HighAPEXPlanning.net Review : Scam Investment Platform

Introduction

In the crowded landscape of online investment and financial platforms, some companies stand out for their transparency, clear corporate structure, verified credentials, and accountability to users. Others, by contrast, rely on shiny marketing, vague business claims, and superficial design to lure unsuspecting investors into environments where accountability is minimal and risk is maximized.

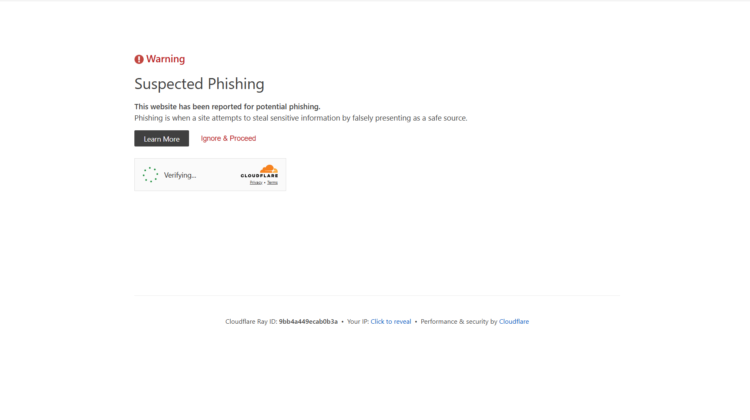

HighAPEXPlanning.net falls squarely into the second category. On the surface, it looks like a sleek, modern investment platform that promises financial growth and opportunity. But a closer examination reveals a pattern of obscurity, misdirection, and structural deficiencies that are classic hallmarks of a platform that should be approached with extreme skepticism.

This review provides a comprehensive analysis of HighAPEXPlanning.net public presentation, business claims, structural transparency, marketing tactics, and operational behavior — all with the aim of equipping readers to make informed decisions about their financial safety.

First Impressions: Glossy Interface, Hollow Details

HighAPEXPlanning.net website is carefully designed. Landing pages feature professional graphics, motivational language, and phrases designed to inspire optimism about financial opportunity. A first-time visitor might easily assume they’ve landed on a legitimate financial services site.

But first impressions can be deceiving. In many high-risk or scam-oriented platforms, emphasis is placed on visual appeal and motivational language precisely because these elements can create a false sense of security, distracting users from the lack of underlying substance.

Click deeper — and the weaknesses in HighAPEXPlanning.net public presentation quickly begin to show.

A Business Model That Can’t Be Clearly Defined

One of the most fundamental expectations of a legitimate investment or financial platform is a clearly articulated business model. Users need to know how the company makes money, how investment returns are generated, and how their own funds will be used.

HighAPEXPlanning.net fails this test. While the site uses broad terms like “growth,” “strategic planning,” and “optimized financial outcomes,” it offers very little in the way of specific, verifiable explanation about:

-

What markets or financial instruments are involved

-

How returns are calculated

-

Whether funds are actively traded, pooled, or invested

-

What risk management strategies are in place

This vagueness is not accidental; it is a common feature of high-risk platforms that want to appear flexible and appealing rather than accountable and precise.

Without a clearly defined operational model, users have no real way to evaluate what they are signing up for, how risk is managed, or what promises are grounded in actual mechanics rather than marketing language.

Corporate Transparency: What’s Missing?

Authentic financial firms typically offer clear corporate information:

-

Registered company name

-

Jurisdiction of incorporation

-

Physical office addresses

-

Names of executives

-

Contact information with verifiable customer service details

By contrast, HighAPEXPlanning.net public materials offer very little in the way of verifiable corporate identity. Leadership and organizational structure are largely hidden behind generic branding language. The platform does not provide clear evidence of legal registration, corporate filings, or physical office locations.

When a company dealing with money and investments chooses not to disclose this level of detail, users are left with no verifiable entity to hold accountable if something goes wrong.

Opaque corporate identity is a red flag precisely because it removes accountability from the equation.

Regulatory Oversight: A Vacuum of Accountability

One of the most important safeguards for investors is regulatory oversight. In most jurisdictions, companies that handle investments, financial planning, or client funds must be licensed by a recognized regulatory authority. These authorities enforce standards for disclosure, reporting, client fund segregation, and ethical conduct.

HighAPEXPlanning.net makes no visible mention of regulatory oversight, licensing numbers, or compliance with financial authorities. This lack of transparency suggest that the platform may be operating without regulatory authorization.

When a financial platform functions outside regulatory frameworks, users have no external body to turn to if issues arise. No audit obligations. No client fund protections. No compliance reports. No dispute resolution oversight.

This is not a casual omission — it fundamentally alters the risk profile of the platform.

