Gatevex.com Exposed : Risky Financial Platform

Introduction

In the ever-expanding world of online financial services, countless platforms emerge promising fast profits, secure trading environments, and easy access to global markets. Some of these services are legitimate, regulated, and built to serve users transparently. Others, however, rely heavily on marketing language, unverified claims, and secrecy — all while masking serious risks. One such platform that has raised red flags across investor communities and regulatory bodies is Gatevex.com.

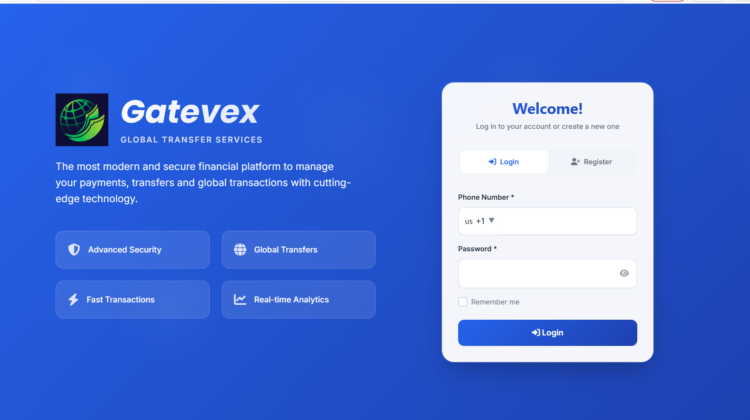

At first glance, Gatevex.com presents itself as a modern financial platform focused on global transfers, fast transactions, and cutting-edge technology. The homepage is slick, the language sounds professional, and the visuals are designed to inspire confidence. But beneath this surface, there are structural issues and warning signals that suggest Gatevex.com may not be at all what it claims to be. In this detailed review, we’ll break down why Gatevex.com is widely regarded as a high-risk and potentially fraudulent platform — and why investors should be extremely cautious.

This analysis touches on regulatory warnings, corporate transparency, operational claims, user experience signals, and the broader pattern of risk that surrounds Gatevex.com.

1. What Gatevex.com Presents — And What It Doesn’t

Upon visiting Gatevex.com, users are greeted with promises of fast transfers, advanced security, and digital financial services built for the modern era. The site emphasizes global reach, modern infrastructure, and seamless transactions. But look closely, and you’ll notice something important:

Gatevex.com does not provide verifiable details about who runs it, where it is regulated, or what legal framework governs its operations. pnc

This combination of professional marketing language with minimal operational transparency is common among platforms that prioritize impression over accountability. While a clean interface can make a platform look legitimate, what matters to investors is what the platform actually discloses about itself — and Gatevex.com public domain is strikingly vague.

2. Regulatory Warnings: A Major Red Flag

One of the clearest signals that a financial platform may be high-risk comes from official regulatory warnings. These warnings are issued publicly when a platform is identified as operating outside legal frameworks or without proper licensing.

In the case of Gatevex.com, multiple authorities have published warnings indicating the platform is not registered or authorized to solicit investors in their jurisdictions. Specifically, financial watchdogs have labeled Gatevex.com as a high-risk entity lacking regulatory approval and warned the public to be cautious.

Regulators expect legitimate trading and transfer services to be registered and overseen by recognized authorities. Without this oversight, users are left without structured protection, enforcement mechanisms, or industry-standard risk management safeguards.

This absence of regulation — especially when verified by official financial authorities — is one of the strongest indicators that a platform may not be operating legitimately.

3. Corporate Transparency: A Blank Slate

When assessing any financial platform, one of the first things responsible investors look for is corporate identity — a clear legal name, registration, headquarters, and leadership team that can be independently verified.

Gatevex.com provides none of this in a clear, verifiable format. The public appearance of the platform lacks details like:

-

Registered company name

-

Physical or legal headquarters

-

Management or executive biographies

-

Business registration documents

Instead, users are left with generalized branding language that does not offer any way to check the platform’s legal accountability. This kind of corporate opacity is common in scam operations, where operators intentionally withhold identifying data to make it harder for users or authorities to trace responsibility.

Without these key pieces of corporate information, a platform’s claims about security, technology, or global reach mean very little.

4. Claims vs. Reality: Impressive Words, No Verifiable Backing

Gatevex.com marketing emphasizes phrases like advanced security, fast transactions, and real-time analytics — language that sounds reassuring and sophisticated. However, the platform does not provide verifiable details about how its technology works, how transactions are secured, or how risk is managed. pnc

Legitimate financial services usually provide clear technical or operational documentation, sometimes including:

-

Whitepapers or detailed product guides

-

Third-party audit results

-

Security certifications

-

Proof of compliance with data protection standards

Gatevex.com public presence includes broad promotional phrases, but no evidence of technical substance supporting those claims.

For a platform that wants users to entrust their money, information like what encryption is used, how digital assets are safeguarded, what risk controls exist — should be presented up front. Gatevex.com does not offer these details.

