Biyapay.com Review — Deceptive Payment Platform

Introduction

In the growing world of online finance, where innovation and digital convenience dominate, there also lurks a dark side — platforms that exploit trust and technological sophistication to commit fraud. One such fraudulent entity is Biyapay.com, a name that has recently drawn widespread attention for all the wrong reasons. Disguised as a legitimate payment and investment platform, Biyapay.com has managed to lure countless unsuspecting users into its web of deceit. This comprehensive review uncovers how Biyapay.com operates, the lies it tells to appear credible, and why it should be recognized for what it truly is — a meticulously constructed scam.

1. The façade of legitimacy — How Biyapay.com presents itself

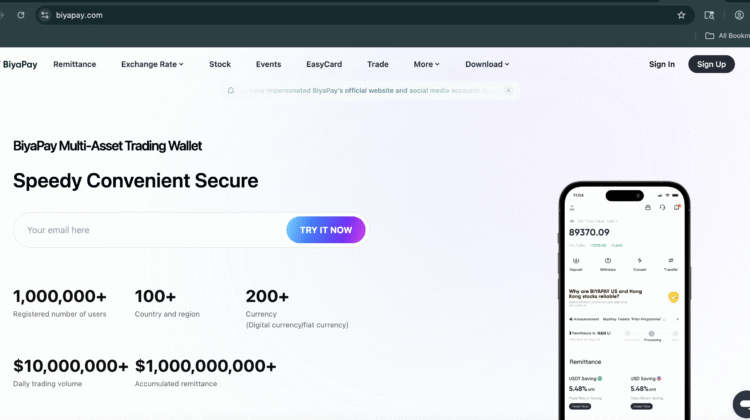

At first glance, Biyapay.com appears professional and reliable. Its website layout is sleek, its colors are appealing, and its content sounds authoritative. It introduces itself as a “next-generation payment and investment platform” designed to make digital transactions faster, easier, and more secure.

Biyapay.com often claims to offer a range of financial services — from facilitating international payments to providing lucrative investment opportunities. It boasts of having advanced technology, fast transaction times, and top-tier security features. To the untrained eye, it looks like a fintech startup bridging the gap between traditional banking and modern finance.

However, upon closer inspection, all these claims crumble under scrutiny. There are no verified licenses, no transparent ownership details, and no credible partnerships. Everything about Biyapay.com — from its mission statement to its customer testimonials — is designed purely to build false credibility.

2. The illusion of innovation — Fake technology and buzzwords

One of Biyapay.com primary tactics is the overuse of tech jargon to convince users of its authenticity. The site constantly references “blockchain-backed security,” “AI-driven payment algorithms,” and “decentralized transaction validation.” These terms are thrown around without any technical explanation or verifiable evidence.

This linguistic manipulation is a common strategy in scam operations. By sounding futuristic and technologically advanced, scammers aim to silence doubt and attract inexperienced users who assume that complicated terminology equals trustworthiness.

In reality, Biyapay.com does not use blockchain or AI for any legitimate purpose. The technology it claims to rely on either doesn’t exist or is copied text from legitimate fintech sites. Its digital systems are not connected to any real financial network — only to its own internal scam database that controls fake balances and transaction statuses.

3. The setup — How victims are drawn into Biyapay.com trap

Biyapay.com recruitment process begins through online advertising and social media promotions. Victims often encounter Biyapay.com through pop-up ads, email campaigns, or sponsored posts promising incredible investment returns and low-cost international transfers.

These ads usually read something like:

“Earn daily profits from our smart payment network!”

“Join the future of finance — instant global payments and guaranteed returns!”

Such enticing messages are supported by fabricated testimonials showing smiling individuals who supposedly made thousands through Biyapay.com. Clicking on these ads directs users to a polished landing page where they’re encouraged to “sign up for free.”

The registration form asks for personal information — including full name, phone number, and email — which becomes the foundation for the next stage of the scam. Within hours, the victim receives a call or message from a so-called “Biyapay.com representative,” a trained scammer who uses persuasive tactics to convince them to deposit money.

4. The sales pitch — Manipulative communication

Once contact is established, Biyapay.com representatives employ psychological manipulation to build trust and create urgency. They present themselves as financial experts or senior account managers who want to help the user “grow their money.”

They use scripted lines like:

-

“We’re helping early investors secure high-yield benefits before the system expands.”

-

“If you start with just $250, you’ll see results in a few days.”

-

“This opportunity won’t be available for long; spots are closing fast.”

The scammers mix friendliness with authority, using charisma and professional-sounding language to make victims feel comfortable. They pretend to offer personalized investment advice, when in fact their only goal is to secure that first deposit.

5. The initial deposit — The first step toward loss

The entry point for Biyapay.com fraud is a seemingly modest minimum deposit, often between $200 and $500. This amount is presented as an activation fee or a minimum balance to begin using the platform’s payment and investment services.

After depositing the money, users are given access to what appears to be a personal dashboard. It includes transaction history, profit charts, and account statistics. At first glance, this dashboard looks legitimate, giving victims a false sense of progress and control.

However, these dashboards are entirely simulated. They display fake balances, falsified transaction confirmations, and fabricated earnings data to create the illusion that the investment is growing.

