Proxinex.com Review — Deceptive Investment Platform Draining Traders’ Funds

Introduction

In recent years, the rise of online investment platforms has brought both opportunity and risk. For every legitimate broker helping traders grow their wealth, there seems to be a dozen fraudulent platforms hiding behind flashy websites and fake promises. One of the latest examples of such deceitful operations is Proxinex.com — a fraudulent trading platform that has been tricking investors with grand claims of professionalism and wealth creation.

This in-depth review exposes the truth about Proxinex, uncovering how it manipulates investors, the warning signs it hides behind, and why it should be recognized for what it truly is: a calculated scam designed to steal money.

The False Appearance of Legitimacy

At first glance, Proxinex.com looks convincing. Its website is sleek and modern, featuring high-resolution stock images, fluctuating charts, and professional design elements that mimic genuine brokerage platforms. The site promises users access to forex, crypto, commodities, and stock markets — all with “low risk and high profit potential.”

They claim to use cutting-edge technology, advanced AI trading tools, and expert analysts who supposedly manage portfolios for clients around the world. For newcomers to investing, this can appear enticing. The platform’s language oozes confidence, with phrases like “maximum security,” “guaranteed returns,” and “unparalleled trading accuracy.”

However, none of these claims hold up under scrutiny. There are no verifiable details about the company’s registration, physical office, or regulatory oversight. Everything Proxinex.com presents is a well-crafted illusion to appear legitimate — a hallmark of financial fraud.

No Regulation, No Accountability

The first and most alarming red flag about Proxinex.com is its lack of regulation. Any legitimate financial brokerage must be registered and authorized by recognized regulators such as the Financial Conduct Authority (FCA), ASIC, or CySEC. These regulators enforce strict standards to ensure that brokers operate transparently and protect their clients’ funds.

Proxinex, however, provides no valid license number or documentation proving it’s under any jurisdiction’s supervision. The “regulation” claims found on its website are fabricated. Some versions of its site even display fake registration numbers or cloned certificates taken from other legitimate firms.

This absence of regulatory oversight means one thing: Proxinex.com can disappear with investors’ money at any time — and there will be no legal recourse.

Fabricated Office Addresses and Contact Details

Another clear indicator of fraud is the fake contact information provided by Proxinex.com. The site lists impressive-looking global office locations, often in financial hubs such as London, Zurich, or Singapore. But when you dig deeper, none of these addresses correspond to real offices. They’re typically random buildings, co-working spaces, or even residential complexes unrelated to the company.

Phone numbers often go unanswered, and email responses — if any — come from generic customer service accounts that use scripted messages. Once a victim deposits funds, communication becomes sporadic, manipulative, or outright hostile.

This anonymity is intentional. It prevents victims from identifying or locating the people behind the operation.

The Sales Funnel: How Victims Are Targeted

Proxinex.com doesn’t rely on chance to find victims; it uses an aggressive marketing funnel designed to attract inexperienced traders. The process typically unfolds in three stages:

-

Attraction Through Ads and Fake Testimonials

Proxinex runs deceptive social media ads, often using stock images of luxury lifestyles, testimonials from “successful traders,” or even fake celebrity endorsements. These ads promise quick profits and financial independence. -

Contact by ‘Account Managers’

After signing up, victims are contacted almost immediately by so-called “account managers” or “financial advisors.” These individuals speak confidently, using financial jargon to appear professional. Their goal is to persuade victims to make an initial deposit, usually around $250–$500. -

Trust Building and Upselling

Once the victim invests, the representative continues to build trust. They show fabricated trading profits on the Proxinex platform, leading the victim to believe their investment is growing. Soon after, they encourage larger deposits, claiming that “upgrading to higher tiers” or “trading with expert support” will yield even greater returns.

The Fake Trading Interface

The trading dashboard provided by Proxinex.com looks sophisticated but is nothing more than a digital illusion. The graphs, price movements, and profit figures displayed are artificially generated by the platform’s backend system. No real trading takes place.

Investors believe they are watching their money grow, but the “profits” they see are pre-programmed to increase gradually, creating a false sense of success. This illusion encourages victims to invest more.

In reality, their funds are never traded — they’re transferred directly into the scammers’ accounts.

The Withdrawal Nightmare

Everything changes once an investor tries to withdraw their money. Initially, small withdrawals may be allowed, often just to build trust. But once a user requests a significant withdrawal — especially of profits — the obstacles begin.

Victims report being asked to:

-

Pay “tax clearance” or “withdrawal fees” before funds can be released.

-

Provide additional identification documents, prolonging delays.

-

Make new deposits to “unlock” the withdrawal feature.

These demands are nothing but stalling tactics. Once the scammers believe they can no longer extract money, they stop responding altogether. In many cases, Proxinex disables the user’s account, blocks access to the platform, or even deletes the account entirely.

