Bright-Securities.com Review – Sophisticated Online Investment Fraud

Introduction

In the vast world of online investing, not every platform that promises profits and professional management is genuine. Some are carefully designed traps set up to deceive unsuspecting investors into parting with their money. Bright-Securities.com is one of these deceptive entities. Behind its polished design and confident claims lies a calculated scheme engineered to extract deposits, fabricate trading activity, and eventually vanish once victims realize the truth.

This detailed review exposes the Bright-Securities.com scam, explaining how it operates, what red flags reveal its fraudulent nature, and how investors have been tricked by its clever manipulations.

1. The Illusion of Legitimacy

At first glance, Bright-Securities.com presents itself as a high-end investment and trading platform. Its website is sleek, modern, and filled with impressive financial jargon. It claims to provide a wide range of investment options, from forex trading and cryptocurrency investments to commodities and indices.

The homepage boasts of “cutting-edge trading tools,” “experienced market analysts,” and “secure transactions.” These phrases are deliberately chosen to sound credible and professional. There’s even mention of compliance with international trading standards and data protection protocols—claims that are never backed by verifiable facts.

However, a closer look reveals an alarming truth: there is no tangible information about the company’s physical address, registration number, or regulatory licensing. The “About Us” section is full of vague statements, and any attempt to verify its registration in major financial jurisdictions such as the UK, Australia, or Cyprus leads to dead ends.

This lack of transparency is the first and strongest indicator that Bright-Securities.com is not a legitimate financial institution but a façade for fraudulent activity.

2. Too-Good-to-Be-True Promises

Bright-Securities lures investors with impossible profit guarantees. It claims to deliver consistent returns regardless of market volatility. Advertising slogans such as “Steady growth with zero risk” or “Your profits are our priority” create a false sense of security.

Real trading involves risk, uncertainty, and market fluctuations. Any company promising guaranteed profits or fixed returns in a volatile market should immediately raise suspicion.

Bright-Securities.com’ promotional materials frequently reference automated trading bots or proprietary algorithms that supposedly “ensure daily gains.” These statements are unsubstantiated and scientifically implausible. There is no legitimate trading system capable of guaranteeing continuous profits without losses.

3. How the Trap is Set

Bright-Securities.com’ marketing strategy is aggressive and manipulative. The scheme typically begins with social media advertisements, fake investment success stories, and testimonials that claim massive earnings in a short period.

Once an individual clicks on one of these ads, they are directed to a sleek landing page asking for basic details—name, email, and phone number. Submitting this information triggers an immediate response from the scammers behind the operation.

Victims soon receive a call or message from a self-proclaimed “financial advisor” or “account manager.” These individuals are skilled at building trust quickly. They speak with confidence, use financial jargon, and portray themselves as seasoned professionals.

Their initial goal is to convince the victim to make a small deposit, usually around $250 or $500. This “entry-level” investment is framed as a low-risk opportunity to test the platform.

4. The Fake Trading Interface

After depositing funds, users are given access to an online trading dashboard that looks legitimate. The interface shows charts, market movements, and account balances that appear to change in real-time. However, this is a complete simulation—a digital illusion designed to mimic a functioning trading platform.

No actual trades occur in the market. The numbers on the dashboard are manually manipulated by the scammers to create the impression of profit. Victims see their balance growing and become convinced that the platform works.

In some cases, the scammers even allow a small withdrawal early on. This tactic is known as a confidence payout. By letting users withdraw a minor amount, the scammers create trust, encouraging the victim to deposit more.

5. Escalation and Pressure Tactics

Once trust is established, Bright-Securities.com’ so-called account managers escalate their demands. They contact the victim frequently, pushing them to upgrade their account tiers or invest in “exclusive opportunities.”

They claim that larger investments unlock access to higher profit margins or premium trading strategies. Common phrases include:

-

“You’re missing out on our VIP plan.”

-

“This offer expires today; act fast.”

-

“Double your capital in two weeks by reinvesting.”

These tactics are deliberate psychological manipulations designed to create urgency and exploit greed. Victims often end up depositing thousands more, believing they’re about to achieve financial independence.

6. The Moment of Collapse – Withdrawal Denied

Everything appears fine until the victim attempts to withdraw a significant portion of their funds. Suddenly, Bright-Securities’ support becomes unresponsive or evasive. Withdrawal requests are delayed, denied, or conditioned upon the payment of additional fees.

Common excuses include:

-

“You must pay a 10% transaction tax before your funds can be released.”

-

“Your account is under audit; withdrawals are temporarily disabled.”

-

“You need to upgrade your plan to unlock your profits.”

These are classic tactics used by investment scams to extract even more money. In reality, no withdrawals are ever processed. Once the scammers sense that the victim is suspicious or unwilling to pay further, communication ceases entirely. The website may even disappear or change its domain name overnight.

7. The Fake Credentials

Bright-Securities.com often lists false certifications and regulatory claims to appear credible. It may display badges or logos resembling legitimate financial regulators such as the FCA, FINRA, or CySEC, but these are counterfeit.

A legitimate broker can always provide a verifiable license number that can be confirmed on a regulator’s official website. Bright-Securities provides no such proof. In some cases, victims have reported that the platform presented fabricated registration certificates when asked for validation.

