LockCoin.net Review — Fraud Platform

Introduction

If you’ve seen LockCoin.net (sometimes presented as lockcoin.net, app.lockcoin.net, or similar variants) and are wondering whether it’s a legitimate crypto service or something to avoid, this post walks through the observable red flags, public signals, and operational patterns that make the platform high-risk. I’m not making legal accusations; I’m laying out verifiable, public indicators and explaining why those indicators matter so you can judge for yourself.

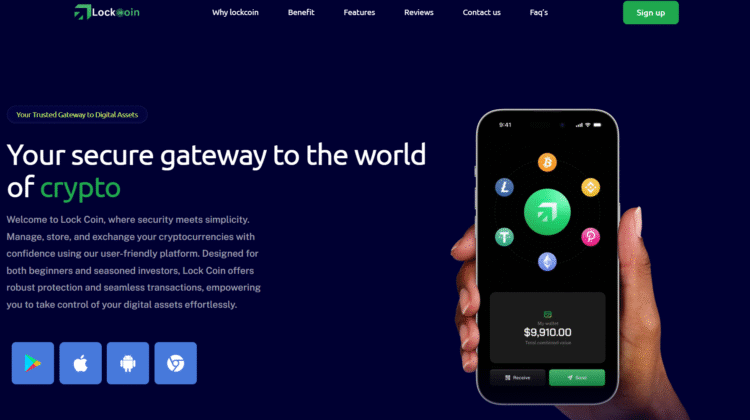

First impressions: slick marketing, thin traceability

LockCoin.com public pages try to look modern and trustworthy: polished landing pages, claims about wallet services or “unlocking” funds, and a client dashboard that appears to show balances and trading functionality. That kind of design is standard and easy to build — it’s also precisely the kind of façade scammers use to create instant credibility. A convincing UI is useful, but it isn’t proof of a legitimate business: the important information is in ownership, licensing, and consistent independent verification — and that’s where LockCoin.net public footprint is weak.

Authoritative regulator action — the clearest public signal

The single strongest, objective piece of information is an investor warning issued by a recognized securities regulator in Quebec that explicitly states Lock Coin is not registered and is not authorized to solicit investors there. Regulatory investor warnings are public, written notices meant to alert consumers after a regulator has reason to suspect a firm is operating outside the law. An authoritative notice like this should shift how you approach any outreach from the platform: it moves the burden of proof to the company to show verifiable licensing and transparent corporate identity.

Independent reputation engines flagging low trust

Multiple automated reputation and security scanners return low trust ratings for LockCoin.net domains. These tools aggregate technical signals (domain age, WHOIS privacy, hosting location), site content, and user reports to produce a score — and LockCoin.net score comes back consistently poor on several of these services. Low algorithmic trust isn’t itself a legal finding, but it’s a strong, objective signal that other users and automated systems find the site risky. That’s especially important in crypto, where anonymity and rapid fund transfers make red flags more consequential.

Pattern of user complaints and independent exposés

Beyond algorithmic flags, there are multiple first-hand and investigative accounts from users and independent bloggers alleging that LockCoin.net operates in ways consistent with known scam patterns — mock dashboards, blocked withdrawals, and pressure from “account managers.” One investigative post and a number of user reports describe situations where accounts appear to be accessible and show gains, but withdrawal attempts are met with delays, escalating demands for further payments, or sudden account restrictions. Taken together, these user-facing reports add a human layer to the automated warnings.

Typical scam characteristics visible in LockCoin.net public behavior

When you map the public signals about LockCoin.net onto known scam playbooks, several overlapping characteristics appear:

-

An attractive interface that simulates legitimacy. The site’s UI and marketing language are crafted to build immediate trust. That helps get users to sign up quickly.

-

Opaque corporate identity. Public registration details and verifiable corporate names are absent or privacy-shielded, making it hard to tie the service to a regulated company. Low transparency about ownership is a classic risk factor.

-

Mixed or fabricated social proof. Promotional reviews and testimonials often coexist with negative reports on independent platforms; in some cases, highly positive reviews on a site are contradicted by critical user accounts elsewhere. That contrast is frequently engineered to confuse people doing quick checks.

-

Reports of blocked or impossible withdrawals. Multiple user narratives and review sites describe deposit-but-no-withdrawal patterns — a near-universal red flag for fraudulent activity.

Each of these elements is an observable behavior or signal rather than a formal legal verdict — but their combination raises the platform’s risk profile substantially.

Why domain and technical signals matter in crypto scams

In the crypto world, moving funds is fast and often irreversible. That’s why technical indicators — domain age, WHOIS privacy, low web traffic, hosting in jurisdictions with weak oversight — matter so much. Scammers often spin up a professional-looking site on a fresh domain, run aggressive outreach to collect deposits, and then rebrand or vanish when complaints mount. The technical summaries available for LockCoin.net show many of those same indicators, which is why several cybersecurity and reputation services highlight the domain as suspicious.

The psychological pattern used to recruit victims

Scams like the ones alleged around LockCoin.net often rely on two emotional levers: urgency and social proof. Users report being contacted by persuasive account managers or seeing messages that suggest limited-time opportunities. Combined with dashboards that display fabricated early gains, these tactics create a pressure cooker where people feel compelled to deposit more. Recognizing those emotional tactics helps explain why otherwise careful people sometimes lose money: the environment is engineered to short-circuit sober decision-making.

What to look for if you’re researching LockCoin.net (neutral, pre-engagement checks)

If LockCoin.net has contacted you or you’re simply researching, here are neutral verification steps that produce documentable facts:

-

Ask for the legal corporate name, registration number, and regulator license number — then verify those details in the appropriate government or regulator registry. A legitimate crypto custodian or broker will have clear, verifiable entries.

-

Compare independent reputation reports (not just a single glowing review). Read the reasons behind low trust scores — WHOIS privacy, new domain, or hosting anomalies are meaningful reasons for caution.

-

Search for corroborated user experiences on independent forums and consumer complaint sites — patterns of blocked withdrawals or consistent personnel names are important signals.

-

These steps focus on pre-engagement verification rather than post-loss actions.

Bottom line: a high-risk profile that merits caution

Taken together — an official investor warning from a securities regulator, poor automated trust scores, multiple independent user complaints, and the familiar behavioral patterns of abusive crypto platforms — LockCoin.net public footprint places it in a high-risk category. That doesn’t substitute for a court verdict, but it does mean any contact, solicitation, or request to deposit funds should be treated with the presumption that the platform is untrustworthy until proven otherwise through transparent, verifiable documentation.

If you’ve been approached by LockCoin.net, the prudent stance is to avoid engaging until the company can produce clear regulatory credentials and verifiable corporate registrations that check out in official registries. In contexts where money is at stake and reversibility is limited, the absence of verifiable proof is itself a meaningful negative signal.