For instance, users might see their balance increase by 10–20% within a few days, which encourages them to deposit more. The numbers are manipulated manually by scammers to mimic success.

6. The escalation — Pressure to invest larger amounts

Once the victim feels confident and starts believing in the platform, Biyapay.com representatives push for larger investments. They might call or message the victim, congratulating them on their “profits” and offering “exclusive plans” for higher returns.

Some of the fake investment packages include names like:

-

Biyapay.com Premium Plan – Promising 15% weekly profit.

-

Elite Investor Package – Offering guaranteed monthly returns.

-

AI Trading Integration Plan – Claimed to use machine learning for high accuracy.

Each of these plans is a lie designed to extract more funds. The more money a victim deposits, the more aggressively the scammers pursue them, using fake account statements and fabricated profit reports to reinforce their trust.

Victims often end up depositing thousands of dollars, believing they are growing wealth, while the scammers simply collect the funds and move them across untraceable accounts.

7. The turning point — When users attempt withdrawals

The scam reaches its climax when users try to withdraw their supposed profits. Up to this point, communication from Biyapay.com representatives is friendly and proactive. But the moment a withdrawal request is made, everything changes.

Victims begin to encounter endless excuses and obstacles such as:

-

Verification issues: “Your account needs to be verified before withdrawal.”

-

Hidden fees: “You must pay a 10% processing or tax fee first.”

-

Technical problems: “Our system is temporarily under maintenance.”

-

New conditions: “You need to upgrade your account to process withdrawals.”

Some victims are even told that their profits are “locked in a smart contract” and that they must invest more to release them. These manipulative tactics prolong the scam and extract more money before the perpetrators disappear entirely.

Eventually, Biyapay.com stops responding altogether. The website may suddenly go offline or block the victim’s login access. In some cases, the scammers move to a new domain and start the operation all over again under a different name.

8. False claims of regulation and legitimacy

To maintain an illusion of legitimacy, Biyapay.com falsely claims to be licensed by major regulatory bodies such as the FCA (UK) or CySEC (Cyprus). The website sometimes displays fake registration numbers or copies of forged certificates.

However, none of these claims can be verified. A genuine check with real financial regulators reveals that Biyapay.com has no registration, no authorization, and no record of operation under any financial jurisdiction.

Additionally, the company’s supposed physical address — often listed in places like London, Singapore, or Zurich — is completely fake. In some cases, the address leads to unrelated businesses or empty offices. This complete anonymity is a deliberate strategy to evade accountability.

9. Payment methods designed to erase the money trail

Biyapay.com payment system is another indicator of fraud. It insists on using irreversible payment methods such as:

-

Cryptocurrency transfers (Bitcoin, Ethereum, USDT).

-

Wire transfers to offshore accounts.

-

Third-party processors that lack transparency.

These methods are chosen specifically because they are difficult to trace or reverse. Victims are discouraged from using credit cards or secure platforms like PayPal, which could allow chargebacks. Once the funds are sent, the scammers immediately move them through multiple wallets or shell accounts, making recovery nearly impossible.

10. The ripple effect — Identity theft and data misuse

Another sinister aspect of Biyapay.com operation is its misuse of personal data. During registration, users are often asked to upload identification documents “for verification purposes.” These documents — passports, IDs, or bank statements — are later misused or sold to other criminal groups.

This leads to a secondary wave of fraud, where victims might later find their identities used in other scams, fake accounts, or unauthorized transactions. Some even receive follow-up messages from “recovery agents” claiming they can retrieve the lost money for a fee — which is yet another layer of deception tied to the same network.

11. Rebranding — The endless cycle of deception

Like many online scams, Biyapay.com does not operate under a single identity for long. Once its reputation begins to crumble and online reviews expose it as fraudulent, the people behind it simply rebrand.

They launch a new website with a fresh name, slightly altered design, and the same fraudulent structure. The scripts, sales pitches, and fake dashboards remain identical. This recycling process allows them to target new victims continuously while avoiding detection and legal consequences.

12. Clear signs that Biyapay.com is a scam

The following red flags confirm that Biyapay.com is not legitimate:

-

No valid financial license or registration.

-

Guaranteed returns with zero risk.

-

Unverifiable company ownership or location.

-

Refusal to process withdrawals.

-

Overuse of crypto payment methods.

-

Fake testimonials and promotional content.

-

Poor grammar and generic website copy.

-

Pressure to deposit larger amounts quickly.

Any single one of these signs should raise suspicion, but together they form an undeniable pattern of organized fraud.

13. The aftermath — Financial loss and emotional toll

The victims of Biyapay.com often lose not just their money, but also their sense of trust in online financial systems. The emotional consequences are severe — anxiety, regret, and shame are common feelings among those who realize they’ve been deceived.

Many individuals hesitate to speak out, fearing embarrassment or believing there’s no hope of justice. Unfortunately, this silence allows scams like Biyapay.com to thrive, preying on others who remain unaware of the danger.

14. Final verdict — Biyapay.com is a fraudulent operation built on lies

After thorough examination, there is no doubt that Biyapay.com is a scam. It is a fake payment and investment platform designed to exploit investor optimism through fabricated technology claims, psychological manipulation, and a carefully crafted illusion of legitimacy.

Conclusion: Report Biyapay.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Biyapay.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Biyapay.com , extreme caution is advised.