PolySharpInvestmentsLimited.com Review — A Deep Dive into a Well-Disguised Fraud

Introduction

Online investment scams keep getting smarter: they borrow professional design, borrow industry jargon, and layer persuasive social engineering on top of convincing-looking websites. PolySharpInvestmentsLimited.com is a textbook example of that kind of modern fraud — a company that looks credible at a glance but, on inspection, operates like a purpose-built money-extraction machine. This review breaks down how the scheme works, the psychological and technical tricks used, the warning signs to spot, and the real harm it causes.

The polished front (and why appearances are dangerous)

PolySharpInvestmentsLimited.com is intentionally built to look like a trustworthy financial institution. The website (and related landing pages) typically use:

-

A professional logo and corporate-sounding name that echoes legitimate funds and holding companies.

-

High-quality stock photography of trading floors, happy clients, and luxury lifestyles.

-

Buzzwords such as “AI-assisted strategies,” “institutional liquidity,” and “risk-adjusted alpha.”

-

Fake badges and certificates that mimic regulator logos or industry awards.

That kind of polish is not accidental. It’s the opening act of the scam: when people see a tidy site with industry language, they lower their guard. The operators count on this — design credibility short-circuits skepticism and shortens the path to that first deposit.

How the funnel works: lure, convert, escalate

The PolySharpInvestmentsLimited.com funnel follows a deliberate three-step pattern:

-

Lure: Targeted ads on social media, sponsored posts, and influencer-style promotions — sometimes outright fake endorsements — push visitors to a slick landing page. These ads promise effortless returns, “automated passive income,” or access to exclusive investment vehicles.

-

Convert: The landing page asks for a name, email, and phone number. Immediately — often within minutes — a “relationship manager,” “financial advisor,” or “onboarding specialist” reaches out through phone, WhatsApp, or Telegram. They are personable, confident, and speak financial-sounding language to build rapport quickly.

-

Escalate: The victim is asked to make a modest initial deposit (commonly $250–$500). Access to a “dashboard” is granted, and the victim is shown rapid, fabricated gains to encourage larger and repeated deposits.

This funnel exploits two things: the modern impatience for quick results, and the human instinct to trust personable authority figures.

The fake trading experience: dashboards, fake profits, and staged withdrawals

PolySharpInvestmentsLimited.com invests in a convincing fake trading environment. The dashboard often displays:

-

Real-time-looking charts that move in expected ways.

-

“Executed trades” with timestamps and instrument names.

-

Account balances and profit figures that climb steadily.

All of those are showpieces. The platform’s front end is designed to simulate real trading while the back end has no connection to real exchanges. Operators can dial profits up or down at will to keep the victim engaged.

To earn trust, the scam sometimes pays a small withdrawal — a few dozen dollars — to create the illusion that funds are accessible. That small, intentional payout is a trap: it proves “withdrawals work,” tempting victims to invest far larger sums so they can withdraw “real profits” later.

The withdrawal trap: fees, verifications, and endless excuses

The moment most victims realize something is wrong is when they request a meaningful withdrawal. PolySharp’s playbook typically includes:

-

Requests for more documentation (KYC) that are never finalized.

-

Claims that withdrawals are subject to “clearing,” “tax,” or “processing” fees that must be paid upfront.

-

New pretexts such as “minimum liquidity windows” or “volume requirements” that conveniently block cash-outs.

-

Increasing demands for additional deposits to cover fabricated charges.

Each delay is engineered to coax one more payment out of the user. When the investor resists, contact becomes sporadic; when they escalate publicly, the site and contact numbers often vanish or get rebranded.

Fake regulation and copied credentials

To avoid scrutiny, PolySharpInvestmentsLimited.com commonly displays fake regulatory claims: made-up license numbers, logos lifted from real regulators, or references to multiple jurisdictions at once. These details are rarely verifiable and frequently trace back to other firms’ credentials.

A legitimate broker will publish verifiable license numbers, physical addresses, and clear corporate filings. PolySharp’s tendency to hide ownership, use private domain registration, and provide unverifiable contact details is a red flag that the “regulatory” claims are a theatrical prop, not protection.

High-pressure sales & psychological manipulation

PolySharpInvestmentsLimited.com sales agents are trained to guide emotional decision-making, not rational analysis. Typical tactics include:

-

Urgency: “Window closing,” “exclusive slot,” or “limited liquidity.”

