Finotraze.com Review : Platform Users Describe as a Scam

Introduction

In recent years, the online investment space has exploded with new platforms promising fast returns, passive income streams, automated trading, and “guaranteed” profit opportunities. Unfortunately, this boom has also given rise to a wave of dubious websites that appear legitimate on the surface but operate in ways that leave investors confused, frustrated, or financially harmed. One name that has repeatedly surfaced in online discussions, complaints, and user testimonies is Finotraze.com—a platform many individuals now describe as a scam.

This blog provides an in-depth, experience-based examination of Finotraze.com, exploring what the platform claims to offer, the red flags users report, and the behavioral patterns that resemble those commonly associated with investment fraud. While this review cannot make legal conclusions, it presents detailed observations and feedback shared by those who interacted with Finotraze.com, helping readers better understand the risks involved.

What Finotraze.com Claims to Offer

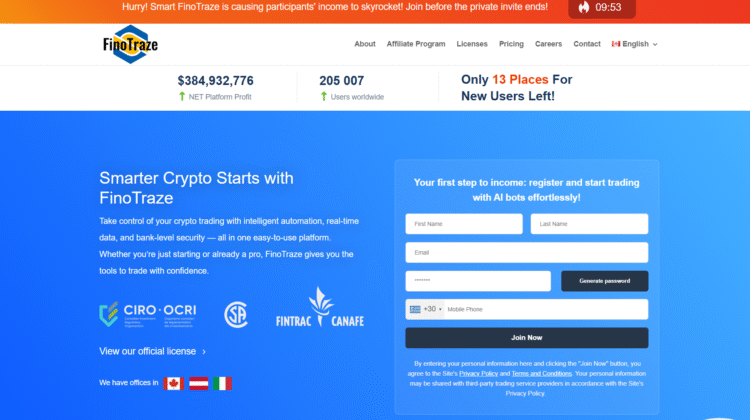

Finotraze.com markets itself as a sophisticated investment and trading platform, often presenting a highly polished website and a narrative positioning itself as a reputable financial service. It typically advertises:

-

Advanced trading technology

-

Automated investment strategies

-

High-yield returns on deposits

-

“Expert guidance” from supposed financial advisors

-

Access to global markets

-

Low entry requirements for newcomers

On paper, these features sound appealing—especially to beginners seeking easy ways to grow their money. However, the more users attempt to navigate Finotraze.com system, the more inconsistencies appear between the platform’s promises and its actual behavior. Many complain that the service seems designed to entice deposits but makes withdrawing funds nearly impossible.

First Red Flag: Aggressive and Manipulative Account Managers

A recurring theme among user accounts is the aggressive communication style of Finotraze.com so-called “account managers.” According to these reports, the platform assigns each new user an advisor who contacts them via phone, text, email, or messaging apps almost immediately after signup—even if the user has not yet made a deposit.

These individuals typically pressure users to:

-

Deposit money as quickly as possible

-

Increase the amount of their initial investment

-

“Take advantage of time-sensitive market opportunities”

-

Trust the advisor’s instructions without hesitation

Many people describe these representatives as persistent, emotionally manipulative, and unwilling to discuss risk. Their messages often carry an urgent tone, implying that any hesitation could cause the user to miss out on profits. In legitimate financial environments, advisors are required to explain risks clearly, avoid pressure tactics, and give clients room to make informed decisions. Finotraze.com reported behavior contrasts sharply with authentic industry norms.

Second Red Flag: Unrealistic Returns and Flawless “Profits”

Another warning sign users highlight involves Finotraze.com portrayal of extremely high returns—sometimes far beyond what is achievable even by expert traders. Once a user deposits money, the platform often shows a rapidly increasing account balance, sometimes doubling or tripling within days. While this may excite inexperienced investors, seasoned traders recognize these patterns as suspicious.

In many alleged scam operations, the returns displayed on the dashboard are fabricated numbers, not actual profits generated through real trading. They are designed to build user confidence, encouraging further deposits. Individuals who interacted with Finotraze.com frequently report that their visible account earnings seemed unnaturally consistent, with almost no losses—a statistical impossibility in real financial markets.

The illusion of constant profit is one of the oldest tactics in fraudulent investment schemes. It creates excitement, numbs skepticism, and motivates investors to commit larger sums before realizing the platform is not what it seems.

Third Red Flag: Withholding of Withdrawals

Perhaps the most concerning trend among user testimonies involves withdrawal issues. Depositing money into Finotraze.com appears easy and instant, but withdrawing it often becomes an ordeal. Users describe scenarios such as:

-

Withdrawal requests remaining pending indefinitely

-

Requests being rejected without explanation

-

Account managers insisting the user must pay additional fees first

-

Sudden changes in account status that prevent access to funds

-

“Compliance checks” that last weeks or months

-

New requirements introduced only after a withdrawal attempt

Some individuals report that once they indicated a desire to withdraw, communication from the platform suddenly became slow or unresponsive. Others claim their account managers turned confrontational, urging them to keep their funds invested or to deposit more.

