BiyaPay.com Review : Scam Investment Platform

Introduction

In the booming world of online financial services — from cryptocurrency exchanges to trading platforms — not all that glitters is gold. Behind sleek websites and compelling marketing language lurk operations that promise easy money and effortless profits but deliver confusion, frustration, and often untraceable losses. One such platform that has drawn increasing skepticism from experienced investors and industry observers alike is BiyaPay.com.

On the surface, BiyaPay.com markets itself as a modern, user-friendly financial service — offering access to investment products, trading tools, and smart asset management. But a closer look reveals a platform that fails on multiple fronts, including transparency, regulation, operational clarity, and user accountability. This review breaks down the key issues and red flags that make BiyaPay a platform to approach with deep suspicion.

1. First Impressions: Glossy Design, Little Transparency

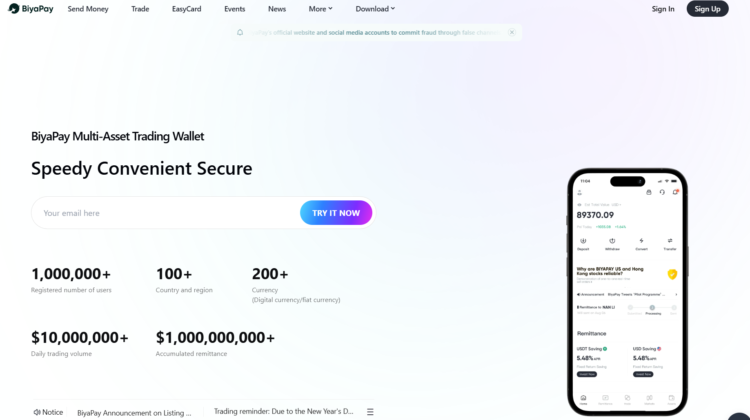

Landing on BiyaPay.com homepage, you are greeted with bright visuals, upbeat messaging, and confident language about “unlocking financial freedom” and “advanced investment solutions.” In today’s online environment, aesthetics are important — but they are not evidence of legitimacy.

Many scam services invest considerable effort into design and presentation because it establishes trust before users start asking tough questions. A slick interface may engage the eye, but it should never be a substitute for concrete information about who runs the service, how it operates, and under what legal framework it exists.

With BiyaPay.com, the gap between marketing language and operational substance becomes apparent quickly once you start digging.

2. Regulatory Oversight: Absent and Unclear

The first test of credibility for any financial platform is regulatory transparency. Legitimate brokers, exchanges, and financial services are registered and regulated by recognized authorities, which enforce rules to protect users, ensure proper handling of funds, and impose disclosure requirements.BiyaPay.com, however, does not provide clear, verifiable regulatory information. There are no identifiable license numbers, no governing financial authority stated, and no transparent disclosure indicating which jurisdiction oversees its operations.

Instead, the platform uses vague phrasing like “compliant with industry norms” or “operating internationally,” without tying those claims to any specific regulatory body. This absence of clear oversight means:

-

No independent authority is holding the platform accountable.

-

Investors lack formal protection frameworks that licensed services provide.

-

There is no enforced standard for transparency, financial reporting, or risk controls.

A financial service that handles deposits, trades, or investment instruments without verifiable regulation is inherently high-risk.

3. Corporate Identity: Who Is Behind BiyaPay.com?

Trustworthy financial platforms clearly disclose corporate identity — including the legal company name, physical headquarters, registration details, and executive leadership. This information helps users verify the entity, understand its jurisdiction, and gauge accountability.

With BiyaPay.com, corporate identity information is opaque and incomplete. The public footprint of the platform does not clearly reveal:

-

A verifiable legal entity

-

A registered corporate address

-

Publicly listed executives or management team

-

Corporate registration identifiers

Instead, users encounter broad phrases about “our global network” and “international team” without factual, independently verifiable details. This corporate vagueness is a classic characteristic of high-risk platforms that seek to minimize accountability and avoid legal scrutiny.

When a platform conceals its legal identity, it becomes nearly impossible to assess who is responsible for its operations or where — legally — disputes could be settled.

4. Marketing Claims Versus Measurable Reality

BiyaPay.com promotional materials lean heavily on aspirational language: “empower your financial journey,” “advanced trading tools,” “maximize growth.” These slogans are designed to excite and inspire, but they are not backed by measurable evidence.

