DI-FIGlobal.info Review — Investigative Look at Reported Red Flags and User Experiences

Introduction

In the crowded world of online financial services and fintech projects, names appear and disappear quickly. One name that has surfaced repeatedly in online complaint threads and investor discussions is DI-FIGlobal.info. This review does not make legal accusations or assert proven wrongdoing. Instead, it compiles recurring user-reported experiences, common red flags, and behavioral patterns that many people say led them to distrust or label DI-FIGlobal.info as high-risk. The aim is to give a thorough, skeptical overview so readers can recognize warning signs and decide what further steps they want to take.

Snapshot: What DI-FIGlobal.info Claims vs. What Users Report

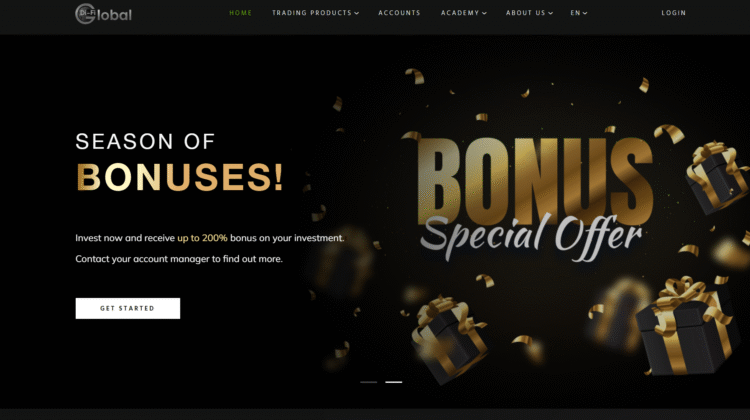

Promotional information circulating about DI-FIGlobal.info, as described by complainants, typically presents the platform as a modern financial technology service: automated investment strategies, algorithmic trading, crypto asset management, or high-yield savings/income products. The marketing is said to emphasize advanced technology, fast onboarding, and attractive returns.

Across multiple user narratives, however, a disconnect emerges. While the platform allegedly markets transparency and professionalism, many users report opacity, pressure to deposit, and obstacles when attempting to withdraw funds. The themes below summarize the most frequent patterns reported by individuals who feel they had negative experiences.

1. Corporate Opacity and Unclear Ownership

One of the strongest threads in user complaints is a lack of clear, verifiable information about DI-FIGlobal.info corporate identity. Commonly reported issues include:

-

No publicly available business registration details or inconsistent company addresses.

-

Founders and management presented only with first names, stock photos, or generic bios.

-

Conflicting or vague legal disclaimers that make it hard to determine where the company is legally based.

Corporate anonymity isn’t, by itself, proof of fraud. But in the context of financial services—where accountability, regulatory registration, and clear corporate governance are standard—such opacity raises understandable questions for prospective users.

2. Promises of High, Quick, or Guaranteed Returns

A recurring complaint centers on promotional claims that many users felt were unrealistic. Reported marketing tactics include promises such as:

-

High daily or weekly percentage gains presented as routine outcomes.

-

Language suggesting minimal or no risk, or “guaranteed” returns.

-

Heavy emphasis on speed and effortless profits via proprietary algorithms.

Financial markets involve risk; legitimate providers typically discuss risk management and avoid absolute guarantees. Where marketing emphasizes certainty and speed rather than measurable methodology, users say that alarm bells should ring—and many commenting about DI-FIGlobal.info describe exactly that reaction.

3. Aggressive Onboarding and Upselling

Multiple reports describe a highly personalized onboarding experience that turns into persistent sales pressure:

-

Dedicated account managers or “success coaches” who personally contact prospects.

-

Tiered account options that promise better returns if users deposit larger sums.

-

Frequent follow-ups and urgency-focused messages (“limited slots,” “special offer”).

Several users state that DI-FIGlobal.info representatives were extremely attentive before deposit but became distant or evasive after funds were transferred. That switch—from enthusiastic acquisition to limited post-deposit support—is a pattern commonly cited in critiques of high-risk platforms.

4. Withdrawal Difficulties and Unexpected Conditions

Perhaps the most commonly reported—and most troubling—category of complaints involves withdrawals. Users describe a range of problems, including:

-

Sudden “processing fees” or “tax” demands when a withdrawal is requested, fees that were not made clear at signup.

