Finotraze.ca Scam : Problematic Fraud Platform

Introduction

In the dynamic world of online investing and cryptocurrency services, new platforms appear every day claiming to offer high returns, sophisticated trading tools, and cutting-edge investment opportunities. Many of these are legitimate businesses operating within compliance and transparency. But a troubling number of them are not. One platform that has attracted growing suspicion, controversy, and alarm is Finotraze.ca — a name increasingly associated with inconsistent performance, opaque operations, and patterns that resemble classic investment scams more than credible financial services.

This detailed review will dissect Finotraze.ca claims, structure, practices, and the red flags that make it extremely questionable as an investment platform. By the end, you should have a clear understanding of why so many observers and participants are deeply skeptical about Finotraze.ca and why it exhibits so many characteristics common to fraudulent operations.

What Finotraze.ca Claims to Be

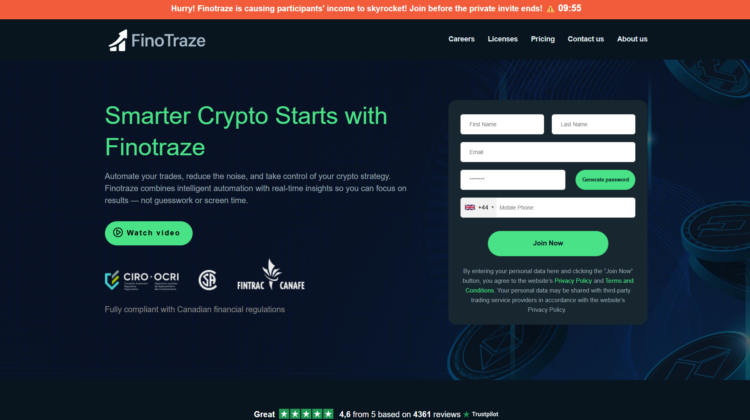

Finotraze.ca presents itself as a modern, digital financial ecosystem designed to help users invest in markets like forex, cryptocurrencies, indices, and commodities. Its advertisements and marketing materials emphasize:

-

Cutting-edge trading tools

-

Professional analytics and automated systems

-

High potential returns for users

-

A user-friendly interface accessible on desktop and mobile

-

Exclusive opportunities for early adopters

On the surface, these claims are crafted to attract both seasoned traders and newcomers eager to grow their money. The styling, visual design, and marketing language mimic legitimate financial service providers. But presentation should never be confused with verifiable substance. In the case of Finotraze.ca, the substance behind the styling is deeply problematic.

The First Red Flag: Lack of Transparency and Verifiable Ownership

One of the fundamental pillars of a legitimate financial institution or trading platform is transparency about who runs it. Real financial services disclose:

-

Corporate registration details

-

Names and backgrounds of executives

-

Physical addresses and contact information

-

Regulatory licensing and oversight

Finotraze.ca fails on all of these counts. There is no clear, verifiable information about who owns or operates the service. No identifiable leadership team is presented, no corporate headquarters are listed in a verifiable manner, and — most importantly — no evidence of regulatory compliance or licensing from well-known financial authorities is provided.

In regulated industries, such disclosures are the baseline requirement. Without them, there is no accountability, no oversight, and no guarantee that user funds are handled according to legal and ethical standards. This lack of transparency is consistent with patterns seen in numerous scam operations, where anonymity of operators protects them from scrutiny and enforcement.

Marketing That Emphasizes Returns, Not Risk

One of the most consistent strategies used by dubious financial platforms is overemphasis on profit potential while minimizing or omitting clear discussion of risk. In legitimate markets — whether traditional finance or digital assets — risk disclosure is a regulatory requirement and a core part of honest investor communication.

Finotraze.ca marketing, however, leans heavily on the idea of high returns, powerful tools, and exclusive opportunity. There is minimal information about the inherent risks of leveraged trading, volatile markets, or algorithmic execution errors. Instead, the promotional language focuses on benefits, earnings potential, and “next-generation financial advantage.”

This asymmetry — a focus on reward without balanced discussion of risk — is a hallmark of many scam operations. Real investment firms don’t guarantee outcomes or suggest financial success is easily achievable. Finotraze.ca messaging, by contrast, repeatedly suggests opportunity without corresponding responsibility.

Opaque Fee Structures and Hidden Conditions

A red flag that frequently appears in complaints from people who have interacted with Finotraze.ca involves its fee and withdrawal structure. Legitimate trading platforms make it very clear:

-

How deposits are handled

-

What fees are charged (and when)

-

How withdrawals work

-

What timelines and conditions apply

Finotraze.ca fee structure, by contrast, is nebulous. Users are often shown a clean interface with balances, profit metrics, and trading dashboards — but the fine print on fees, processing timelines, charge conditions, and conversion requirements is vague at best. This opacity creates an environment where users are unaware of how much they are really paying or under what conditions they can access their own funds.

