Wefunder.com Scam : Risks of Equity Crowdfunding

Introduction

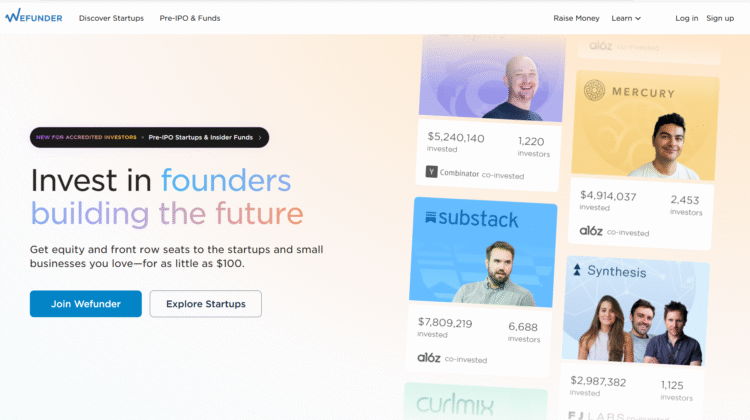

Equity crowdfunding has transformed the way everyday people access early-stage investing. Platforms like Wefunder.com have become digital meeting grounds for founders in search of capital and investors hunting for high-risk, high-upside opportunities. With a sleek interface, an active pipeline of startups, and an accessible barrier to entry, Wefunder.com has positioned itself as one of the most recognizable names in the regulated crowdfunding space.

But visibility does not equal universal approval. While Wefunder.com operates legally under U.S. crowdfunding regulations, it has attracted a noticeable volume of criticism, concerns, and confusion from investors who did not fully understand the nature of startup investing before participating. These concerns often circulate online and can lead people unfamiliar with the platform to wonder whether they are dealing with a legitimate opportunity or a risky ecosystem that can easily be misinterpreted.

This article examines the major concerns, perceived red flags, misunderstandings, and user-reported frustrations surrounding Wefunder.com. The goal is not to label the platform as illegitimate, but to unpack why some investors walk away dissatisfied and why the experience can feel riskier than many anticipate.

1. The Illusion of Accessibility: Why Ease Can Be Misleading

One of Wefunder.com major selling points is accessibility. Investors can browse dozens of companies, evaluate pitch decks, and invest small amounts with just a few clicks. For individuals accustomed to retail stock platforms, this may feel like investing in a normal publicly traded company.

This sense of familiarity is where many misunderstandings begin.

Early-stage startup investing is fundamentally different from traditional investing in almost every way:

-

You are buying into companies that often have limited revenue, untested business models, or incomplete financial histories.

-

Most startups will fail or remain too small to produce meaningful investor returns.

-

Crowdfunded investments can stay illiquid for years or indefinitely.

-

Even if a company succeeds, the early equity or notes offered to small investors might not convert or pay out as expected.

Because Wefunder.com interface is modern, simple, and highly marketable, some investors later report feeling blindsided by how risky the underlying investments were. This mismatch between presentation and reality is one of the most commonly voiced frustrations.

2. Startup Failure Rates: The Hard Truth Some Investors Learn Too Late

A key point of tension between platforms like Wefunder.com and users is the statistical likelihood of failure.

Historically:

-

The majority of startups never produce investor returns.

-

Most either shut down, get acquired at low valuations, or stagnate for years.

-

High-profile successes are rare outliers.

These patterns are normal in venture capital, but retail investors seeing flashy pitches and enthusiastic founders may assume greater safety or upside than what the odds support.

As a result, some users who lose their investment — which is common in this asset class — later view the platform itself as the problem rather than the inherent nature of startup risk.

The platform facilitates the investment, but the risk belongs to the startup. Yet perception often blurs that line, leading to allegations of unfairness or disappointment.

3. The Marketing Language: Confidence vs. Certainty

Many investors cite concerns about how startups present themselves on Wefunder.com pages. Crowdfunding campaigns frequently use promotional language, ambitious forecasts, inspiring storytelling, and optimistic projections. To someone accustomed to public stock disclosures and conservative financial statements, these pitches can feel exaggerated.

