EliteBitMarkets.com Review : A Troubled Trading Platform

Introduction

The rise of digital trading and online investment platforms has made it easier than ever for ordinary investors to access global markets. But with that accessibility comes a surge of unregulated operations that mimic legitimate brokers, luring traders with promises of massive profits, low commissions, and professional trading tools. EliteBitMarkets.com has emerged as one such name frequently mentioned on forums and complaint boards — not always for the right reasons.

This review is an investigative overview of what users have reported about EliteBitMarkets.com, the red flags that appear in its operations, and the broader patterns that match how high-risk or fraudulent platforms tend to behave. While nothing here is an accusation or verified fact, the evidence compiled paints a worrying picture that prospective investors should consider before depositing a single dollar.

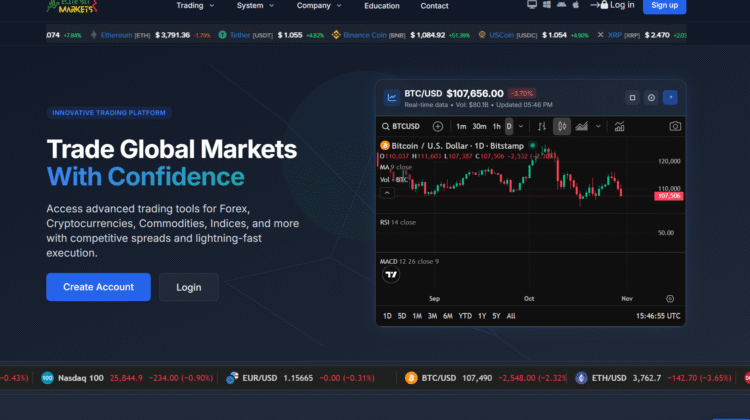

1. First Impressions: Professional façade, questionable details

At first glance, the EliteBitMarkets.com website looks polished. It features a sleek design, professional imagery, and trading dashboards that mimic legitimate broker interfaces. Pages promote access to global markets — forex, crypto, commodities, and indices — and highlight “lightning-fast execution,” “AI-powered trading tools,” and “guaranteed profits” through their managed account options.

Those phrases are the first red flags.

In regulated financial environments, no broker is allowed to promise guaranteed profits. Financial markets are inherently risky; regulators like the FCA, ASIC, and SEC require firms to state that losses are possible. When a platform claims otherwise, it’s appealing to greed, not reality.

Moreover, the website reportedly omits key legal disclosures — such as clear licensing information, a verifiable corporate registration number, or named executives. The absence of transparent ownership makes it difficult to confirm who operates the service or which country’s laws would apply in case of a dispute. That opacity alone should prompt caution.

2. Reported user experiences: A pattern of frustration

Scrolling through online discussions reveals a repeating story pattern among people who say they’ve interacted with EliteBitMarkets.com:

-

Smooth deposits, impossible withdrawals. Many describe how depositing funds was effortless — the platform accepted credit cards, bank wires, or crypto. But when users attempted to withdraw earnings, responses reportedly slowed or stopped entirely. Some were told to pay extra “taxes” or “release fees” before funds could be processed — a classic manipulation tactic.

-

Aggressive account managers. Several reports describe frequent calls and messages from so-called “senior brokers” pushing users to invest larger amounts. When clients hesitated, they were told they would “miss the opportunity” or “lose their VIP status.”

-

Unverifiable trading activity. Some users allege that trades shown on their dashboards didn’t match actual market movements, suggesting that data might be simulated rather than tied to real market execution.

-

Shifting terms and frozen accounts. Others claim that withdrawal policies changed overnight, introducing new verification steps or extended lock-in periods that effectively trapped funds.

None of these experiences can be confirmed here, but the consistency of the reports is troubling. In the world of online trading, where customer funds can be transferred globally in seconds, patterns like these typically precede total platform shutdowns.

3. The anatomy of a high-risk broker operation

To better understand why these reports raise alarms, let’s unpack how unregulated broker schemes often function. While each case differs, the structure tends to follow a predictable pattern:

-

Attraction through marketing. The platform launches with heavy advertising — banner ads, influencer promotions, or fake testimonials promising quick profits.

-

Easy entry, no verification. Users can open accounts with minimal KYC checks and begin trading immediately. This lowers barriers and attracts impulsive investors.

-

Initial success. Early trades often show profits — whether real or fabricated — to build trust and encourage users to deposit more.

