MasterEdgeTrust.net Review: Deceptively Professional Investment Fraud

Introduction

The world of online finance has become a double-edged sword — it offers convenience and opportunity but also an open door for digital deception. Among the rising tide of fraudulent investment platforms, one name has been steadily drawing complaints and suspicion: MasterEdgeTrust.net .

At first glance, MasterEdgeTrust.net appears to be a cutting-edge wealth management company offering diversified investment portfolios, cryptocurrency trading, and “innovative asset management solutions.” Its website looks sleek, the language sounds authoritative, and the team photos give off an air of credibility. Yet behind this professional façade lies what appears to be a cleverly constructed scam.

In this detailed investigation, we’ll unpack how the MasterEdgeTrust.net scam operates, how it seduces unsuspecting investors, and what patterns make it unmistakably fraudulent.

1. The Allure of Professionalism

Scams like MasterEdgeTrust.net t don’t start by looking suspicious — they start by looking perfect.

When visitors first encounter the MasterEdgeTrust.net website, they’re greeted by a minimalist design, corporate-sounding copy, and promises of “secure investment growth through cutting-edge financial strategies.” Every page is dressed in the language of trust: “licensed advisors,” “global reach,” and “transparency.”

The company claims to manage diversified portfolios across real estate, forex, and cryptocurrency. It promotes itself as a “modern trust firm” combining technology with human expertise — a pitch designed to attract everyone from small investors to professionals seeking passive income.

Everything about it feels polished. That’s what makes it dangerous.

2. The Illusion of Legitimacy

What sets MasterEdgeTrust.net apart from basic “get-rich-quick” schemes is how deeply it mimics a legitimate financial institution. It presents registration numbers, legal disclaimers, and documents that look official. There’s even a “compliance” page referencing well-known regulatory bodies — though on closer inspection, the information doesn’t match any real public records.

A core part of the illusion is the language of regulation. The scammers behind MasterEdgeTrust.net know that investors are trained to look for certain buzzwords — “FCA-licensed,” “audited,” “regulated,” “insured.” So they scatter these terms throughout their marketing, without providing verifiable proof.

The entire setup is an exercise in psychological manipulation: give potential investors just enough apparent legitimacy to keep them from digging deeper.

3. The Pitch: Low Risk, High Return, Fast Growth

Once potential clients register, the tone shifts from “corporate website” to high-pressure sales pitch.

Account representatives (often calling themselves “financial analysts” or “relationship managers”) reach out via email, phone, or WhatsApp. They present personalized “investment opportunities,” promising steady growth with almost no risk.

Their pitch follows a predictable formula:

-

“We help our clients grow their wealth securely.”

-

“Our diversified portfolios protect against market volatility.”

-

“Our clients average between 20%–40% annual return.”

The key psychological hook is consistency and reassurance — they claim not to make people rich overnight, but to provide “reliable growth.” That claim sounds conservative enough to seem plausible, yet it remains mathematically impossible under real market conditions.

4. How the Scam Hooks Investors

After the initial conversation, investors are invited to deposit a small “test amount,” often around $250 or $500.

Once funds are deposited, users are given access to a digital dashboard — a portal that mimics real trading software. On the surface, it shows live price charts, account balances, and a running record of “profits.” Behind the curtain, these numbers are completely fabricated.

Within days, investors see their balance increase, giving them the illusion of success. They’re then encouraged to “capitalize on momentum” by adding larger amounts. The supposed “analyst” provides market commentary, daily updates, and even sends screenshots of “successful trades.”

It’s a convincing act — until you try to withdraw your money.

5. The Trap: Withdrawal Barriers and False Promises

The biggest red flag in the MasterEdgeTrust.net operation is how it handles withdrawals.

Initially, small withdrawals are processed smoothly to build trust. Once an investor attempts to withdraw a significant amount, the delays begin.

Common excuses include:

-

“Your account is under compliance verification.”

-

“Additional anti-money-laundering documents are required.”

-

“There’s a pending administrative fee before we can release funds.”

-

“The withdrawal queue is long due to server maintenance.”

These tactics serve two purposes: to stall time and to pressure investors to send more money. Victims are often told that paying an extra “tax,” “clearance fee,” or “conversion cost” will unlock their funds. In reality, each additional payment disappears into the same black hole as the original deposit.

After enough stalling, the communication stops entirely. Phone calls go unanswered, email responses vanish, and the investor dashboard locks out access.

6. Behind the Curtain: Fake Team, Fake Address, Fake Entity

A deeper look into the details surrounding MasterEdgeTrust.net reveals a pattern seen in numerous online scams.

The supposed “team” listed on the website consists of names and photos that do not correspond to any real financial professionals. A reverse image search often shows the same headshots being used on unrelated websites.

The “corporate office” address is usually a virtual mailbox in a city known for offshore registrations — or in some cases, a shared workspace building where the company has no presence.

The firm’s claimed registration number (if any) typically belongs to an unrelated business or doesn’t exist at all. This combination of vague identity markers allows the scammers to vanish overnight and reappear under a new name.

7. The Marketing Strategy: Social Media and Fake Endorsements

MasterEdgeTrust.net reach is amplified through aggressive online marketing.

On social media, it presents glossy visuals of successful traders, satisfied clients, and luxury lifestyles supposedly earned through “smart investing.” These images are recycled stock photos.

