Traydai.org Review : Suspicious Investment Platform

Introduction

In today’s online investing world, new trading and asset-management platforms appear almost daily. Some introduce innovative tools, while others operate with questionable transparency, leaving users frustrated and confused. One name that has circulated in various discussions is “Traydai.org,” a platform some users have described as suspicious due to experiences they claim to have had while attempting to trade or invest. While these claims remain unverified, the pattern of complaints attributed to the platform makes Traydai.org an interesting case study in how online trading platforms can appear legitimate on the surface yet still display red flags that concern users.

This review does not confirm wrongdoing. Instead, it examines the behaviors, structures, and communication patterns commonly associated with platforms users label as fraudulent, using the reported concerns around Traydai.org as a reference point. The goal is to give readers a detailed, in-depth analysis of the type of warning signs that may lead people to question a platform’s credibility, and to help potential users understand how such situations unfold.

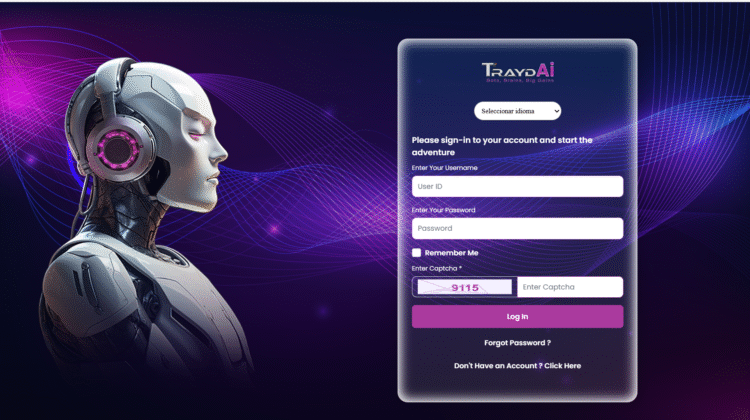

1. First Impressions: The Surface-Level Appeal

According to user descriptions, Traydai.org presents itself as a sleek and modern trading platform. Many platforms that later raise suspicion often share similar traits:

-

Professionally designed websites

-

High-quality graphics depicting financial success

-

Language emphasizing simplicity, fast profits, or beginner-friendly tools

-

Claims of advanced algorithms or expert teams

-

Testimonials showcasing extraordinary returns

At first glance, descriptions of Traydai.org suggest it fits neatly into this category. A polished exterior can create an aura of legitimacy, making new users feel comfortable depositing funds. However, visual appeal alone never guarantees trustworthiness. Scammers often invest heavily in presentation because appearance is one of the most effective tools to win confidence quickly.

The contrast between a platform’s sleek interface and the issues users later report is often the first sign that something is amiss.

2. Registration and Onboarding: Too Good to Be True?

Another pattern frequently noted in user discussions about Traydai.org is the ease of signing up and the almost immediate follow-up communication. Many users describe how quickly they were contacted, often within minutes, by someone claiming to be an account manager or trading specialist.

Rapid, high-pressure onboarding is a common trait of questionable platforms. The initial representative may be friendly, enthusiastic, and knowledgeable. They may present themselves as personally invested in the user’s financial success and claim to guide them every step of the way. These interactions can feel reassuring at first—but they also cultivate dependency.

Some users say they were encouraged to deposit funds immediately, often with the explanation that “market windows” or “special opportunities” were closing soon. While this tactic can exist in legitimate environments, in the context of suspicious platforms it may be used to create urgency and reduce the time individuals spend researching or reconsidering.

3. Early Profits: The Illusion of Success

Many reviewers who have shared their experiences with platforms they later believed to be scams often report a similar pattern: initial profits that appear quickly and effortlessly. These small early gains may be reflected within the platform’s dashboard but do not necessarily represent real trading activity.

Some Traydai.org users reportedly saw their account balances increase shortly after making their first deposits. This pattern often serves two purposes:

-

Build Trust – When users see numbers rising, they naturally feel more confident in the platform.

-

Encourage Additional Deposits – Once early success is shown, representatives may suggest reinvesting or adding more funds to “maximize growth.”

This psychological reinforcement can be powerful. Users begin to believe the platform’s system works exceptionally well and that they have discovered a unique opportunity. In many suspicious cases, early profits are merely simulated figures programmed into the platform interface rather than actual market gains.

4. Communication Shifts: From Friendly to Forceful

One detail commonly mentioned when users discuss platforms they believe are fraudulent is the noticeable shift in communication tone. Early on, representatives may be patient and supportive. But once deposits slow down or withdrawal requests begin, the tone often changes dramatically.

