maxwideinvestmentlimited.com Review : Behind the Mask of a Digital Investment Trap

Introduction

In today’s world of online trading and digital finance, investors are constantly bombarded with offers that promise effortless profits and financial freedom. Many of these platforms appear legitimate — sleek websites, glowing testimonials, and words like “AI-powered trading” and “guaranteed returns” scattered across every page. But beneath this polished surface often lies a dangerous deception.

maxwideinvestmentlimited.com is one such example. Presented as a forward-thinking investment firm offering lucrative opportunities in cryptocurrency, forex, and global asset management, it markets itself as a gateway to wealth. Yet, countless individuals have discovered that what appears to be an investment opportunity is instead a carefully constructed scam designed to drain investors of their money and trust.

This article breaks down how the maxwideinvestmentlimited.com scheme operates — from its illusion of credibility to the psychological manipulation it deploys — and how it manages to fool even cautious investors.

The Façade of Professionalism

At first glance, the maxwideinvestmentlimited.com website radiates professionalism. The design is clean, with charts showing rising profits, simulated trading dashboards, and corporate images of “financial experts” in suits. Phrases like “innovative asset management,” “global compliance,” and “reliable investment strategies” are plastered throughout the platform.

It gives the impression of a legitimate, well-structured financial entity. The website claims the company is registered and regulated, providing generic registration numbers and addresses supposedly located in financial hubs like London or Zurich. However, a deeper investigation reveals that these details are fabricated.

The registration number doesn’t appear in any official business registry, and the provided office address either leads to a co-working space or a location with no connection to the company at all. The company’s “management team” photos are actually stock images lifted from free photo databases — a common tactic used by fraudulent operations to create an illusion of credibility.

This artificial image of legitimacy is designed to lower the victim’s defenses. When a site looks professional and uses the right language, people tend to trust it automatically — and MaxWide exploits this instinct with precision.

How Victims Are Lured In

maxwideinvestmentlimited.com relies on aggressive and sophisticated marketing strategies to draw in potential victims. Social media ads, paid influencers, and fake “success stories” circulate widely across platforms like Facebook, Instagram, and TikTok.

These posts often promise extraordinary returns on minimal investments. Examples include slogans such as:

-

“Double your money in 7 days!”

-

“Earn passive income through our AI trading bots.”

-

“Join thousands of successful investors already profiting with MaxWide.”

The language is emotionally charged and tailored to attract people searching for financial independence or quick gains. Clicking on any of these ads leads to a registration form requesting a name, email, and phone number.

Once submitted, this information becomes the entry point into the scam. Victims are soon contacted by a so-called “financial advisor” — an individual who speaks confidently about markets, investment plans, and “tailored opportunities.” Their primary objective: convince the prospect to make an initial deposit, often starting at $250 or $500.

The Initial Investment and the Illusion of Success

After the first deposit, the investor gains access to MaxWide’s online dashboard — an interface that looks remarkably advanced. It displays market movements, asset portfolios, and live trade updates. However, everything visible on this dashboard is entirely fabricated.

The numbers rise and fall as if real trades are happening, but no money is ever actually invested. The fake trading environment is built to mimic real brokerage platforms, complete with charts, profit indicators, and transaction histories.

Within a few days, the investor starts to see apparent gains. Their balance increases, trades show positive outcomes, and profit percentages seem consistent. This early “success” is one of the scam’s most effective tools. It creates excitement, trust, and a strong psychological commitment to continue investing.

The “advisor” calls back, congratulating the investor and suggesting they increase their deposit to unlock “premium accounts” or “high-yield opportunities.” Some victims are told they’ve been selected for a “special program” that guarantees even higher returns — provided they deposit more funds immediately.

Psychological Manipulation: The Core of the Scam

The operators behind maxwideinvestmentlimited.com are not amateur scammers. They are trained in psychological sales manipulation and behavioral pressure tactics. Their communication strategy follows a predictable cycle of trust, urgency, and fear — the trifecta of successful financial fraud.

-

Trust Building

The “advisor” often speaks warmly and repeatedly. They may call several times a week, addressing the investor by name and discussing personal financial goals. This repeated contact builds an emotional bond. The victim begins to see the scammer as a trusted financial partner rather than a stranger. -

Creating Urgency

Once trust is established, the next phase involves pressure. The advisor claims that a unique investment opportunity is closing soon or that market conditions are ideal for a limited time. The investor feels compelled to act quickly before “missing out.” -

Invoking Fear

When the investor hesitates or questions the system, the advisor switches tactics — warning that delays could lead to losses or account closure. Some even fabricate small “losses” on the dashboard to create anxiety, pushing the investor to deposit more money to “recover” funds.

Each stage of this manipulation is carefully calibrated to elicit compliance and suppress doubt.

The Turning Point: Attempting a Withdrawal

The illusion collapses when the investor tries to withdraw funds. Initially, small withdrawal requests — often under $100 — might be approved to maintain credibility. This reinforces the victim’s belief that the platform is legitimate.

However, when larger sums are requested, the problems begin. The investor receives emails stating that withdrawals are “under review” or “pending verification.” Later, the company invents new conditions:

-

“You must pay a 10% tax fee before release.”

