CCBIGlobal.com Review — A Fraudulent Investment Platform

Introduction

In the rapidly expanding digital investment space, countless platforms vie for investor attention — and unfortunately, not all of them are legitimate. CCBIGlobal.com is one such entity that has drawn serious scrutiny and skepticism for its deceptive practices, lack of transparency, and behavior consistent with online investment scams. While the platform markets itself as a next-generation financial and trading service, a closer examination reveals troubling signs that indicate it is not what it claims to be.

This comprehensive review explores how CCBIGlobal.com operates, the red flags that expose its fraudulent nature, the psychological tactics it uses to ensnare victims, and why it should be approached with extreme caution.

A Convincing First Impression — But Don’t Be Fooled

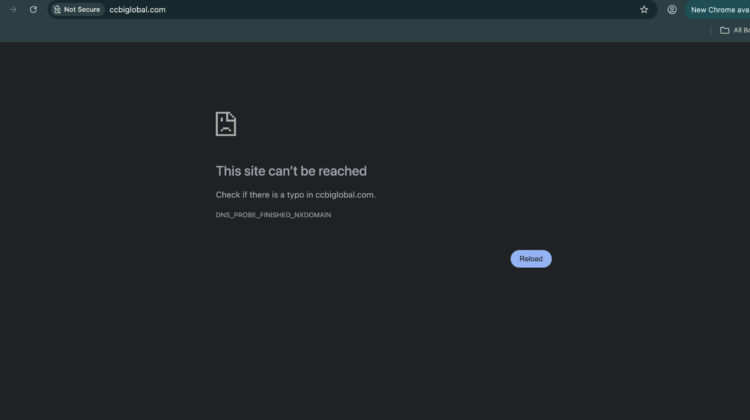

When you first visit CCBIGlobal.com website, you are met with a professional layout, bold claims of advanced trading technology, and confident language about wealth creation and investor success. The platform presents itself as a trustworthy, user-friendly, and globally connected financial hub capable of delivering significant returns.

Some of the features highlighted include:

-

A sleek trading dashboard

-

Automated trading tools

-

Cryptocurrency, forex, and commodities access

-

Dedicated account managers

-

High-performance investment plans

All of these elements are designed to create a false sense of credibility and to appeal to both new and experienced investors. However, while the site may look polished, its substance is severely lacking, and that is where the first red flags appear.

Misleading Marketing and Unrealistic Claims

CCBIGlobal.com marketing materials are filled with phrases designed to attract investors by promising effortless profits and exceptional performance. Some of these include:

-

“Guaranteed Returns”

-

“Risk-Free Investing”

-

“Fast and High Profits”

-

“AI-Enhanced Investment Strategies”

In legitimate finance, phrases like “guaranteed returns” and “risk-free investing” simply do not apply. Financial markets are inherently unpredictable — even the most seasoned fund managers cannot promise profits, and any platform that claims otherwise is either extremely ignorant of financial basics or deliberately deceptive.

The use of such misleading claims is a classic tactic in investment scams. By implying high and predictable performance, CCBIGlobal.com plays on human optimism, prompting investors to overlook caution and act on impulse.

Lack of Verifiable Regulation

Financial services providers operating in legitimate markets must be regulated by recognized authorities — bodies like the Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC), CySEC, or ASIC. These regulatory bodies ensure investor protection, enforce compliance, and provide oversight.

CCBIGlobal, however, fails in this fundamental aspect:

-

No clear regulatory registration is provided.

-

No verifiable licensing numbers are displayed.

-

No credible financial authority is linked to the platform’s operations.

The absence of verifiable regulation is a major red flag. Platforms that operate without regulatory oversight are not accountable to any legal standards, and they can manipulate funds or investor data without consequence. Without proof of regulation from a recognized authority, there is no assurance that CCBIGlobal.com operates ethically or legally.

Anonymous Ownership and Lack of Transparency

Another concerning aspect of CCBIGlobal.com is the complete lack of transparency regarding its ownership and leadership. Legitimate financial firms provide detailed information about:

-

Corporate registration

-

Physical office locations

-

Founders and executives

-

Contact information

CCBIGlobal.com provides none of this. There is no corporate address, no named representatives with verifiable backgrounds, and no traceable point of contact. The platform’s “contact us” page usually offers generic email forms or instant chat features that are often unresponsive or run by automated scripts.

When a company refuses to disclose even basic corporate details, it suggests an intent to remain hidden and avoid accountability — a tactic commonly used by fraudulent entities.

Elaborate and Manipulative Onboarding

CCBIGlobal.com uses an onboarding process that becomes increasingly aggressive and persuasive over time. Once a user completes the initial registration, they are frequently contacted by a so-called “account manager” or “investment advisor.” These individuals often:

-

Sound knowledgeable and friendly

-

Use financial jargon to impress

-

Reassure users about the safety of their investment

-

Stress urgency to act quickly

This approach is less about user education and more about psychological persuasion. The account managers typically encourage users to make a deposit quickly — often under the guise of a limited-time opportunity or exclusive offer.