The scam also relies on fake testimonials — written reviews posted on forums and websites created by the scammers themselves. Some of these testimonials claim “verified success stories,” complete with fake account screenshots showing huge profits.

Occasionally, the operation pays for sponsored posts on smaller finance blogs, giving the illusion of third-party endorsement. This marketing ecosystem exists solely to build an aura of legitimacy around a hollow enterprise.

8. How Victims Get Trapped Emotionally

The genius — and cruelty — of the MasterEdgeTrust.net scam lies not just in stealing money but in manipulating trust.

Scammers often spend weeks cultivating relationships with clients. They use empathy, charm, and financial jargon to appear knowledgeable. Victims come to see their “advisor” as a friend or mentor. That psychological bond becomes the weapon used against them.

When problems arise, scammers exploit guilt and fear. They tell victims, “If you withdraw now, you’ll lose your profits,” or “Regulators will freeze your account if you don’t pay the clearance fee.”

This emotional manipulation can cause investors to act against their instincts — sending even more money in hopes of saving their investment.

9. The Collapse: When the Facade Falls Apart

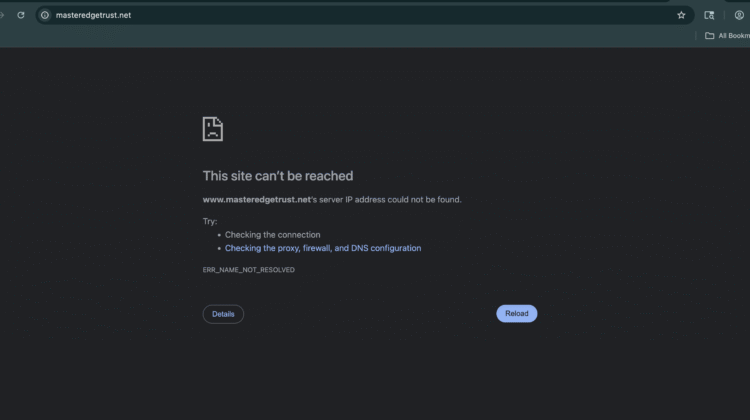

Every scam has an expiration date. Eventually, as complaints spread online, new deposits slow down. At that point, the operators of MasterEdgeTrust.net typically shut down the website, delete their social media pages, and disappear.

The company name ceases to exist — but often, the same scammers reappear under a new brand with a slightly altered domain and layout.

Because victims rarely know the real individuals behind the scam, accountability becomes nearly impossible.

10. The Anatomy of the Fraud — Step by Step

To summarize how the MasterEdgeTrust.net operation unfolds:

-

Attraction Phase: Sleek website, credible-sounding language, and online ads lure potential investors.

-

Engagement Phase: “Advisors” contact leads personally, creating trust and urgency.

-

Deposit Phase: Small investments are encouraged to start, with simulated profits shown on dashboards.

-

Escalation Phase: Investors are persuaded to deposit larger sums based on fake returns.

-

Extraction Phase: Withdrawal attempts are blocked, and extra fees are demanded.

-

Abandonment Phase: Communication ends, and the company vanishes or rebrands under a new name.

This lifecycle is not unique to MasterEdgeTrust.net— it’s the blueprint for dozens of modern online investment scams.

11. The Warning Signs in Hindsight

Looking back, several signs expose the scam’s true nature:

-

Too-Consistent Profits: Legitimate investments fluctuate; fake platforms show steady gains.

-

Fake Corporate Identity: No verifiable registration, license, or physical presence.

-

High-Pressure Communication: Urgency to deposit, reluctance to allow withdrawals.

-

Fee-Based Delays: Requests for additional payments to “unlock” funds.

-

Copy-Paste Marketing: Reused text and images found on multiple fraudulent sites.

Each red flag may appear small on its own, but together they form a glaring pattern of deception.

12. Lessons from the MasterEdgeTrust.net Case

The story of MasterEdgeTrust.net highlights several lessons about online investment safety:

-

Always confirm regulatory credentials through independent public registers, not screenshots or PDFs.

-

Be suspicious of guaranteed or unusually consistent returns.

-

Never transfer funds to platforms that refuse to verify their legal status.

-

Beware of “account managers” who insist on communicating only through encrypted chat apps.

-

Genuine firms encourage questions — scammers pressure you to act fast.

The sophistication of scams like this one demonstrates how important skepticism has become in digital finance.

13. The Final Verdict

MasterEdgeTrust.net is not an investment platform — it’s a digital trap built on manipulation, imitation, and illusion. It mirrors the structure of legitimate financial firms but lacks every hallmark of authenticity: transparency, accountability, and regulation.

From fake credentials to fabricated trading dashboards, every element of MasterEdgeTrust.net was engineered to create one outcome — the transfer of investor funds into the hands of anonymous fraudsters.

Behind its polished marketing lies nothing more than a revolving door of deception.

End Note

The case of MasterEdgeTrust.net illustrates the new frontier of financial fraud: sleek, data-driven scams that weaponize professionalism. They no longer rely on broken English or amateurish websites. They rely on believability.

In a world where even scams look legitimate, the only defense left is scrutiny. Every investor, regardless of experience, must learn to question what appears professional — because, as the story of MasterEdgeTrust.net proves, some of the most convincing companies are the most dangerous.

Conclusion: Report MasterEdgeTrust.net Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, MasterEdgeTrust.net raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through MasterEdgeTrust.net , extreme caution is advised.