Wefunder.com Review : Critical Look at the Risky Platforms

Introduction

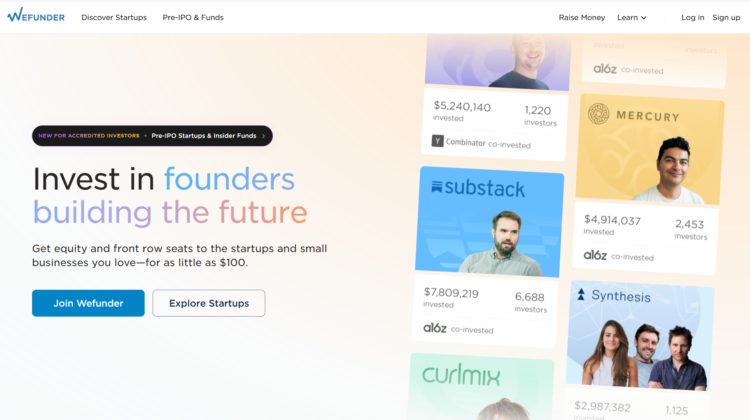

Equity crowdfunding has exploded in popularity over the past decade, giving everyday people access to early-stage investment opportunities that were once limited to accredited investors. Among the biggest names in this space sits Wefunder.com, a crowdfunding portal known for offering investment access to hundreds of startups, community projects, and entrepreneurial ventures.

Although Wefunder.com is a legitimate, regulated platform, many investors have described experiences that left them frustrated, disappointed, or financially blindsided. Some users go so far as to say the platform “felt like a scam,” not because the site itself is illegal, but because crowdfunding carries structural risks and psychological traps that many beginners don’t fully understand until it’s too late.

This review takes a critical, caution-heavy look at Wefunder.com: its model, its shortcomings, the types of problems commonly reported by investors, and why the platform can create a “scam-like” feeling for those who aren’t prepared for the realities of startup investing.

The Illusion of Accessibility

One of Wefunder.com biggest selling points is its promise to democratize investing. With modest minimum investments, everyday people can suddenly participate in startup funding rounds that look exciting, polished, and full of potential.

However, this accessibility comes with an under-discussed flaw:

Most non-accredited investors don’t have the experience needed to properly evaluate risky early-stage companies.

On the surface, campaigns often appear convincing. They feature:

-

slick videos

-

compelling founder stories

-

polished pitch decks

-

projections that show enormous upside

But what many new investors overlook is the statistical reality:

the vast majority of startups fail—often quietly, without updates, without liquidity, and without accountability.

This mismatch between marketing presentation and statistical outcome is one of the main reasons some Wefunder.com investors feel burned.

A Marketplace Where Optimism Overshadows Reality

Another recurring criticism is that campaigns on Wefunder.com tend to emphasize:

-

extraordinary growth potential

-

big promises of disruption

-

emotionally charged narratives

-

ambitious, optimistic forecasts

But rarely do they provide equal weight to:

-

failure rates

-

risk factors

-

financial weaknesses

-

operational shortcomings

-

realistic probability of return

Investors often assume that a project featured on a well-known platform must have undergone a rigorous vetting process. But equity-crowdfunding platforms generally do not conduct deep due diligence. Their purpose is to facilitate fundraising, not to guarantee sound investment opportunities.

This misunderstanding fuels disappointment when ventures underperform or collapse.

Startup Failure Feels Like Getting Scammed — Even When It Isn’t

Startups fail all the time, but when they fail after raising money from everyday investors, the emotional impact is much harsher. On Wefunder.com, many frustrated investors describe:

-

founders going silent

-

companies sending vague or infrequent updates

-

disappearing social media pages

-

broken communication channels

-

pivots that dramatically alter business direction

-

the complete lack of liquidity for years

While none of this is illegal, it creates the feeling of being misled, especially for new investors who weren’t aware that this level of uncertainty is normal in early-stage investing.

The Illusion of Community Oversight

Wefunder.com markets itself as community-driven, implying that the collective participation of thousands of small investors creates a kind of decentralized scrutiny.

But this “crowd wisdom” can be misleading.