A legitimate financial platform usually provides:

-

Detailed descriptions of products and services

-

Clear documentation of how tools and strategies work

-

Independent performance metrics or audited results

-

Balanced risk disclosures that discuss potential losses

BiyaPay.com public materials lack these critical elements. Instead of measurable substance, users are presented with broad statements that suggest possibility without explaining how that possibility is realized.

This creates a scenario where users are asked to trust claims without being given the context to evaluate them critically.

5. Fee Structure: Hidden and Undisclosed

A transparent fee structure is one of the cornerstones of a reputable financial service. Users must know exactly:

-

What they are charged for trades

-

Whether deposits incur fees

-

What withdrawal costs might apply

-

Whether there are maintenance or inactivity fees

BiyaPay.com fee disclosures — where they exist at all — are scattered, ambiguous, or buried in hard-to-interpret language. Instead of clear, itemized fees, investors encounter terms like “competitive pricing” or “variable charges,” which do not provide any actionable insight into actual costs.

Without an itemized fee schedule, users have no reliable way to understand the real cost of using the platform, including how fees might impact net returns or trading outcomes.

When a financial service hides or obfuscates fees, it significantly undermines trust and makes informed decision-making nearly impossible.

6. Deposits and Withdrawals: A Cloud of Uncertainty

One of the most critical aspects of investor confidence in any platform is the ability to access your own funds.

With BiyaPay.com, there is no clear and detailed explanation of how deposits and withdrawals work. Users are left wondering:

-

What payment methods are accepted?

-

How long does it take to withdraw funds?

-

Are there minimum or maximum limits?

-

Are documents required for every withdrawal?

-

Are there hidden penalties or conditions?

The platform’s public information on these crucial processes is vague at best. This lack of specific detail creates uncertainty about whether users can reliably get their money out once it goes in — a serious red flag in financial service scrutiny.

7. Customer Support: Poor or Non-Responsive

A robust support structure is essential for any legitimate financial service. Factors that differentiate real platforms from scam operations include:

-

Multiple support channels

-

Responsive, knowledgeable representatives

-

Clear escalation paths for complex issues

-

Timely replies to account, trade, or transaction questions

BiyaPay.com reported support infrastructure, however, is weak. Users frequently describe:

-

Slow response times

-

Generic or templated replies

-

No live human support or verified hotline

-

Unhelpful answers to important questions

When support isn’t responsive or effective, users are left to navigate complex issues on their own — a situation that often amplifies financial risk and frustration.

8. Data Security: Vague Technical Disclosures

In financial platforms, security is not a luxury — it’s a requirement. Legitimate services clearly explain:

-

How user data is protected

-

What encryption standards are used

-

Whether third-party security audits exist

-

What protocols are in place to prevent unauthorized access

BiyaPay.com provides broad statements about secure systems but fails to detail actual technical standards, practices, or proof of audits. This lack of specific data security disclosure means users have no clear understanding of how their personal and financial information is protected — a unsettling gap in a platform that handles sensitive data.

11. Key Red Flags Investors Should Know

Here’s a consolidated list of the most significant warning signs associated with BiyaPay.com:

-

No clearly verifiable regulatory oversight

-

Opaque corporate identity with no legal accountability

-

Unsubstantiated performance claims

-

Lack of transparent fee structures

-

Ambiguous deposit and withdrawal processes

-

Ineffective or non-responsive customer support

-

Insufficient data security disclosures

-

Sparse and inconsistent independent user feedback

-

Marketing language heavy on hype, light on fact

Each of these issues individually should prompt caution. Combined, they form a pattern that strongly suggests BiyaPay.com operates with limited transparency and accountability — traits commonly identified in scam-oriented platforms.

End Note : BiyaPay.com Fails Core Credibility Tests

Investing online should be built on clarity, accountability, and verifiable structure. A platform that offers those things clearly, transparently, and consistently is one that deserves trust and serious consideration.

BiyaPay.com, by contrast, repeatedly fails foundational checks:

-

It does not demonstrate verifiable regulatory compliance.

-

It conceals or omits corporate identity details.

-

It uses promotional language in place of clear operational explanation.

-

It lacks transparent fees, dependable support, and concrete security disclosures.

-

It doesn’t cultivate a solid independent reputation among users.

All these factors combined create a profile that is not consistent with reputable financial services. Users deserve access to services that explain how their money is used, how risks are managed, and how they can access support when needed. BiyaPay.com does not provide that.

Conclusion: Report BiyaPay.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, BiyaPay.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through BiyaPay.com, extreme caution is advised.