StratosLumex.com Exposed — A Deep Dive into a Red-Flagged Crypto Platform

Introduction

StratosLumex.com (appearing as domains like stratoslumex.com, stratoslumex.net, and related subdomains) presents itself as an algorithm-driven crypto trading and investment platform promising automated returns and “proprietary liquidity algorithms.” Over 2025 it has accumulated multiple public warnings, poor trust scores on site-checkers and a stream of user complaints. Below I unpack what the platform claims, how it operates in practice, the concrete red flags and why you should treat it with extreme caution.

What StratosLumex.com claims to be

On the surface, StratosLumex.com markets itself as a next-gen trading ecosystem: algorithmic execution, “managed teams,” OTC liquidity tools and guaranteed-ish returns for users who deposit crypto or fiat. The website language is polished and technical, leaning on buzzwords like “AI-driven pricing,” “custody ecosystem” and “liquidity management” to create an aura of legitimacy. Telegram and social channels associated with the name echo those claims and attempt to build social proof by posting performance snapshots and community messages.

Real-world actions: regulators and watchdogs have stepped in

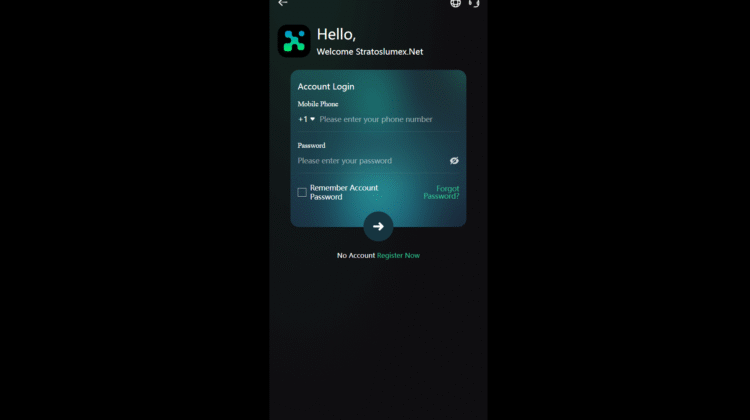

This is the first and strongest objective signal you should consider. Italy’s financial regulator (CONSOB) has explicitly identified websites using the StratosLumex.com branding and taken enforcement steps against them, describing the services offered through those sites as unauthorized and taking measures to block access for Italian users. The regulator’s resolution names the domains and describes how the platform allowed users to register, access a “reserved area” and make crypto purchases — the same basic flow used by many scam operations to onboard victims.

Independent site-safety scanners and reputation monitors also flag the platform with very low trust scores, describing multiple indicators consistent with fraudulent or high-risk websites (hidden ownership, suspicious hosting, short domain age, presence on spam/phishing lists). Community review sites and user complaint threads likewise show strongly negative ratings and firsthand reports of blocked withdrawals and customer-support silence.

How the funnel works

Based on public reports and complaints, a typical interaction looks like this:

-

Attraction & onboarding: Users find attractive ads or are recruited through social media/Telegram channels that promise algorithmic returns and “managed” trading accounts.

-

Pressure to deposit: After registration, the platform offers deposit incentives, sometimes tiered packages that claim to unlock higher returns and “priority” managers.

-

Dashboard illusions: The user dashboard shows simulated P&L, apparent trades and increasing balances — a classic technique to encourage larger deposits.

-

Withdrawal friction: When users try to withdraw, they encounter delays, excuses, or requirements to make additional “verification” or “service” payments. Complaints describe blocking, disappearing support channels and frozen accounts.

These steps are hallmarks of many investment frauds: early signals of fabricated returns and engineered obstacles to getting money back.

Concrete red flags you can’t ignore

-

Regulatory action: CONSOB’s action to order blocking and name the domains is a major, verifiable signal — regulators don’t act without complaints and evidence. Regulatory intervention changes the conversation from “be careful” to “this entity is actively being treated as unauthorized.”

-

Very low trust scores from multiple scanners: Several website-safety services assign very low trust scores to StratosLumex.com domains. Those algorithms look at hosting history, domain age, SSL/certificate anomalies, WHOIS privacy and presence on abuse lists — converging indicators that the site is risky.

-

User reports describing the same failure modes: Multiple user reviews and social posts report the same pattern: deposits accepted, withdrawals delayed or refused, and unresponsive support. When independent users report the same problems across platforms, the pattern is more credible.

-

Marketing that leans heavily on buzzwords and opacity: Overuse of technical jargon (AI, algorithms, OTC custodian) without clear, independently verifiable technical documentation or audited claims is a classic social-engineering tool. It’s used to overwhelm nontechnical readers and create fake credibility.

-

Multiple domain variations and subdomains: The presence of several similar domains and subdomains (for example, stratoslumex.com, stratoslumex.net, h5.stratoslumex.com) is typical for operations that try to recover quickly after takedown or to split services across different endpoints to avoid traceability.

The playbook — why this is likely a Ponzi-like or exit-scam operation

Putting the signals together gives us a reasonable hypothesis about the platform’s business model and intent:

-

The platform appears to rely on new deposits to keep the dashboard numbers “looking” healthy.

-

Early users (if any) may have been paid small withdrawals to build trust and attract bigger deposits — the classic Ponzi carrot.

-

Once inflows slow or regulators begin blocking access, withdrawals are restricted and support evaporates, leaving most depositors unable to retrieve funds.

-

The use of attractive but vague technical claims (algorithms, custodial systems) provides plausible-sounding cover for what is primarily an onboarding-and-extracting scheme.

Signs that differentiate scams from legitimate services

If you’re trying to tell the difference between a true crypto provider and a scam, look for:

-

Clear regulatory status (licensed entity, registration numbers you can verify).

-

Transparent teams with verifiable identities and professional track records.

-

Third-party audits and custody arrangements with names of custodians you can confirm independently.

-

Independent community feedback on reputable forums (not just Telegram or Facebook groups where the operator controls comments).

StratosLumex.com shows none of these positive markers at scale; instead, the balance of evidence points in the other direction.

Tone and takeaway

This is not a “maybe” or “watch this space” situation — the combination of regulator action, poor trust scores and repeated user complaints moves StratosLumex.com into the category of a high-risk, likely fraudulent operation. If you’re reading marketing material from the platform, treat it as advertising-only content: slick claims backed by hype do not equate to a real, verifiable business model.

Final verdict

StratosLumex.com exhibits multiple, independent warning signs commonly present in Ponzi-style or exit-scam crypto platforms: regulatory blocking and mention by a national regulator, automated safety services flagging the domains, repeated user complaints about withdrawals, and opaque marketing that leans on jargon rather than verifiable facts. Taken together, those signals create a strong case that the platform is not a safe place to deposit money.

If you value evidence-based assessment, the items above — regulator action and multiple independent safety signals — are the strongest reasons to treat StratosLumex.com with extreme distrust.

Conclusion: Report StratosLumex.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, StratosLumex.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through StratosLumex.com , extreme caution is advised.