-

Social proof: Invented case studies, fake testimonials, or images of supposed clients.

-

Authority: Posing as ex-bankers, hedge fund managers, or licensed advisors.

-

Reciprocity: Allowing small withdrawals early to build trust, then asking for more.

These tactics create an emotional momentum — victims move from curiosity, to excitement, to escalation — and once they’ve invested more money, the cost of stopping (emotionally and financially) becomes higher.

Data risk: identity theft and secondary misuse

PolySharpInvestmentsLimited.com often requests sensitive documentation under the pretext of compliance: passport scans, utility bills, selfies, even bank card photos. This data is a currency on its own. Once harvested, it can be used for identity theft, sold on illicit markets, or used in other fraud operations. The financial loss is typically just the first damage; the personal and long-term identity risks can linger for months or years.

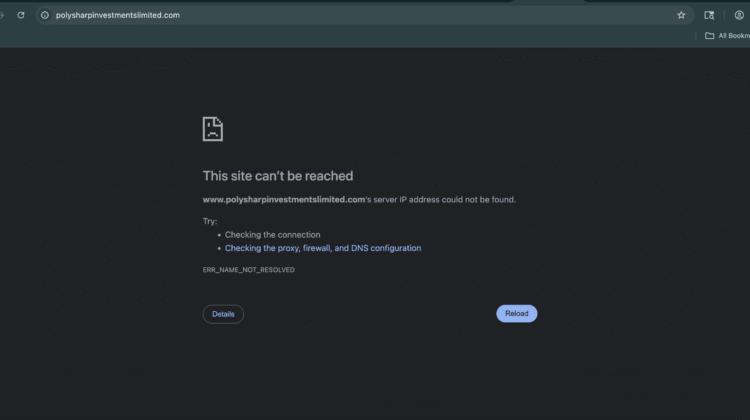

Rebrand-and-relaunch: the carnival never truly closes

When complaints accumulate or a domain is blacklisted, the operators behind PolySharp simply switch brands. They clone the same template, change the logo and name (e.g., PolySharp → PolyEdge → SharpInvest), and reuse scripts, call centers, and affiliate networks. This ability to morph makes it hard for victims and watchdogs to stop them permanently — by the time one site is reported, another is already live.

Real-world signs that PolySharpInvestmentsLimited.com is fraudulent

Watch for these unmistakable indicators:

-

Promises of guaranteed, consistent high returns.

-

Aggressive outreach immediately after signup.

-

No verifiable business registration, or anonymous domain WHOIS.

-

Regulatory logos or license numbers that cannot be validated.

-

Pressure to deposit more, with “exclusive” upsell offers.

-

Withdrawal requirements that include upfront “fees” or endless verification.

-

Requests to fund accounts via cryptocurrency or untraceable payment rails.

-

Testimonials that reuse stock photos or appear on many different scam sites.

Any one of these should raise suspicion; several together are very likely a definitive sign of fraud.

The human cost

Beyond the lost money, victims of PolySharpInvestmentsLimited.com report long-term psychological harm: shame, embarrassment, anxiety, and loss of trust in legitimate financial services. Some lose retirement funds or emergency savings; many are reluctant to report losses out of fear or embarrassment, which only helps scammers avoid accountability. And because the operation also harvests personal data, victims may face identity crimes long after the website disappears.

Final thoughts: how to think about platforms like PolySharpInvestmentsLimited.com

PolySharpInvestmentsLimited.com is not a misguided startup or a poorly regulated broker — its structure, tactics, and behavior match a deliberate, organized fraud designed to extract funds and disappear. The tools they use (glossy design, fake dashboards, and persuasive account managers) are effective at manufacturing trust quickly, but none of these are substitutes for verifiable credentials, transparent regulation, and independent third-party oversight.

When evaluating any investment platform, insist on verifiable evidence: look up license numbers on regulator sites, verify physical company filings, question aggressive sales pressure, and never rush into payments that cannot be reversed. Skepticism and verification are the best defenses against this kind of sophisticated scam.

Conclusion: Report PolySharpInvestmentsLimited.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, PolySharpInvestmentsLimited.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through PolySharpInvestmentsLimited.com , extreme caution is advised.