Delays in withdrawal processing, undisclosed fees, and conditional charges are tactics often used in scam schemes to diminish the value of funds and discourage users from retrieving their money.

Customer Support: Invisible When It Matters Most

Another consistent pattern seen in problematic platforms — and reported by individuals who have attempted to interact with Finotraze.ca — is poor or non-responsive customer support. Initially, support may respond promptly to general questions and onboarding inquiries. But when users face issues with withdrawals, account verification, or accessing funds, communication reportedly becomes slow, evasive, or completely absent.

Real financial platforms understand that responsiveness and accountability are critical components of their service. When users encounter obstacles, supportive, clear assistance is standard procedure. The absence of reliable, transparent customer support in Finotraze.ca operations is a serious concern and frequently aligns with scam behavior where operators avoid scrutiny once money has changed hands.

Escalating Deposit Requests and Retention Pressure

In experiences reported by some individuals familiar with platforms like Finotraze.ca, a disturbing pattern emerges: the platform appears to encourage repeated deposits rather than facilitating transparent use of existing funds.

This manifests in several ways:

-

Prompts to upgrade accounts for better returns

-

Pressure to make additional deposits “to unlock benefits”

-

Suggestions that more capital will clear account blocks

-

Messages implying that larger balances yield better support

This dynamic is typical in fraudulent operations. Rather than facilitating user success, the platform’s structure appears designed to keep capital incoming rather than capital accessible. Legitimate trading environments do not condition access to one’s own money on further contributions.

User Complaints About Funds Becoming Inaccessible

Perhaps the most alarming pattern reported in community discussions is that users see balances in their accounts but cannot retrieve them. Accounts may display accumulated earnings or even initial principal amounts, yet the withdrawal process becomes a maze of conditional steps, additional “requirements,” or unexplained delays.

This mirrors the behavior of known fraudulent financial schemes in which:

-

Users are shown attractive balances to build trust

-

Withdrawal requests trigger new conditions

-

Support issues new tasks users must satisfy

-

Access to funds becomes effectively blocked

It is worth emphasizing that appearance of a balance on a digital dashboard is not equivalent to real access to capital. Financial platforms operating in good faith ensure clear, justified, and accessible withdrawal processes — not procedural obstruction.

Lack of Independent Verification or Audit

Serious financial institutions — especially those handling complex investment products or digital assets — undergo independent audits, security reviews, and compliance checks. These are often made public or referenced to assure stakeholders that the platform meets industry standards.

There is no indication that Finotraze.ca has undergone any credible independent audit or verification. This includes audits of its trading engines, security practices, capital reserves, or compliance systems. The absence of such verification means users have no way to confirm:

-

That the platform holds sufficient capital

-

That it segregates client funds as required

-

That its systems are secure from manipulation

-

That the trading results it displays are real

Without independent auditing, every claim on Finotraze.ca dashboard is unverifiable and, at best, superficial.

Comparing Finotraze.ca to Scam Patterns in Financial Markets

When viewed against well-documented patterns of investment scams, Finotraze.ca exhibits many of the same characteristics:

✔ Anonymous or Hidden Ownership

Operators do not disclose transparent leadership or corporate information.

✔ No Recognized Licensing or Regulation

The platform lacks credible financial oversight from established authorities.

✔ Opaque Fee and Withdrawal Policies

Users are unclear on when and how they can access funds.

✔ Escalating Conditions for Withdrawal

Requests to release funds trigger new requirements or additional deposits.

✔ Lack of Independent Audit or Verification

No public audits or compliance confirmations are provided.

✔ Aggressive Recruitment and High-Return Messaging

Focus on earnings rather than balanced explanations of risk.

This combination of traits is rarely found in legitimate services but is commonly seen in fraudulent investment operations designed to attract funds and avoid accountability.

Final Assessment: Proceed With Extreme Skepticism

After a thorough review of Finotraze.ca structure, marketing, user interactions, and operational transparency, the platform displays multiple traits consistent with risky and potentially fraudulent investment schemes. The absence of verifiable corporate information, lack of regulatory oversight, opaque financial processes, and reported user experiences all contribute to an alarming profile that should raise serious doubts.

In financial markets — whether traditional or digital — confidence must be earned through transparency, accountability, compliance, and fair treatment of users. Finotraze.ca practices undermine these principles.

For anyone evaluating digital investment platforms in the future, the key takeaway is this: trust must be built on verifiable evidence, not attractive marketing or superficial dashboards. Platforms that obscure basic details about their operations, require large deposits without clear terms, and create barriers to accessing funds should be scrutinized with great care.

Conclusion: Report Finotraze.ca Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Finotraze.ca raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Finotraze.ca , extreme caution is advised.