MEXC.com Review – Uncovering the Deceptive Tactics

Introduction

In the expanding world of cryptocurrency, new exchanges and investment platforms appear almost daily. Many claim to offer quick profits, user-friendly interfaces, and secure trading environments. Unfortunately, this same environment has become fertile ground for scams disguised as legitimate platforms. One such operation that has drawn increasing suspicion and criticism is MEXC.com— a platform that markets itself as a cutting-edge exchange but exhibits numerous signs of deceit.

This in-depth review explores the suspicious nature of MEXC.com, its manipulative tactics, false promises, and the pattern of fraudulent behavior that defines its operations. While it might appear professional at first glance, deeper investigation reveals alarming red flags consistent with typical online financial scams.

The Appeal of MEXC.com: A Deceptive First Impression

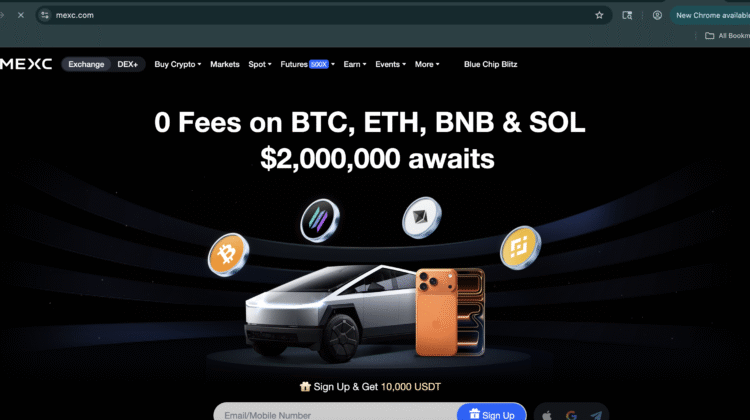

At first glance, MEXC.com presents itself as a modern cryptocurrency exchange that offers access to digital asset trading, futures markets, and various financial products. The website’s design is sleek, boasting charts, performance graphs, and professional-looking dashboards meant to inspire confidence. It claims to offer low trading fees, high liquidity, and innovative investment options that can help users maximize their profits in the crypto market.

However, beneath the polished design lies an unsettling truth: MEXC.com marketing pitch and operational conduct display hallmarks of a fraudulent entity masquerading as a legitimate crypto exchange. The site’s claims are largely unverifiable, and user experiences reveal repeated incidents of blocked withdrawals, misleading promises, and disappearing customer support — all typical characteristics of a scam.

False Claims of Regulation and Legitimacy

One of the first red flags surrounding MEXC.com is its dubious regulatory standing. Legitimate crypto exchanges operate under strict oversight from recognized financial authorities. These include bodies such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or similar agencies in other jurisdictions.

MEXC.com claims to comply with international regulatory standards, yet provides no verifiable proof of being licensed by any recognized authority. The so-called “registration certificates” or “compliance badges” visible on its website or promotional materials are often fabricated. A deeper inspection shows that no record of the company exists in any official financial registry.

This lack of transparency regarding ownership and regulation is a major warning sign. Genuine exchanges are proud to display verifiable details about their licensing, management team, and company address. MEXC.com, on the other hand, conceals this information — a move that strongly suggests an intent to operate in the shadows.

Anonymous Operations and Fake Company Information

A legitimate financial service provider operates with traceable contact details and an identifiable leadership structure. MEXC, however, hides behind anonymity. The website’s “About” section offers vague and generic information about its “global presence,” but provides no physical office address, no names of founders or executives, and no registered headquarters.

In many cases, the domain registration for MEXC.com site is private, preventing anyone from identifying who owns or controls it. This is a classic technique employed by online scammers to prevent accountability once their fraudulent activities are exposed.

Furthermore, many users have reported that MEXC.com representatives use false names and fake profiles when contacting clients. These agents claim to be expert traders, financial consultants, or customer support officers, but none of their identities can be verified. It’s all part of the illusion — giving victims the impression of professionalism and trustworthiness while operating under complete anonymity.

Aggressive Marketing and Unrealistic Promises

Like most scams, MEXC.com relies heavily on unrealistic promises to attract victims. Promotional materials and social media campaigns highlight extraordinary returns, often suggesting that users can earn guaranteed profits through automated trading bots, exclusive signals, or arbitrage systems.

Phrases like “trade with zero risk”, “guaranteed daily profit”, or “automated earnings on every transaction” are central to their marketing. These claims are mathematically impossible in real trading markets. Legitimate exchanges never guarantee profits — they facilitate trades where outcomes depend entirely on market conditions and user strategy.

By promoting the illusion of effortless wealth, MEXC.com preys on both novice investors and experienced traders seeking passive income, luring them into a web of deception that ends in financial loss.

The Process: From Attraction to Deception

MEXC.com scam structure follows a well-documented pattern observed in many fraudulent trading operations.

