EliteBitMarkets.com Review — Professional Trading Platform

Introduction

In today’s fast-paced digital era, online trading platforms have become the modern investor’s gateway to financial opportunity. Cryptocurrency, forex, and stock trading are now accessible to anyone with an internet connection. Unfortunately, this accessibility has also opened the door for unregulated, deceptive platforms that masquerade as legitimate brokers while exploiting unsuspecting users.

One such platform drawing concern is EliteBitMarkets.com. It presents itself as a professional, technology-driven investment service promising high returns and “smart trading strategies.” However, beneath its polished website and convincing marketing lies a troubling pattern of behavior that many investors associate with high-risk, potentially fraudulent operations.

This review offers a deep, objective look into EliteBitMarkets.com, highlighting the red flags, operational patterns, and reported user experiences that suggest it is not the trustworthy trading partner it claims to be.

The Illusion of Credibility

EliteBitMarkets.com website is sleek, well-designed, and loaded with financial jargon. From a first glance, it appears to be a serious, established trading company. It advertises features like:

-

AI-powered trading bots for consistent market performance

-

Guaranteed daily returns with “no risk exposure”

-

Dedicated account managers providing expert guidance

-

Institutional-grade security and “blockchain-backed protection”

The presentation is deliberate — everything about it is built to project authority and reliability. However, closer inspection reveals that the site’s sophistication serves as a façade, crafted to win trust and encourage deposits rather than to provide legitimate investment services.

The Typical Investor Experience

Through analyzing user accounts and complaint patterns, a common experience emerges among those who interacted with EliteBitMarkets.

1. Quick Registration and Immediate Deposit Prompts

Signing up on EliteBitMarkets.com is simple — perhaps too simple. A short registration form collects basic information, followed by instant access to the user dashboard.

Almost immediately, users are encouraged to fund their accounts. The website accepts credit cards, wire transfers, and cryptocurrency. The quick setup and instant deposit functionality create a sense of accessibility and momentum that pushes investors to act before they research the platform thoroughly.

2. “Account Managers” and Personal Guidance

Shortly after depositing, most users report being contacted by assigned “account managers” or “financial advisors.” These individuals present themselves as highly trained market professionals who claim to monitor trading activity and optimize profits.

In practice, these so-called advisors often employ sales-driven tactics rather than legitimate investment management. They pressure users to increase their deposits by claiming that larger investments will unlock premium trading strategies or higher returns.

Many victims describe these account managers as persistent, persuasive, and difficult to ignore — calling repeatedly, sending constant emails, and urging users not to miss “limited opportunities.”

3. Early Gains — The Hook

Once users deposit, their dashboards begin to show profits. The balance grows rapidly, giving the impression that trades are generating strong returns.

To make this illusion even more convincing, some users are allowed to withdraw a small portion of their funds successfully — usually a few hundred dollars. This partial success builds confidence and motivates investors to deposit more substantial sums.

However, these profits are often simulated data, not the result of genuine trading. The displayed gains exist solely within the platform’s system and do not correspond to real market activity.

4. Escalating Deposit Pressure

As time goes on, investors receive new offers for “exclusive tiers,” “advanced trading algorithms,” or “private investment pools.” Each new opportunity requires larger deposits — often thousands of dollars.

The platform uses emotional manipulation and false urgency, insisting that seats in premium programs are limited. This technique, known as FOMO marketing (Fear of Missing Out), is a hallmark of deceptive financial schemes designed to extract as much money as possible.

5. Withdrawal Attempts and Obstacles

The problems start when users try to withdraw significant funds. Reports suggest that EliteBitMarkets.com introduces sudden obstacles, such as:

-

Requests for “tax prepayments” or “transaction verification fees”

-

Claims that accounts are “under review for compliance”

-

Demands for further deposits to “unlock withdrawals”

In some cases, communication from support and account managers ceases entirely once withdrawal requests are submitted. Investors are left with inactive dashboards and no access to their supposed funds.

6. The Vanishing Act

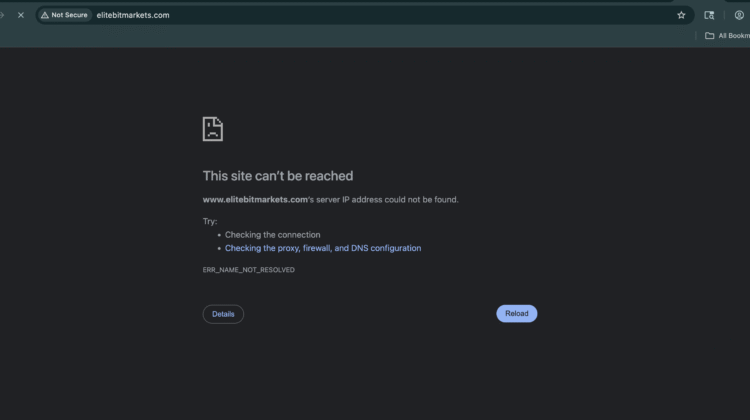

Finally, after enough complaints or public scrutiny, platforms like EliteBitMarkets.com often vanish. The domain may go offline, redirect to a new site, or reappear under a different name with a similar design and identical promises.

