RiseProfitFX.com Review : Fake Brokerage Platform

Introduction

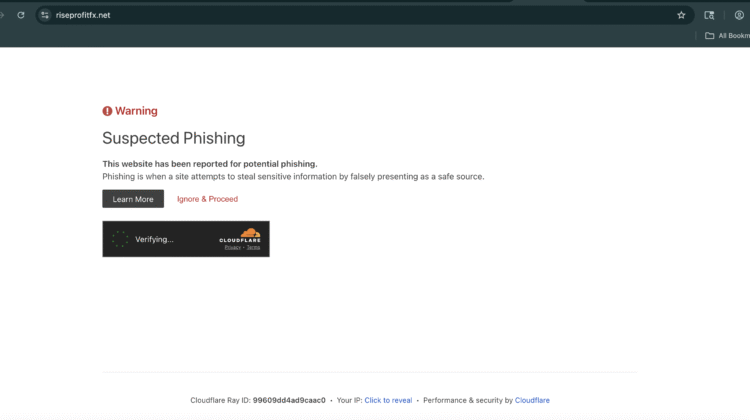

The online trading boom has produced countless legitimate brokers — and just as many clever frauds that copy professional language, polished UIs, and investor-seducing promises. RiseProfitFX.com is one of those operations: a glossy website and slick marketing wrapped around a simple business model — take deposits, show fake profits, block withdrawals, and disappear. This review breaks down, in plain language, how RiseProfitFX.com works, the psychological tricks it uses, the red flags to watch for, and why the platform is almost certainly a well-engineered scam.

1. The polished façade: professional design, empty substance

When you first land on RiseProfitFX.com homepage you’ll see everything designed to disarm suspicion: clean layout, animated charts, stock photos of “successful traders,” and confident language about “AI-driven algorithms” and “guaranteed returns.” The site often displays fabricated performance metrics and glowing testimonials from people who supposedly made life-changing gains.

That professional look is important — it creates the illusion of a regulated, sophisticated financial firm. But be skeptical: many fraudulent operators invest heavily in design precisely because it makes people stop asking questions. Under the surface there is usually little or no verifiable company information, no meaningful regulatory footprint, and no real trading infrastructure.

2. The irresistible pitch: unrealistic guarantees and magical algorithms

RiseProfitFX.com core sales pitch is familiar: specialized algorithms and expert managers produce steady, high returns with minimal effort from the user. Expect banners promising high weekly or monthly percentages, “guaranteed” profits, or “risk-free” starter packages.

Those claims are the ultimate red flag. Real markets are volatile; no legitimate broker guarantees returns. When a platform promises easy riches in a short timeframe, it’s not offering financial innovation — it’s selling wishful thinking.

3. How the scam recruits victims: the funnel

The recruitment process is engineered:

-

Paid ads & social media: Eye-catching promotions, often using stolen photos or fake celebrity endorsements to imply credibility.

-

Landing pages: Micro-sites that collect a name, email, and phone number in exchange for a “free demo” or “fast start.”

-

Instant outreach: Within minutes a “personal account manager” calls, messages via WhatsApp/Telegram, or invites you to a private chat. The agent is friendly, confident, and persuasive — and they follow a script designed to convert.

The initial deposit request is deliberately small (often $250–$500) to lower the barrier to entry. Once a user commits that first amount, the operators begin the next, more dangerous phase.

4. The fake trading dashboard: illusion of profits

After depositing, users are given access to a trading dashboard that looks convincingly real: live charts, open positions, win/loss reports, and an account balance that rises steadily. That “growth” is the scam’s engine.

The dashboard is a visual illusion. The numbers can be scripted to climb, positions can be simulated, and “executed trades” can be entirely fabricated. This faux success builds trust and encourages additional deposits — exactly what the scammers need.

Many victims report seeing small, timely “withdrawals” paid out early on. This is deliberate: a minor payout makes the whole system look legitimate and lures victims into investing much larger sums.

