entirely.

The Psychological Tactics

Biyapay.com operation thrives on its ability to exploit human psychology. Several manipulation tactics are consistently employed to maintain control over victims.

1. Trust Through Professionalism

Scammers use corporate language, professional email templates, and credible-looking documents to simulate legitimacy. The goal is to make victims believe they are dealing with a regulated financial institution.

2. Fear of Missing Out (FOMO)

Urgency is a critical tool. Victims are told they must act quickly to secure a limited opportunity, making them overlook red flags and skip due diligence.

3. Social Proof

Fake testimonials, fabricated “user success stories,” and counterfeit screenshots create a false sense of community. Victims think that if others are profiting, it must be real.

4. Small Wins Before the Big Loss

Allowing a small withdrawal early on is one of the most effective ways to gain trust. It convinces victims that their money is safe, encouraging them to deposit much larger amounts.

5. Emotional Manipulation

The scammers build personal relationships with their targets, often using empathy and flattery. They remember details from conversations, creating a false sense of friendship and loyalty.

The Collapse of the Illusion

Eventually, every scam reaches a breaking point. For Biyapay.com, it happens when victims realize they can no longer withdraw funds and the representatives have vanished.

The website might suddenly become inaccessible, or a notice appears stating that the platform is “under maintenance.” Sometimes the domain is quickly redirected to a new fake platform with a different name but identical design.

In some cases, victims notice that their supposed “profits” on the dashboard have turned negative overnight — a final tactic to justify why they can’t withdraw funds. The scammers claim the market has crashed or that the trading algorithm suffered a temporary loss, leaving users empty-handed.

Within weeks, the company disappears entirely, leaving no trace of its operators.

Red Flags Exposing the Scam

While Biyapay.com operation is cleverly designed, several warning signs clearly reveal its fraudulent nature:

-

No Official Licensing or Registration – The company provides no evidence of regulatory oversight or legal registration in any country.

-

Anonymous Ownership – The names of executives or founders are absent, and the “team” photos are often stock images.

-

Unrealistic Promises – Claims of guaranteed profits or daily returns are mathematically impossible in real financial markets.

-

Crypto-Only Payments – Requiring deposits in cryptocurrencies is a key tactic, as such transactions are irreversible and untraceable.

-

Pressure to Reinvest – Constant encouragement to deposit more money is a hallmark of investment scams.

-

Fake Technical Jargon – The use of terms like “AI trading,” “smart algorithms,” and “blockchain arbitrage” without explanation signals deception.

-

Withdrawal Barriers – Legitimate platforms never demand additional payments before allowing users to withdraw funds.

Each of these red flags, when combined, paints a clear picture of intentional deceit.

The Human Cost

The Biyapay.com scam has left emotional and financial scars on countless individuals. Many victims describe feelings of guilt and shame for having fallen for what seemed like a legitimate opportunity. Some were retirees seeking to grow their savings; others were young professionals experimenting with digital finance.

The psychological trauma of being deceived — the constant communication, false hope, and eventual betrayal — often lingers long after the financial loss. Victims report anxiety, insomnia, and distrust toward all online financial services thereafter.

This emotional devastation underscores the human side of online scams: they aren’t just financial crimes, but deeply personal acts of manipulation.

End Note

Biyapay.com is a textbook example of how modern online scams operate under the guise of innovation. It uses the language of fintech, the design of professional payment systems, and the emotional manipulation of investment fraud to create a perfect illusion of legitimacy.

Every aspect of the platform — from its sleek interface to its persuasive representatives — is meticulously engineered to build trust, extract funds, and then disappear without consequence.

While Biyapay.com claims to empower global financial freedom, it delivers nothing but deception and loss. Its existence serves as a chilling reminder that in today’s digital financial landscape, even the most professional-looking websites can be nothing more than traps designed to exploit trust and ambition.

Behind every promise of “instant profit” or “secure trading” lies the same old scheme: a scam engineered to take advantage of human hope.

Conclusion: Report Biyapay.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Biyapay.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Biyapay.com, extreme caution is advised.