Users who describe interactions with Traydai.org representatives report patterns such as:

-

Repeated calls urging additional deposits

-

Pressure to upgrade to higher-tier accounts

-

Frequent mention of “time-sensitive opportunities”

-

Emotional manipulation, such as suggesting the user is missing out

-

Dismissiveness when users express uncertainty

This shift is not always immediate, but once it occurs, the supportive tone may be replaced with insistence and even irritation. It becomes clear that communication is driven primarily by the goal of increasing deposits rather than helping users trade effectively.

5. Withdrawal Complications: The Breaking Point

The most critical factor in determining whether a platform is trustworthy is the withdrawal process. In reports about platforms perceived as scams, this is where issues typically begin.

User claims about Traydai.org frequently include scenarios such as:

-

Requests for additional verification documents beyond what was originally required

-

Delays with vague explanations

-

Appeals stating that certain trades must first be completed

-

Claims that withdrawals require paying a tax, fee, or margin before funds can be released

-

Account managers becoming unresponsive or evasive

These issues follow a consistent pattern seen across many suspicious trading operations. A legitimate platform might require verification or impose reasonable withdrawal limits, but it would not repeatedly invent new obstacles or demand extra payments before releasing user funds.

When a withdrawal becomes impossible or endlessly delayed, users often realize that the profits shown on the screen were meaningless numbers—not actual gains they can access.

6. The Psychological Pattern: A Common Cycle

In analyzing user reports about Traydai.org and similar platforms, a clear psychological pattern emerges:

1. Attraction

A professional website and promises of simplicity draw the user in.

2. Validation

A friendly representative and simulated profits build the illusion of success.

3. Investment

The user deposits more funds, feeling optimistic and reassured.

4. Pressure

Communication intensifies as the platform pushes for increasingly larger deposits.

5. Realization

Withdrawal issues expose the platform’s true nature.

6. Frustration

Attempts to resolve the issue lead nowhere, and communication often stops.

This emotional roller-coaster is not unique to any one platform; it represents the structure many questionable operations use to capitalize on trust, optimism, and inexperience.

7. What Makes a Platform Appear Suspicious?

The user-reported concerns about Traydai.org match a number of well-known warning signs:

-

Lack of verifiable regulatory information

-

Difficulty withdrawing funds

-

Aggressive or manipulative sales tactics

-

Unusual fees or unexpected charges

-

Overly positive initial results

-

Unresponsive or evasive customer service

It’s important to clarify again that these descriptions do not confirm that Traydai.org itself engages in wrongdoing, but they do represent the types of behaviors that raise concern within the trading community.

8. The Broader Pattern Among Questionable Platforms

Platforms that users later describe as scams often share deeper structural traits:

1. No Transparent Ownership

Websites may omit details about the company’s physical location, legal registration, or leadership team.

2. No Independent Reputation

There may be few or no credible third-party reviews beyond suspiciously glowing testimonials.

3. Overuse of Marketing Buzzwords

Common phrases like “AI trading,” “guaranteed profits,” or “expert-managed portfolios” appear frequently.

4. Reliance on Direct Calls

User reports often mention heavy outreach by supposed account managers.

5. A Shadowy Operational Structure

Terms and conditions may be vague, unclear, or frequently updated without notice.

When multiple such traits appear together, potential users often take it as a sign that the platform should be approached with caution.

9. Final Thoughts: A Case Study in Caution

Traydai.org serves as a strong case study for the types of concerns that arise when users interact with platforms that present themselves as trading or investment solutions but behave in ways that raise doubt. Whether or not the platform is genuinely fraudulent cannot be confirmed here, but the consistent themes within user discussions highlight warning signs anyone should recognize.

By evaluating platforms through the lens of transparency, communication quality, regulatory oversight, and withdrawal reliability, individuals can better navigate an online landscape filled with both legitimate opportunities and suspicious operations.

In the end, the experiences attributed to Traydai.org —rapid onboarding, simulated gains, high-pressure sales behavior, and withdrawal barriers—reflect a pattern worth studying carefully. Users deserve platforms that value transparency, respect, and accountability. Any service that fails these basic standards, regardless of name, warrants scrutiny.

If more traders take the time to analyze these red flags early, far fewer will find themselves caught in situations that leave them confused, frustrated, or financially strained.

Conclusion: Report Traydai.org Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Traydai.org raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Traydai.org , extreme caution is advised.