5. The pressure tactics: turning curiosity into escalation

Once a trader sees apparent gains, the account manager shifts tone. The friendly guide becomes a salesman:

-

“Upgrade to VIP to unlock higher returns.”

-

“There’s a market window — deposit now to not miss the surge.”

-

“Clients who invested more this month doubled their profits.”

These are classic high-pressure sales techniques: urgency, social proof, authority. Victims often escalate deposits into thousands or tens of thousands of dollars, convinced the platform is delivering real returns.

6. The withdrawal nightmare: fees, verification, delays

The scam’s reveal comes when the victim attempts to withdraw substantial funds. Typical obstacles include:

-

Requests for additional “verification fees,” “taxes,” or “processing charges.”

-

Claims that funds are “locked in an open position” or must meet a minimum trading volume before withdrawal.

-

Repeated delays and shifting timelines.

-

Sudden account freezes with vague “security” explanations.

Each excuse is engineered to extract even more money. People who pay these “fees” inevitably discover that the payments only deepen the problem: their money never returns, communications go silent, and the platform eventually goes offline.

7. Fake regulation and fabricated credentials

To appear safe, RiseProfitFX.com may display badges or cite registration numbers for well-known regulators. In practice those references are often:

-

Fabricated license numbers.

-

Logos copied from legitimate regulators.

-

License info that belongs to other companies.

Legitimate brokers provide verifiable registration details — a company name you can look up, a real office address, and a license number that matches the regulator’s public database. If that information is missing, inconsistent, or unverifiable, treat it as a major warning sign.

8. Identity and data risks

Beyond lost money, users who upload ID documents and financial details risk identity theft. Fraudsters commonly request passports, driver’s licenses, and bank statements under the pretense of “KYC” or “AML” checks. Once collected, that data can be abused, sold, or used in other criminal schemes — compounding the victim’s harm long after the broker vanishes.

9. The vanish-and-rebrand playbook

RiseProfitFX.com, like many fraudulent operators, typically follows a cycle:

-

Attract deposits and build a pool of victims.

-

Run the fake dashboard and escalate deposits.

-

Block withdrawals and require more fees.

-

When complaints rise or the operation becomes risky, shut down the site and abandon the brand.

-

Reappear under a new name with the same scripts, templates, and contact center.

This rebranding makes it hard to trace perpetrators and means new victims are always being targeted.

10. Clear red flags to watch for

You should be highly suspicious of any trading platform that shows one or more of the following characteristics:

-

Guaranteed or unusually high returns with little or no risk.

-

Aggressive outreach from “personal managers” after minimal contact.

-

No verifiable regulation or company registration.

-

Anonymous or hidden ownership and no real office address.

-

Pressure to deposit more and promises of exclusive “windows.”

-

Complex or changing withdrawal requirements (fees, volume minimums, tax payments).

-

Professional-looking dashboards that don’t match external market data.

-

Claims of celebrity endorsements or media features that can’t be independently confirmed.

Any one of these should be a dealbreaker; several together are a near-certainty that the platform is fraudulent.

11. The human cost

Beyond dollars and cents, scams like RiseProfitFX.com inflict emotional damage: shame, anger, and loss of trust. Many victims are ordinary people seeking better financial outcomes — retirees, wage earners, or small savers — who wind up worse off than before. The psychological impact can be long-lasting and is part of why these scams are so destructive.

12. Final verdict

RiseProfitFX.com exhibits the textbook behaviors of a fraudulent online broker: glossy marketing, unrealistic promises, a simulated trading interface, pressure to invest more, and systematic barriers to withdrawal. The combination of these tactics is not the outcome of incompetence — it’s the method of an organized scam operation.

If you encounter RiseProfitFX.com or a platform that mirrors the red flags described above, the prudent assumption is that it is dangerous. Protect your personal data, avoid further deposits, and treat any unverifiable broker with skepticism. In the online trading world, professionalism in design does not equal legitimacy — and when it comes to guaranteed profits and urgent deposit demands, the safest position is doubt.

Conclusion: Report RiseProfitFX.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, RiseProfitFX.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through RiseProfitFX.com , extreme caution is advised.