In reality:

-

most investors are inexperienced

-

many decisions are driven by emotion, not analysis

-

popularity snowballs once a campaign gains momentum

-

early investors often influence others through enthusiastic comments

As a result, a mediocre or high-risk venture can end up raising large sums simply because of group psychology, not merit. When those investments crash, participants often feel like they were caught in a hype cycle.

Campaign Pages Are Still Marketing — Not Independent Analysis

Although Wefunder.com requires companies to provide certain disclosures, campaign pages are fundamentally marketing tools. Companies choose what to highlight, how to frame their story, and what metrics to emphasize.

Common issues include:

-

cherry-picked financial data

-

overly optimistic customer projections

-

inflated market-size claims

-

slick branding that masks weak fundamentals

-

founder charisma overshadowing due diligence

While everything may technically comply with regulations, inexperienced investors often underestimate how skillfully startups craft their public image.

A Serious Lack of Liquidity

One of the biggest shocks for newcomers is how locked-up their money becomes.

On Wefunder.com:

-

Shares cannot be easily sold

-

There is no secondary market

-

Investments may be illiquid for 5–10 years

-

Many companies vanish quietly without formal dissolution

-

Some provide almost no updates after raising funds

This illiquidity—combined with poor communication—leads investors to feel abandoned or deceived.

Communication Issues Amplify Investor Frustration

A common complaint across many crowdfunding platforms is the deterioration of communication after funding closes. Investors often describe:

-

months with no updates

-

founders ignoring messages

-

vague explanations for missed milestones

-

“updates” that are promotional rather than informative

Wefunder.com itself does not enforce strict communication schedules, which means investors are at the mercy of each company’s willingness to engage. When silence sets in, the experience can feel indistinguishable from being scammed, even if the cause is merely poor management or an overwhelmed founder.

The Emotional Roller Coaster of Startup Hype

One underappreciated risk of platforms like Wefunder.com is the emotional manipulation inherent in startup storytelling. Campaigns often use:

-

aspirational branding

-

personal narratives

-

underdog imagery

-

social-impact messaging

-

high-energy promotional videos

This creates emotional buy-in — which can cloud judgment and lead investors to overlook critical weaknesses.

When the investment later performs poorly, people feel deceived, even if the founders never explicitly misled them. The disappointment stems from emotional expectations, not contractual guarantees.

Regulations Protect the Platform — Not the Investor

Because Wefunder.com is a regulated portal operating under crowdfunding laws, it must follow specific rules. But those rules are designed:

-

to allow fundraising

-

to define disclosures

-

to protect the platform from liability

They do not guarantee that an investment is sound.

Wefunder.com does not promise returns, profitability, or long-term diligence for any company raising on its site. Once the campaign ends, investors are effectively left in the hands of the founders — and the platform has little involvement thereafter.

For newcomers, this can feel like a bait-and-switch: the platform plays a major role in presenting the opportunity, but a minimal role in what happens afterward.

Why Some People Call It “Scam-Like” — Even Though It Isn’t a Scam

To summarize, people who invest on platforms like Wefunder.com sometimes walk away feeling “scammed” because:

-

They underestimate the true risk of startup investing.

-

Companies often fail quietly, leaving investors with nothing.

-

Campaign pages look highly professional and persuasive.

-

Founders may stop communicating after raising funds.

-

There is no liquidity, sometimes for a decade or more.

-

The emotional marketing feels misleading once reality sets in.

These factors create an experience that can feel like a scam to people expecting transparency, speed, and accountability typical of public-market investing.

Final Thoughts: A Platform Full of Risk, Not a Guaranteed Opportunity

Wefunder.com is not a scam—but it is a platform where inexperienced investors can easily get in over their heads. The combination of high failure rates, persuasive marketing, emotional narratives, limited oversight, and illiquidity creates an environment in which many users end up feeling misled or burned.

The platform functions legally and within regulatory frameworks, but legality doesn’t erase the risks or the emotional sting of losing money on ventures that once seemed full of promise.

Before participating in any equity-crowdfunding campaign, investors must understand: this is gambling with a business façade. Only money you can afford to lose should ever be invested, and expectations must be grounded in the reality that most startups never achieve their ambitions.

Conclusion: Report Wefunder.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Wefunder.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Wefunder.com , extreme caution is advised.