This fake legitimacy is one of the most dangerous aspects of the scam. It convinces even cautious investors that they are dealing with a lawful entity.

8. How Victims Are Trapped Psychologically

Bright-Securities doesn’t just steal money; it manipulates psychology. The scammers behind the scheme are trained in social engineering—the art of influencing behavior through trust and emotion.

They use several techniques to manipulate victims:

-

Authority bias: Presenting themselves as financial experts.

-

Reciprocity: Offering “bonuses” or “free trading credits” to build obligation.

-

Fear of missing out: Creating artificial urgency.

-

Consistency pressure: Reminding victims of their earlier commitments to keep them investing.

By the time the victim realizes something is wrong, they have often invested large sums, sometimes even borrowing money under the illusion of quick returns.

9. The Vanishing Act

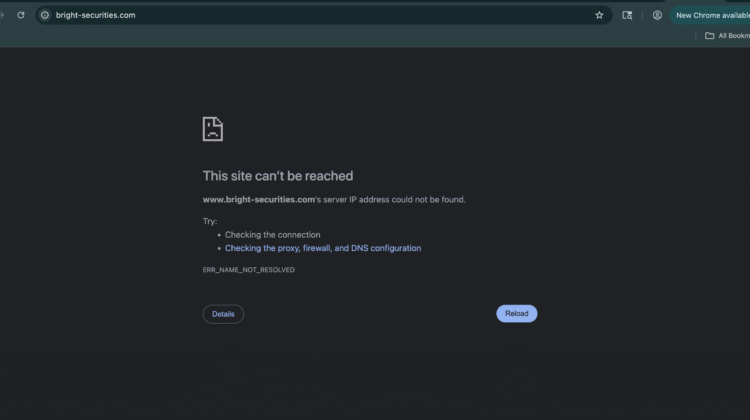

When Bright-Securities.com has extracted enough funds from a group of victims, it performs its final move: disappearance.

The website goes offline or redirects to a new domain with a different name and logo but the same design. Email addresses stop responding, phone lines are disconnected, and all traces of the company vanish.

In many cases, the scammers simply rebrand under a new name and continue their operation using the same structure, scripts, and fraudulent dashboard. This cycle allows them to continuously target new victims while escaping detection.

10. Common Red Flags Identifying Bright-Securities.com as a Scam

Several clear indicators mark Bright-Securities as a fraudulent operation:

-

No verifiable company registration or regulatory license.

-

Anonymous ownership and fake contact information.

-

Unrealistic promises of guaranteed returns.

-

Pressure tactics to deposit more money.

-

Fake trading dashboards showing fabricated profits.

-

Obstructed or denied withdrawal requests.

-

Counterfeit trust badges and licenses.

-

Untraceable offshore payment channels (crypto or wire transfers).

Every one of these traits aligns with the typical structure of online investment scams.

11. The Impact on Victims

The consequences of scams like Bright-Securities.com extend far beyond financial loss. Victims often describe feelings of betrayal, shame, and helplessness. Many believed they were engaging with a real broker, supported by professionals and legitimate trading systems.

When the truth emerges, the emotional fallout can be devastating. People lose not only their savings but also their confidence in financial systems and online investments. The sophisticated nature of Bright-Securities’ manipulation makes the experience even more psychologically damaging.

12. The Pattern Behind the Scam

Bright-Securities is not an isolated case—it fits into a larger network of cloned and rebranded scams. Similar platforms often share nearly identical websites, with minor changes in color schemes, logos, and domain names.

This repetition suggests that Bright-Securities.com is part of a broader fraudulent operation that recycles its structure to stay ahead of detection. Once complaints or exposure increase, the scammers abandon the name and resurface elsewhere.

13. Key Lessons and Red Flags for Investors

Bright-Securities.com exemplifies how sophisticated online scams can appear legitimate on the surface. Investors can protect themselves by recognizing these red flags early:

-

Verify all registration claims through official regulatory websites.

-

Be skeptical of platforms that promise risk-free profits.

-

Avoid brokers that demand payment through cryptocurrency or untraceable transfers.

-

Always research a company’s background and user reviews before depositing.

-

Never let urgency or persuasion override due diligence.

14. End Note –

Bright-Securities.com is a polished but fraudulent investment platform designed to deceive and exploit. Every component of its operation—from the fake trading dashboard to its fabricated advisors—is engineered to create trust, extract money, and vanish.

Its strategy follows the same pattern seen in countless online trading scams: seductive promises, psychological manipulation, fabricated profits, and blocked withdrawals. The professionalism of its presentation hides the fact that there are no real investments, no real trading, and no legitimate business operations behind it.

For anyone considering Bright-Securities.com or encountering similar platforms, the warning is clear: this is not a financial opportunity—it is a scam disguised as one. The only goal of Bright-Securities.com is to take money from unsuspecting investors and disappear, leaving behind digital ashes and financial devastation.

In short, Bright-Securities.com is not a brokerage, it’s a carefully orchestrated fraud—a reminder that in the world of online investments, skepticism and verification are the most powerful forms of protection.

Conclusion: Report Bright-Securities.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Bright-Securities.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Bright-Securities.com , extreme caution is advised.