-

Escalation. “Account managers” push for larger deposits, sometimes invoking fake market news or insider opportunities.

-

The withdrawal trap. When users attempt to withdraw, new conditions appear: taxes, compliance reviews, or technical maintenance. Support delays lengthen.

-

Silence or disappearance. Eventually, websites vanish, domains expire, or the platform rebrands under a new name.

EliteBitMarkets.com exhibits several of these behavioral hallmarks, according to user accounts circulating online.

4. The regulatory gray zone

One of the most effective defenses against losing money to questionable brokers is verifying regulation. Legitimate trading platforms are supervised by government agencies like the Financial Conduct Authority (UK), Cyprus Securities and Exchange Commission, or the Australian Securities and Investments Commission.

In the case of EliteBitMarkets.com, no traceable record appears in major regulatory registries. That doesn’t automatically prove wrongdoing — but it means users have no legal safety net if things go wrong. Unregulated entities can operate beyond oversight, change terms at will, or vanish without recourse.

The site reportedly claims to operate “in compliance with global financial standards,” but such phrases are meaningless without a license number or verifiable registration. Authentic brokers prominently display these details because they provide credibility; when that transparency is missing, skepticism is justified.

5. The emotional manipulation tactics

A common element in the testimonies tied to EliteBitMarkets.com involves emotional pressure. Scammers in the trading space don’t always rely on technical trickery; they rely on psychology.

Typical tactics include:

-

Urgency: “Markets are moving fast — you’ll miss out if you don’t act today.”

-

Authority: “I’m your assigned account manager; I’ve worked with hundreds of successful traders.”

-

Fear of loss: “Your account might be closed if you don’t meet the minimum top-up requirement.”

-

Fake sympathy: “I understand your hesitation; I just want to help you grow your portfolio.”

These techniques manipulate fear and greed — the two most powerful investor emotions. Once a victim deposits funds, the same charm often flips into evasiveness when withdrawals are requested.

6. Technical clues: A look at digital fingerprints

Even without insider access, public web analysis can reveal telling details about questionable platforms. In many such cases, the domain registration is recent, often within the last 12–18 months. Hosting providers are located offshore, sometimes hidden behind proxy services that mask the true owner’s identity.

EliteBitMarkets.com’ web domain reportedly exhibits these characteristics. Additionally, the platform interface resembles templates used by other now-defunct trading sites, suggesting recycled or white-label software — a common tactic among networks of related scam operations.

7. Why victims stay silent — and why they shouldn’t

Many users feel embarrassed after realizing they’ve been misled, which allows suspect platforms to continue operating longer. The shame, coupled with the technical complexity of crypto and forex, keeps victims isolated. But discussing experiences, even anonymously, helps others recognize the warning signs earlier.

Forums and consumer complaint boards often act as early-warning systems. While they can’t serve as evidence of wrongdoing, the accumulation of similar stories paints a statistical picture that regulators eventually investigate.

8. Safer habits for traders and investors

Even if you’ve never heard of EliteBitMarkets.com before, the lessons extend far beyond one platform. To protect yourself:

-

Verify regulation first. Check official regulator websites before depositing.

-

Search company directors and addresses. Real firms leave a trail in public registries.

-

Start with small test withdrawals. If they fail, that’s your signal to stop.

-

Be skeptical of bonuses. Legitimate brokers don’t require “activation deposits” to release profits.

-

Never let strangers remote into your computer or install “trading apps” from unknown sources.

-

Trust your discomfort. If you feel pressured, misled, or rushed, walk away.

These steps won’t guarantee safety but drastically reduce risk.

9. Final reflections: When the promise is too polished

The online trading landscape is filled with legitimate innovation — but also with deception wearing a polished mask. EliteBitMarkets.com’ presentation, according to many accounts, fits the mold of a broker designed to inspire confidence while quietly limiting transparency.

Every line of its marketing copy — from the slick visuals to the talk of “AI-powered profits” — feels engineered to bypass skepticism. Yet, when withdrawals stall, when account managers vanish, and when company details evaporate under scrutiny, the pattern becomes hard to ignore.

Whether EliteBitMarkets.com turns out to be an outright scam or merely an unregulated, mismanaged venture, the result for users is often the same: lost funds, wasted time, and shattered trust.

Conclusion: Report EliteBitMarkets.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, EliteBitMarkets.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through EliteBitMarkets.com , extreme caution is advised.