Anonymous Leadership: No Accountability at the Top

A trustworthy investment firm welcomes transparency about its leadership, providing biographies, professional experience, qualifications, and verifiable public profiles for its executives.

HighAPEXPlanning.net does the opposite — leadership details are vague or entirely absent. There are no identifiable executives, no clear management team, and no way to independently verify the backgrounds of the people behind the platform.

This lack of transparency is significant because leadership identity and credibility matter when you are considering entrusting your money to a platform. Anonymous leadership removes accountability and increases the risk that financial mismanagement, misrepresentation, or worse can occur without consequence.

Marketing Over Information: A Common Tactic

HighAPEXPlanning.net public language is heavy on motivational statements and light on factual explanation. Statements evoke concepts like “empowering financial futures” and “strategic wealth positioning,” but they fail to accompany those statements with:

-

Clear explanations of financial mechanisms

-

Disclosure of risk factors

-

Fee schedules or cost structures

-

Examples of actual performance data

This kind of marketing-first language is common among platforms designed to elicit emotional responses rather than informed evaluations. The goal is often to get users to act quickly — before they realize how little information they have to work with.

Customer Support: Limited and Non-Specific

Communication accessibility is a key factor in evaluating any financial service. Legitimate companies typically offer multiple support channels, staffed by trained professionals who can address customer questions about accounts, funds, and operational procedures.

HighAPEXPlanning.net, however, provides only limited or generic communication options. Contact forms and basic email addresses are presented, but there is no evidence of trained support teams, clear escalation procedures, or transparent accountability in customer service.

This lack of robust support infrastructure is another sign that the platform is not built around user protection and long-term trust.

Scarcity of Independent User Feedback

One of the most reliable ways to evaluate a financial platform’s real-world performance and trustworthiness is through independent user feedback published on neutral forums or review sites. Platforms with years of responsible operation tend to generate both positive and critical reviews, which can be cross-checked and evaluated for patterns.

In HighAPEXPlanning.net case, there is minimal credible independent feedback. Almost no verifiable customer experiences, no confirmed testimonials, and certainly no measurable presence in public trading communities.

This absence of user data suggests either:

-

The platform is too new to have established a real user base

-

Users are not sharing their experiences because they are dissatisfied

-

Independent evaluation is being obscured or suppressed

Regardless of the reason, a lack of independent user voices should prompt caution.

Structural Patterns Common to Questionable Platforms

When evaluating platforms like HighAPEXPlanning.net, several structural patterns often point toward a high-risk or untrustworthy operation:

-

Opaque corporate identity — no verifiable company registration or public accountability

-

No regulatory oversight — operating outside recognized financial frameworks

-

Anonymous or undisclosed leadership — no transparent executive accountability

-

Marketing emphasis over factual clarity — appeal over substance

-

Limited customer support infrastructure — poor access to real assistance

-

Absence of independent user reviews — no verifiable community feedback

-

No explicit risk disclosures — imbalance between opportunity and caution

These patterns rarely occur in reputable firms because transparency and accountability are fundamental to maintaining investor confidence and regulatory compliance. When these elements are absent, the risk profile rises sharply.

How to Spot Legitimate Platforms (And What HighAPEXPlanning.net Lacks)

Reputable financial platforms tend to have:

-

Clear licensing and regulatory disclosures

-

Verifiable corporate information

-

Open leadership profiles

-

Comprehensive risk disclosures

-

Transparent fee structures

-

Robust customer support

-

Independent user testimonies

HighAPEXPlanning.net lacks nearly all of these elements in its public presentation, leaving users with little beyond motivational language and vague promises.

Final Analysis: A Platform Built on Uncertainty

At the end of the day, HighAPEXPlanning.net outward professionalism masks a deeper structural deficiency: a lack of verifiable transparency and accountability. Without clear corporate identity, regulatory oversight, leadership disclosure, or meaningful communication channels, the platform cannot be evaluated using standard criteria for legitimate financial services.

This absence of foundational characteristics — replaced instead with polished marketing language and vague opportunity statements — is precisely the environment in which high-risk and scam-style platforms thrive.

For anyone considering using HighAPEXPlanning.net for financial planning, investment, or wealth growth, the lack of transparency and accountability points to a platform that should be treated with extreme skepticism.

Whether the platform’s operators intended to mislead users or simply never established the necessary infrastructure for legitimacy is not for this review to determine. What is clear — based on structural analysis and common patterns — is that HighAPEXPlanning.net does not meet the basic standards expected of trustworthy financial platforms.

Conclusion: Report HighAPEXPlanning.net Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, HighAPEXPlanning.net raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through HighAPEXPlanning.net , extreme caution is advised.