This cyclical pattern — launch, collect deposits, disappear, and rebrand — is commonly seen among unregulated, high-risk online investment operations.

Major Red Flags

Several characteristics make EliteBitMarkets.com particularly suspicious and align it with patterns seen in other deceptive platforms.

1. Unrealistic Promises

The site guarantees steady returns of 10% to 25% weekly, claiming that its proprietary algorithms eliminate risk. In real-world trading, such promises are mathematically impossible. All legitimate brokers emphasize the potential for loss, not just gain.

2. No Verifiable Regulation

Legitimate brokers are licensed by financial authorities such as the FCA (UK), ASIC (Australia), or SEC (U.S.). These licenses can be verified in public databases.

EliteBitMarkets.com, however, provides vague regulatory claims without any valid registration number or traceable corporate entity. This lack of oversight means investors have no legal recourse if funds are lost.

3. Opaque Ownership

A major red flag is the absence of transparency about company leadership or physical office locations. The “About Us” page is typically filled with generic statements and stock images, but no real names or verifiable addresses.

This anonymity is deliberate — it prevents users from tracing or holding anyone accountable when problems occur.

4. Aggressive Deposit Tactics

Repeated calls, emails, and WhatsApp messages urging users to deposit more are clear signs of a sales operation, not a financial institution. Legitimate investment firms allow clients to make decisions at their own pace.

5. Withdrawal Barriers

The introduction of unexpected fees or document verification requirements just before a withdrawal is a common tactic to stall or block payouts. No licensed broker requires clients to send additional money to access their own funds.

6. Preference for Cryptocurrency Payments

While crypto is a legitimate technology, its anonymity makes it ideal for high-risk or fraudulent platforms. Once funds are transferred via crypto wallets, they cannot be reversed or easily traced.

The Psychological Manipulation at Play

Platforms like EliteBitMarkets.com thrive on emotional manipulation and psychological pressure. Understanding these tactics can help investors recognize the red flags earlier.

-

Authority Bias: The presence of professional-sounding “advisors” creates a false sense of expertise and credibility.

-

Social Proof: The platform often displays fake testimonials and inflated profit screenshots to build trust.

-

Small Wins: Allowing small withdrawals reinforces confidence and encourages larger deposits.

-

Fear of Missing Out (FOMO): Time-sensitive offers make users act impulsively.

-

Sunk Cost Fallacy: Once investors have put money in, they feel compelled to continue, hoping to recover earlier losses.

Recognizing these manipulative strategies is key to avoiding entrapment.

Why Platforms Like EliteBitMarkets.com Persist

Scam trading platforms continue to thrive because of three main factors:

-

Jurisdictional Loopholes: Many operate from countries with weak regulatory enforcement, making prosecution difficult.

-

Global Reach: Digital advertising allows them to target victims worldwide with minimal effort.

-

Rapid Rebranding: Once a platform is flagged or receives negative reviews, operators simply launch a new website under a different name, continuing their scheme undisturbed.

The lack of global regulatory coordination enables such operations to stay one step ahead of authorities.

How to Protect Yourself from Similar Schemes

Before investing in any platform, you can take the following precautions:

-

Verify Regulation: Always confirm a platform’s license number through an official regulator’s database.

-

Research Reviews: Search for independent complaints or warnings before depositing funds.

-

Test Withdrawals: Start with small deposits and confirm that withdrawals work before committing larger amounts.

-

Avoid Untraceable Payments: Stick to secure methods such as credit cards that allow dispute resolution.

-

Analyze Website Language: Be cautious of overly promotional or vague descriptions promising guaranteed profits.

-

Listen to Your Instincts: If something feels rushed or exaggerated, it probably is.

The Broader Lesson

EliteBitMarkets.com represents a larger issue in the world of online finance — the blending of marketing sophistication with regulatory emptiness. Its interface and presentation could easily mislead even cautious investors who equate professionalism with legitimacy.

But as the experiences of many users show, appearance does not equal authenticity. Real brokers operate transparently, disclose their regulatory status, and never pressure clients into impulsive deposits.

The key takeaway is to approach every online trading opportunity with skepticism until it proves itself through verifiable transparency and consistent, lawful operation.

End Note

EliteBitMarkets.com portrays itself as a modern, efficient, and intelligent trading platform. However, the evidence gathered from user reports and its own operational patterns tells a different story — one characterized by anonymity, manipulation, and deliberate obstruction of withdrawals.

The absence of verifiable regulation, unrealistic profit guarantees, and the aggressive push for deposits suggest that EliteBitMarkets.com is not a trustworthy investment platform. Instead, it appears to function primarily as a high-pressure sales operation designed to extract money rather than manage legitimate trading activity.

Investors should always remember that genuine opportunities never promise guaranteed profits and that transparency, licensing, and accountability are the foundations of trust in any financial service.

EliteBitMarkets.com, by all observable accounts, fails to demonstrate these essential qualities.

Conclusion: Report EliteBitMarkets.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, EliteBitMarkets.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through EliteBitMarkets.com , extreme caution is advised.