Platforms that legitimately manage investments do not condition withdrawals on further payments, nor do they arbitrarily restrict access to a client’s own funds. This pattern—often described by Finotraze.com users—aligns closely with behaviors reported in other online investment scams.

Fourth Red Flag: Lack of Regulation and Verifiable Company Information

One of the clearest indicators of a trustworthy financial service is regulatory oversight. Authentic trading platforms are regulated by recognized financial authorities, which provide public documentation and tools for verifying licenses.

With Finotraze.com, users frequently report difficulty confirming:

-

The platform’s official business registration

-

Its regulatory compliance status

-

The identities of its owners or executives

-

Where the company is physically located

-

How long it has been operating

Many find discrepancies or vague wording in Finotraze.com corporate details. Some describe the company’s address as either nonexistent or belonging to unrelated businesses. Others note that the names of the supposed founders or managers cannot be traced elsewhere online. When consumers cannot verify basic corporate credentials, the risk of fraud increases substantially.

Fifth Red Flag: Fake Reviews and Misleading Marketing

Another area of suspicion involves the online presence surrounding Finotraze.com. Several individuals have observed that the platform seems to rely heavily on fabricated testimonials, often featuring overly enthusiastic praise that lacks detail or appears copied between different review sites. The language in these posts tends to be generic and promotional, contrasting sharply with the far more numerous reports complaining of losses, blocked withdrawals, and unfulfilled promises.

Some platforms associated with similar patterns attempt to bury negative reviews by publishing flattering articles, paid endorsements, or sponsored content. Readers should always be cautious when researching platforms that appear to have an excess of suspiciously positive, low-effort reviews.

Sixth Red Flag: Sudden Changes in Terms, Fees, and Account Requirements

Many users report that Finotraze.com introduces new conditions at unpredictable moments. These can include:

-

Unexpected withdrawal fees

-

Requirements to reach a higher investment “tier” before withdrawing

-

Mandatory verification steps not mentioned at signup

-

Additional charges labeled as tax, insurance, or compliance fees

Such surprises often appear only after a user attempts to access their funds. People describe being asked to deposit hundreds or thousands more to unlock their accounts or process a withdrawal—requests no legitimate platform would make. This behavior represents a common pattern in high-risk online investment schemes.

Seventh Red Flag: Disappearing Support and Vanishing Accounts

Several individuals claim that after resisting further deposits or repeatedly insisting on a withdrawal, their accounts suddenly became inaccessible. Some say their login credentials stopped working; others state that the website appeared offline or their account history vanished entirely. Customer support, once highly responsive during the deposit phase, often stops answering messages when users push back.

This rapid deterioration of communication is often a sign that the platform never intended to provide ongoing service and was primarily focused on extracting as much money as possible before shutting down interactions.

Behavior Patterns That Resemble Common Scam Structures

Based on widespread user descriptions, Finotraze.com exhibits behavioral patterns often associated with fraudulent investment schemes:

-

Luring deposits with unrealistic profits

-

Prioritizing deposits while obstructing withdrawals

-

Using psychological pressure and urgency tactics

-

Displaying misleading dashboard earnings

-

Constantly introducing new obstacles to accessing funds

-

Gradually reducing communication once users express doubts

While none of these alone proves fraudulent intent, their combination forms a troubling picture. Many users who interacted with Finotraze conclude that the platform’s primary goal is to obtain deposits rather than facilitate legitimate trading.

The Impact on Victims

Individuals who shared their stories often describe deep frustration, financial loss, and emotional distress. Some invested savings they could not afford to lose, believing the platform was legitimate due to its polished website and convincing advisors. Others report feeling embarrassed or ashamed, which delayed their willingness to speak out. It is important to emphasize that anyone can fall victim to a well-crafted scam—these platforms are engineered to appear credible and exploit trust.

Final Thoughts: Why Finotraze.com Raises Serious Concerns

Based on the extensive number of reports describing deceptive practices, aggressive pressure, withdrawal issues, and unverifiable company information, Finotraze.com raises numerous concerns for potential investors. While this blog does not make legal accusations, the combination of red flags strongly suggests that individuals should exercise extreme caution.

Online investment opportunities can be legitimate, but true financial services operate transparently, are regulated, and encourage informed decision-making—not pressure tactics or secrecy. When a platform behaves in a way that consistently disadvantages users, blocks withdrawals, or obscures its identity, it becomes essential to step back and reassess.

Consumers sharing their experiences with Finotraze.com overwhelmingly describe the platform as a scam-like operation. Anyone considering engaging with such a service should carefully evaluate the risks, verify regulatory credentials, and pay close attention to patterns that do not align with professional financial conduct.

Conclusion: Report Finotraze.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Finotraze.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Finotraze.com , extreme caution is advised.