The objective is simple: reduce hesitation and move users toward immediate financial commitments before they have had a chance to verify legitimacy or do external research.

Escalating Investment Pressure

Once a user makes an initial deposit — often positioned as a low-risk entry point — the pressure to deposit larger sums intensifies. Users may hear statements like:

-

“Your returns will grow faster with a higher tier plan.”

-

“We recommend upgrading to maximize profits.”

-

“This opportunity will not last long.”

These upselling tactics are designed to exploit greed and fear of missing out (FOMO). They push users to increase their investment before verifying whether the platform is credible.

In legitimate investment environments, advisors provide balanced information, including potential risks, expected volatility, and long-term strategy. They never encourage repeated deposits based on unrealistic profit claims.

Fake Trading Dashboards and Fabricated Returns

One of the most deceptive elements of CCBIGlobal.com is its trading dashboard — an interface that appears to show live performance, profit statistics, and investment growth. On the surface, this dashboard looks like the real thing, with charts, balances, and performance indicators that update over time.

However, in fraudulent schemes, these interfaces are often entirely simulated and not connected to any real trading system. The displayed figures may be manipulated by the platform to show profitable activity regardless of actual market conditions.

This fabricated performance does two things:

-

Builds user confidence — Users see their balance “growing,” which gives the impression that the platform delivers consistent returns.

-

Encourages more deposits — The false sense of success motivates users to add more funds in the hope of earning more.

Because the data is controlled internally, there is no way for users to verify whether any real trading or investment activity is taking place.

Withdrawal Barriers and Obstruction

The true test of any investment platform is its ability to process withdrawals. For users of CCBIGlobal.com, the withdrawal process typically becomes problematic — and eventually obstructed — once a request is made.

Common issues include:

-

Requests for additional “security verification”

-

Demands for unexpected fees or charges

-

Claims that withdrawal conditions have changed

-

Repeated delays with no concrete timelines

-

Abrupt communication breakdowns after withdrawal requests

In a legitimate environment, withdrawal methods, timelines, and fees are clearly disclosed upfront and executed within a reasonable period. CCBIGlobal.com pattern of creating new requirements after money has already been deposited is a classic mechanism used by fraudulent platforms to delay or prevent funds from being released.

An Entirely Controlled User Experience

CCBIGlobal.com entire user experience appears designed to keep users engaged without providing genuine financial service. The combination of simulated dashboards, unverified performance metrics, and pressure from account managers creates a closed loop that is controlled entirely by the platform.

Users see what the platform wants them to see. Positive feedback loops are generated internally, not through real market performance. Meanwhile, potential obstacles — such as withdrawals — are introduced only when users attempt to exercise control over their own funds.

This controlled environment is not the behavior of an accountable financial firm.

Fake Testimonials and Misleading Social Proof

To further bolster its image, CCBIGlobal.com often uses testimonials and success stories that appear to be from satisfied “users.” However, these testimonials frequently:

-

Use generic or stock images

-

Include overly broad statements like “I made so much money!”

-

Offer no verifiable transaction records

-

Use repetitive language across different testimonial pages

These are classic signs of manufactured social proof — designed to influence perception and drown out legitimate criticism.

Psychological Exploitation and User Manipulation

Scams like CCBIGlobal.com thrive on human psychology. Several cognitive biases make people vulnerable:

-

Greed: The lure of quick, high returns encourages risk-taking.

-

Authority: Account managers position themselves as experts.

-

Urgency: Implied limited-time offers push hasty decisions.

-

Confirmation Bias: Users see what they want to see — profits on the dashboard.

CCBIGlobal.com actively leverages these biases through scripted interactions and simulated data.

The Broader Pattern of Scam Networks

CCBIGlobal.com structure and behavior resemble many other online scam operations. Fraudsters often create multiple platforms with similar interfaces, different names, and slight variations in marketing, cycling through brands when one becomes too widely criticized.

This “carousel of scam sites” phenomenon makes it difficult for victims to track patterns, as each domain appears initially fresh and legitimate.

Final Assessment

After analyzing its operations, claims, and user interactions, CCBIGlobal.com emerges as a highly suspicious, high-risk platform that exhibits multiple characteristics common to online financial scams:

-

No verifiable regulation

-

Anonymity of operators

-

Misleading profit and investment claims

-

Simulated trading environments

-

Pressure to deposit more funds

-

Obstructed withdrawals

-

Fake social proof

These are not accidental oversights — they are hallmarks of intentional deception.

Investors must be vigilant and approach platforms like CCBIGlobal.com with skepticism. Financial decisions should always be grounded in verifiable evidence, transparent regulation, and responsible disclosure — none of which CCBIGlobal consistently provides.

Conclusion: Report CCBIGlobal.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, CCBIGlobal.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through CCBIGlobal.com, extreme caution is advised.