-

Requests to increase account balances or purchase an upgraded plan in order to enable withdrawals.

-

Lengthy “verification” or “compliance” delays with little transparency or definitive timelines.

-

Accounts being locked or access restricted immediately after withdrawal attempts.

These kinds of obstacles are central to why many users classify DI-FIGlobal.info as high-risk. It’s important to note these points are described by users and compiled here as reported patterns rather than independently verified facts.

5. Customer Support That Changes Tone After Deposits

A common narrative reported by users: support is proactive and friendly during recruitment, then becomes slower, scripted, or non-responsive once money is on the line. Specific complaints include:

-

Rapid, helpful responses while users are deciding to deposit.

-

Canned replies or repeated requests for “additional documentation” when withdrawals are requested.

-

Long response times or unanswered messages when support is needed most.

This shift in customer service behavior is cited repeatedly in user descriptions and contributes heavily to the perception of risk.

6. Website and Marketing Red Flags

Observers who have scrutinized DI-FIGlobal.info online presence mention several suspicious indicators:

-

Stock imagery and professional-looking pages paired with vague or boilerplate text.

-

Testimonials that appear generic, lack verifiable details, or use repeated phrases.

-

Claims of awards, partnerships, or endorsements that are not substantiated with verifiable information.

While slick presentation alone isn’t proof of impropriety, discrepancies between style and substance often cause users to doubt a platform’s bona fides.

7. Pressure Tactics and Emotional Appeals

Reported tactics used by DI-FIGlobal.info representatives, according to user accounts, often rely on psychological pressure: urgency, exclusivity, and appeals to status or opportunity. Examples include:

-

“Act now” messaging and artificial scarcity claims.

-

Personalized pitches implying a unique chance to join a restricted program.

-

Reassurances that hesitant users will miss out on superior returns.

Such approaches are effective at driving deposits but often prioritize short-term onboarding over long-term client relationships—another reason users characterize the platform as high-risk.

8. Lack of Clear Regulatory Disclosures

A recurring complaint is that DI-FIGlobal.info does not consistently provide verifiable regulatory details. In many jurisdictions, legitimate financial services must disclose licensing, registration numbers, and compliance information. Users who investigated DI-FIGlobal.info reportedly found this documentation either absent, unclear, or inconsistent.

Regulatory status by itself is not a definitive indicator of intent—but absence of registration, when expected, increases the perceived level of risk.

9. Testimonials and Social Proof that Don’t Add Up

Many reviews and site testimonials are described as lacking in verifiable detail. Common concerns include:

-

Testimonials written in similar styles with repeated phrasing.

-

Lack of identifiable or traceable customer names and results.

-

Overly enthusiastic statements with no concrete performance data.

When social proof appears manufactured, it undermines trust and is frequently cited in user assessments of DI-FIGlobal.info credibility.

10. Why Many People Use the “Scam” Label

When multiple patterns align—opaque company details, unrealistic promises, withdrawal hurdles, selective responsiveness, pressure tactics, and questionable online content—many users conclude the risk is high enough to warrant calling the operation a scam. That label, in user communities, often functions as shorthand for “pattern of behavior consistent with previously exposed deceptive platforms.”

This review intentionally refrains from asserting criminality or presenting legal conclusions. Instead, it synthesizes recurring user-reported experiences and recognized warning signs so readers can form an informed opinion.

Final Thoughts

DI-FIGlobal.info case, as described across many user accounts, highlights a familiar playbook: attractive marketing drawing attention to easy returns, persistent sales and upselling, and a troubling pattern of friction when users ask to withdraw funds or seek clear business documentation. Those factors combined explain why a significant number of users categorize DI-FIGlobal.info as high-risk.

If you encounter platforms making similar claims, consider demanding clear, verifiable documentation: corporate registration, regulatory licenses, audited performance records, transparent fee schedules, and credible third-party validation. The absence of these fundamentals—especially when paired with the other patterns described here—helps explain why many online conversations about DI-FIGlobal.info are filled with concern and skepticism.

This review aims to summarize the recurring themes that lead investors and commentators to view DI-FIGlobal.info with caution. It is an investigative-style synthesis of reported user experiences and common red flags—not a legal judgment—and is intended to help readers recognize patterns that often precede problematic outcomes in online financial services.

Conclusion: Report DI-FIGlobal.info Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, DI-FIGlobal.info raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through DI-FIGlobal.info , extreme caution is advised.