Some commonly criticized issues include:

-

Future revenue projections that feel unrealistic

-

Marketing claims that are hard to verify

-

Overly optimistic descriptions of market size or competitive advantage

-

Lack of clear data supporting the pitch

Wefunder.com, like other regulated portals, requires basic disclosures, but it does not guarantee that projections will come true or that founders will deliver on their promises. Some investors misunderstand this and interpret overly enthusiastic pitches as misleading or exaggerated.

This is not the platform’s misconduct, but the nature of startup fundraising — where enthusiasm, aspiration, and storytelling are part of the culture.

4. Illiquidity and Long Holding Periods: The Hidden Frustration

One of the largest user frustrations relates to liquidity, or rather, the lack of it.

Once you invest in a startup:

-

You generally cannot sell your stake.

-

There is no secondary market for most crowdfunded shares.

-

You may wait 5–10 years for any possible return.

-

Many companies never reach an exit event, leaving shares permanently stagnant.

Investors who enter expecting a timeline similar to stock trading or crypto trading often feel trapped. Some describe their Wefunder.com investments as “frozen,” “dead,” or “never moving.”

This leads to sentiments of being misled, even though illiquidity is explicitly part of startup investing.

The frustration is understandable when expectations and reality diverge sharply.

5. Communication Issues: Silence From Startups After Funding

Another widespread complaint is not about Wefunder.com itself, but about the startups funded through it. Many small investors expect consistent communication or operational updates after investing. In reality, most startups go silent for long stretches, and some never provide meaningful updates at all.

Common investor complaints include:

-

Updates stopping shortly after fundraising closes

-

Founders becoming unreachable

-

No clear reporting on how funds were used

-

Lack of financial transparency

This creates a perception of abandonment, especially for new investors who expect a level of accountability that early-stage companies typically do not maintain.

It is not uncommon to see disappointed users describe their experience in strongly negative terms, interpreting silence as wrongdoing rather than normal startup behavior.

6. Complex Financial Instruments: SAFE Notes and Confusion

Many first-time investors misunderstand the instruments they are buying. Wefunder.com campaigns often use SAFE notes, convertible notes, or restricted equity units that function very differently from conventional shares.

Common sources of confusion include:

-

SAFEs may never convert if the startup does not raise future funding.

-

Convertible notes may have thresholds or conversion triggers that investors don’t fully grasp.

-

Crowdfunded investors may have no voting rights.

-

Some agreements dilute early backers if new rounds occur.

These complexities become flashpoints for investor dissatisfaction. People sometimes assume they are buying stock with immediate ownership rights, only to discover that their actual rights and outcomes depend on future events that may never occur.

7. Founder Reliability: When Campaign Promises Don’t Materialize

Some of the most intense criticisms arise when a funded startup:

-

Fails to launch the promised product

-

Takes far longer than expected to deliver results

-

Experiences internal problems

-

Changes business direction

-

Runs out of money quickly

In these situations, investors sometimes blame Wefunder.com even though the platform does not operate the startups and does not manage their funds after the raise.

Yet it is easy to see why people feel betrayed — when expectations are high and communication is sparse, disappointment turns into distrust.

8. The Real Risk: Misunderstanding the Nature of Startup Investing

Many negative experiences on Wefunder.com can be traced to one core misunderstanding:

People expect startup investing to behave like traditional investing.

In reality:

-

Losses are normal.

-

Returns are rare.

-

Communication is minimal.

-

Illiquidity is expected.

-

Legal rights are limited.

-

Outcomes are uncertain.

When investors internalize these realities, the platform feels like a risky but understandable environment. When they don’t, it feels like a trap — even though the risk was inherent from the start.

Final Thoughts: Not a Scam, But Far From Simple

Wefunder.com itself is a legitimate regulated portal, but the experience of startup investing can feel harsh, confusing, or disappointing for those unfamiliar with its realities. Many criticisms come from a mismatch between investor expectations and the nature of early-stage entrepreneurship.

The platform’s role is to facilitate deals, not to guarantee outcomes. The startups themselves determine whether an investment succeeds or fails — and most will fail.

A careful, informed, and highly skeptical approach is essential for anyone entering the world of equity crowdfunding. Platforms like Wefunder.com open the door, but investors are responsible for walking through it with eyes wide open.

Conclusion: Report Wefunder.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, Wefunder.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through Wefunder.com , extreme caution is advised.