-

“Your profits are locked until you upgrade to a higher tier.”

-

“Our compliance department requires additional deposits to verify your account.”

These are all fabricated excuses to extract more money. When victims refuse to pay these “fees,” communication begins to break down. Calls go unanswered, emails bounce, and the live chat support disappears. Eventually, the victim is locked out of their account entirely, and their funds are gone.

The Hidden Machinery Behind the Scam

maxwideinvestmentlimited.com is not a standalone operation. It’s part of a broader network of clone investment schemes that share the same infrastructure, design templates, and call centers.

The pattern typically follows this sequence:

-

Website Launch – A new platform with a convincing name is launched, complete with fake company credentials.

-

Lead Generation – The site advertises aggressively on social media, attracting thousands of potential investors.

-

Conversion Phase – Call center agents contact the leads, persuading them to deposit initial funds.

-

Retention and Extraction – Victims are manipulated into depositing more, while fake dashboards simulate trading activity.

-

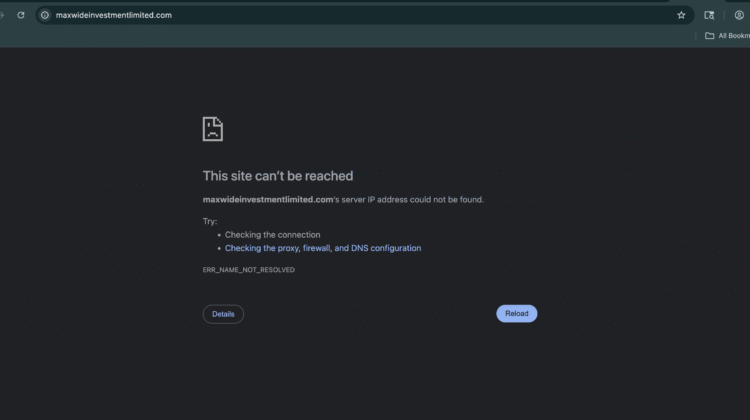

Exit Strategy – Once complaints start piling up or regulators take notice, the website disappears, and a new one emerges under a different name.

This rotating model allows scammers to continually evade exposure while targeting new victims under a fresh brand identity.

Identifiable Red Flags

There are multiple signs that expose maxwideinvestmentlimited.com as a fraudulent platform. Some of the most telling include:

-

Lack of Regulation:

Despite claiming to be registered, there is no evidence of oversight from any financial authority. -

Anonymous Team:

No real executives or staff are listed. All “about us” details are vague or copied from other sites. -

Unverifiable Address:

The corporate addresses listed lead to shared office spaces or empty buildings. -

Guaranteed Profits:

Any platform that claims fixed returns in volatile markets is inherently untrustworthy. -

Crypto-Only Payments:

The platform insists on cryptocurrency deposits, ensuring transactions cannot be reversed or traced easily. -

Fake Testimonials:

Identical “client success stories” appear word-for-word across multiple scam sites.

Each of these red flags, on its own, is a reason for caution. Together, they form an unmistakable pattern of deception.

The Human Impact

Behind the statistics and warning signs are real people whose lives have been affected by maxwideinvestmentlimited.com operation. Some lost their entire savings; others drained retirement funds or borrowed money to invest after being promised exponential growth.

The emotional damage is often worse than the financial loss. Victims describe feelings of shame, anger, and betrayal. Many blame themselves for “falling for it,” unaware that the scam was structured to outsmart even the most cautious investor.

Scammers exploit not only financial desperation but also trust — a fundamental human instinct. Once that trust is broken, the psychological scars can linger far beyond the lost money.

The Broader Pattern of Online Investment Fraud

The case of maxwideinvestmentlimited.com is a reflection of a much larger issue plaguing the digital economy. As financial services migrate online, scammers exploit the anonymity of the internet to create fake investment entities that mimic real institutions.

These operations are often international, with developers, marketers, and con artists working across borders. Their adaptability makes them difficult to trace and even harder to prosecute. By the time one operation collapses, another arises under a new name, reusing the same website design and marketing copy.

Understanding this cycle is crucial in recognizing that MaxWide isn’t a one-off — it’s a symptom of a global web of financial deception.

End Note

maxwideinvestmentlimited.com represents the modern face of digital financial fraud. Behind its clean interface and confident promises lies a ruthless system engineered to deceive and exploit.

From the fabricated trading dashboards to the manipulative “advisors,” every component of MaxWide’s operation is a calculated move designed to create trust, extract deposits, and disappear without consequence.

What makes this scam particularly insidious is how ordinary it appears. It doesn’t rely on hacking or theft — just persuasion and illusion. And that is what makes it so dangerous.

In a world where online investments can look indistinguishable from fraud, vigilance is no longer optional — it’s essential. The story of maxwideinvestmentlimited.com serves as a harsh reminder that not every opportunity that glitters online is gold. Sometimes, it’s a trap disguised as success.

Conclusion: Report maxwideinvestmentlimited.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, maxwideinvestmentlimited.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through maxwideinvestmentlimited.com , extreme caution is advised.