5. Deposits and Withdrawals: Ambiguity Over Access to Funds

One of the basic operational questions you should ask about any financial platform is: Can I access my own funds? And under what conditions?

In Gatevex.com case, there is no clear, published policy detailing how deposits and withdrawals are handled, what fees might apply, how long transactions take, or what verification procedures are required.

This lack of clarity creates an environment where:

-

Users cannot know in advance how quickly they can withdraw funds

-

Policies could be changed without notice

-

Terms might be enforced retroactively or arbitrarily

A transparent financial platform explains its money-movement rules clearly so users can make informed decisions. Gatevex.com does not provide this level of clarity in its public documents.

6. Customer Support: Minimal and Non-Responsive

Access to responsive, multi-channel customer support is a key sign of a legitimate financial service. Users should be able to get help with account issues, transaction questions, verification problems, and security concerns.

Gatevex.com does not appear to provide robust support channels. There is little public evidence of active customer service avenues — such as verified phone support, live chat, or structured ticketing — and no transparency about how support issues are escalated.

This lack of accessible support is more than an inconvenience; it’s an operational risk. When users cannot easily reach support with real questions, problems escalate, losing funds can go unresolved, and confidence erodes quickly.

This is a common characteristic of platforms that aim to minimize accountability and maximize ambiguity around user rights and procedures.

7. Hidden Fees and Lack of Transparency

Every reputable financial platform discloses its fee structure clearly and upfront. This allows users to calculate potential costs associated with:

-

Trading

-

Depositing

-

Withdrawing

-

Account maintenance

-

Currency conversion

Gatevex.com website does not prominently feature an itemized fee schedule. Any fee information that appears is vague and often buried in general terms. Without a clear breakdown, users cannot assess:

-

What they will be charged

-

When fees apply

-

How fees affect their net returns

-

Whether there are penalty charges

Opacity around fees is another hallmark of platforms that seek to extract money while keeping conditions unclear.

8. Site Details Hint at Risk

An additional consideration for evaluating any online platform is how its website is structured and managed. While Gatevex.com site uses professional visuals and simplified language, this can sometimes be a mask for deeper issues. Platforms designed to look legitimate often recycle generic templates, buzzwords, or reused marketing language without substantive documentation — a pattern associated with high-risk or fraudulent sites rather than regulated, credible financial services.

The absence of any transparent legal or operational documentation in the public domain reinforces this observation.

9. Why Regulatory Warnings Matter

When a platform is explicitly flagged by financial authorities, that is not a trivial observation. Regulatory warnings are issued only after platforms are reviewed internally and found to be operating outside legal compliance, lacking proper registration, or engaged in behavior that could harm investors.

The fact that Gatevex.com has been officially identified as not registered and not authorized to solicit investments in specific jurisdictions amplifies these concerns.

Regulators in different countries examine platforms based on:

-

Whether they hold mandatory licenses

-

Whether they disclose corporate leadership

-

Whether they provide clear financial terms

-

Whether they protect user funds under established laws

When Gatevex.com repeatedly fails these checkpoints in official reviews, the conclusion among regulatory bodies is clear: this platform is high-risk and not fit to serve as a regulated investment platform.

10. Key Red Flags Every Potential Investor Should Know

Here’s a consolidated list of the most serious warning signs associated with Gatevex.com:

-

No transparent regulatory oversight from recognized financial authorities

-

Lack of corporate identity and legal documentation tied to responsible individuals

-

Vague operational claims about technology and security without evidence

-

Unclear deposit and withdrawal protocols

-

Minimal customer support channels with no clear escalation paths

-

Hidden or ambiguous fee structures

-

No verified success data or independent user testimonials

-

Official regulatory warnings identifying the platform as high-risk

-

Marketing language that prioritizes buzzwords over substance

These are not minor usability complaints — they represent fundamental gaps in how a trustworthy financial platform should operate.

End Note : Gatevex.com Fails Fundamental Credibility Tests

In the world of online finance and digital asset platforms, transparency, regulation, and accountability are non-negotiable. Gatevex.com falls short on all of these critical fronts.

Despite its attractive interface and compelling marketing language, the platform’s lack of clear regulation, opaque corporate identity, ambiguous operational details, and absence of verifiable performance or security documentation suggest it is not a reliable or trustworthy investment or financial service provider.

Investing or depositing funds on platforms that operate without oversight or transparency is inherently risky — and in Gatevex.com case, the risks go well beyond normal market volatility or user experience challenges. The documented regulatory warnings and structural shortcomings indicate a pattern that many describe as scam-like or fraudulent.

If you’re evaluating platforms to manage your financial assets, due diligence is essential. And in the case of Gatevex.com, there are serious reasons to approach it with extreme caution — or avoid it entirely — in favor of services with established licensing, transparent operations, and credible track records.

Conclusion: Report Gatevex.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Gatevex.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Gatevex.com, extreme caution is advised.