-

Initial Attraction:

Users are drawn in through flashy advertisements on social media or search engines. These ads typically promise quick profits, risk-free trading, or exclusive access to professional trading tools. -

Account Setup:

Once a victim registers, the platform requests personal information and encourages a small initial deposit — often between $250 and $500. This amount is marketed as a “starter investment” to begin trading. -

Fake Profit Generation:

After funds are deposited, users see simulated profits reflected on their dashboards. The numbers increase rapidly, giving the illusion that trades are performing successfully. In reality, no genuine trading occurs — the figures are entirely fabricated by the platform’s backend system. -

Pressure to Invest More:

Scammers posing as “account managers” contact users via email, phone, or messaging apps. They use aggressive sales tactics, urging clients to invest larger amounts to “unlock” higher returns. Some even fabricate market news or trends to manipulate urgency. -

Withdrawal Blockage:

When users attempt to withdraw profits or even their initial deposits, they encounter endless delays. MEXC.com invents various excuses — such as needing account verification, paying additional fees, or completing certain trade volumes before withdrawal. -

Final Disappearance:

Once victims stop sending money, communication ceases. The platform may delete their account, block access, or vanish entirely. In some cases, scammers rebrand under a new name and resume operations elsewhere.

Fake Customer Support and Communication Barriers

MEXC.com so-called customer support system is another key element of its deceit. The platform appears to offer professional assistance through live chat and email, but these channels rarely lead to real help.

Most victims report generic, automated responses that do not address specific issues. In more severe cases, users are outright ignored once they begin asking about withdrawals or regulation. The so-called “support team” exists primarily to maintain the illusion of legitimacy during the deposit phase — not to assist with real account issues.

The goal is simple: to keep victims engaged long enough to extract more funds before vanishing.

Unverifiable Trading Activities

A defining characteristic of fraudulent exchanges like MEXC.com is their lack of verifiable trading data. While they showcase active charts and order books, none of this data corresponds to actual trades on public blockchain networks or known liquidity providers.

Unlike legitimate exchanges that integrate verifiable transaction IDs or transparent order book data, MEXC.com trading activity exists solely within its internal system — a fabricated environment designed to mimic real market behavior. This allows scammers to manipulate every number displayed on the platform, from trade prices to account balances.

Reports of Frozen Accounts and Vanishing Funds

Numerous users have described experiences of sudden account suspension or unexplained balance reductions. After depositing substantial amounts, users notice that their funds either disappear entirely or are “locked” pending verification. Requests for explanations or refunds are met with silence or vague statements about “security protocols.”

Some victims have reported being told to deposit even more money to “reactivate” their accounts or release their funds — another manipulation tactic to squeeze out additional deposits before completely cutting off contact.

The Use of Fake Reviews and Online Manipulation

To bolster its false credibility, MEXC.com engages in online reputation manipulation. The internet is filled with overly positive reviews praising the platform’s reliability, fast withdrawals, and user-friendly interface. However, these reviews often share identical language, poor grammar, and artificial enthusiasm — all signs of paid or automated content.

Meanwhile, genuine victims describe the opposite experience: unresponsive support, unprocessed withdrawals, and complete account losses. These authentic complaints are frequently buried under the wave of fake positive posts, a deliberate effort to mislead potential investors.

The Pattern of Disappearance and Rebranding

Once negative publicity catches up, scam platforms like MEXC.com often rebrand under new names or domains. The operators shut down the website, transfer the design and database to a new address, and resume their fraudulent activity under a fresh identity. This cycle ensures that they can continue deceiving new victims while avoiding detection or legal accountability.

Given this pattern, it is not surprising that MEXC.com operators remain anonymous. The absence of transparency allows them to re-emerge in the future under a different brand name with minimal effort.

Final Analysis: Why MEXC.com Is a Scam

Every aspect of MEXC.com operation — from its unverifiable regulation and fake trading data to withdrawal issues and fake reviews — points toward deliberate fraud. It functions not as a genuine trading platform but as a financial trap designed to lure users into depositing money that will never be returned.

The professional appearance of the website, the use of technical jargon, and the manipulation of profit dashboards are all strategic tools meant to deceive. No legitimate financial or crypto entity operates with such secrecy, anonymity, or disregard for transparency.

End Note

The story of MEXC.com serves as a reminder that not every exchange claiming to offer high returns or advanced tools is legitimate. The platform uses sophisticated marketing and psychological manipulation to create an illusion of opportunity while systematically draining funds from unsuspecting users.

From fake regulatory claims and fabricated trading data to aggressive deposit tactics and blocked withdrawals, MEXC.com exhibits every hallmark of a classic online scam. Behind its polished digital front lies a calculated operation designed to exploit the dreams and trust of those eager to succeed in cryptocurrency trading.

In the end, the platform’s promises of security and prosperity are nothing but smoke and mirrors — a carefully orchestrated deception that leaves victims with empty wallets and shattered trust in online investing.

Conclusion: Report MEXC.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, MEXC.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through MEXC.com , extreme caution is advised.