Psychological Manipulation and Control

The people behind Proxinex.com are not amateur scammers — they are experts in psychological manipulation. Their goal is to make the victim emotionally dependent on the supposed “advisor.” They use charm, empathy, and persuasion to build trust, then pivot to guilt, urgency, and fear to pressure further deposits.

Common manipulation tactics include:

-

Creating urgency: “You need to act now — this trading window closes today.”

-

Guilt-tripping: “I’ve worked hard to get you this opportunity; don’t waste it.”

-

Authority pressure: “As your account manager, I strongly recommend increasing your stake.”

Over time, the victim becomes emotionally invested, making it even harder to accept the reality that they’ve been deceived.

Fake Reviews and Online Reputation Laundering

To maintain credibility, Proxinex.com floods the internet with fake reviews and testimonials. These are written by paid content farms or automated bots and appear on blogs, comment sections, and social media pages.

The fake reviews usually share identical phrasing such as:

-

“Proxinex.com helped me achieve financial freedom!”

-

“Professional brokers and fast withdrawals — highly recommended.”

-

“I’ve made consistent profits every week since joining.”

At the same time, legitimate complaints from victims are often buried or deleted. Scammers sometimes even report genuine negative reviews as “spam” to hide their reputation.

No Real Customer Support

Proxinex.com pretends to have a professional customer support team, but in reality, the support system is part of the scam structure. The so-called “support representatives” only exist to pacify victims when they start to question the platform.

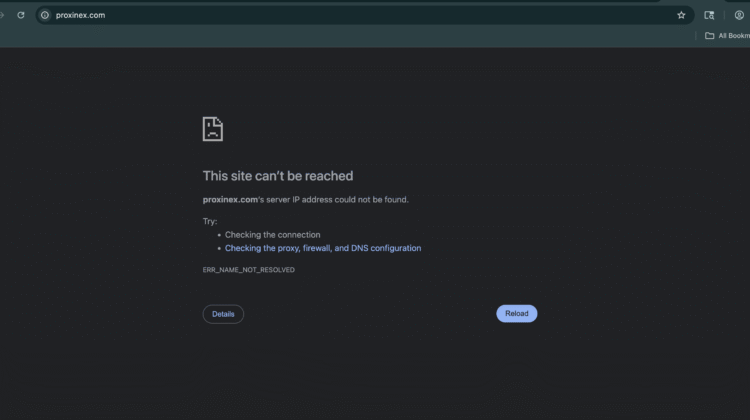

Their responses are generic, rehearsed, and designed to delay. Once the victim becomes too insistent or begins to demand answers, communication is cut off completely. Emails bounce, phone lines disconnect, and the platform often goes offline temporarily.

Stolen Identity and Data Misuse

The dangers of Proxinex.com extend beyond financial loss. During the sign-up process, the platform requests personal information and documents under the pretense of “KYC verification.” Victims often upload passports, ID cards, and proof of address.

This data is then exploited for further scams, sold to other criminal groups, or used to open fraudulent accounts. Victims may later experience unauthorized transactions or identity theft as a result.

The Rebranding Cycle

One of the most deceptive strategies used by scams like Proxinex.com is rebranding. Once a site begins to attract too many complaints or negative attention, the operators simply abandon it and launch a new one under a different name.

They reuse the same website design, same scam structure, and even the same fake testimonials. Past examples have included platforms with similar structures that vanished overnight — only to reappear weeks later under a new name with slightly altered branding.

The Real Cost for Victims

Behind the statistics are real people who’ve lost not just money but emotional stability. Many victims of Proxinex.com are ordinary individuals — retirees, small business owners, and parents seeking additional income. The losses range from hundreds to tens of thousands of dollars.

Victims often report deep shame and psychological distress after realizing they were manipulated. Some describe being unable to trust legitimate financial institutions afterward. The emotional damage caused by Proxinex’s deceitful practices can last long after the financial loss itself.

A Classic Scam Blueprint

Proxinex.com fits the same mold as dozens of other fraudulent investment platforms that have surfaced in recent years. The core pattern remains identical:

-

A sleek, professional-looking website.

-

Fake claims of regulation and security.

-

Unrealistic promises of consistent profits.

-

Manipulative “account managers.”

-

Fabricated trading dashboards.

-

Obstructed withdrawals and sudden disappearances.

It’s a formula that has defrauded thousands of people worldwide, and Proxinex.com is simply one more name in that long list of financial predators.

End Note

Everything about Proxinex.com — from its fake credentials and fabricated trading activity to its psychological manipulation and withdrawal delays — reveals it as a fraudulent operation. There is no evidence of real trading, no transparency, and no legitimate oversight.

The platform exists solely to trick people into depositing funds and then vanishes when those funds are gone. Its operators hide behind anonymity, fake identities, and rebranded domains, leaving victims empty-handed and disillusioned.

No matter how convincing the website looks or how persuasive the so-called advisors sound, Proxinex.com is not a real investment firm. It is a calculated scam built to exploit trust and greed.

Conclusion: Report Proxinex.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Proxinex.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Proxinex.com , extreme caution is advised.