XProMarkets.com Review : Scam Investment Platform

Introduction

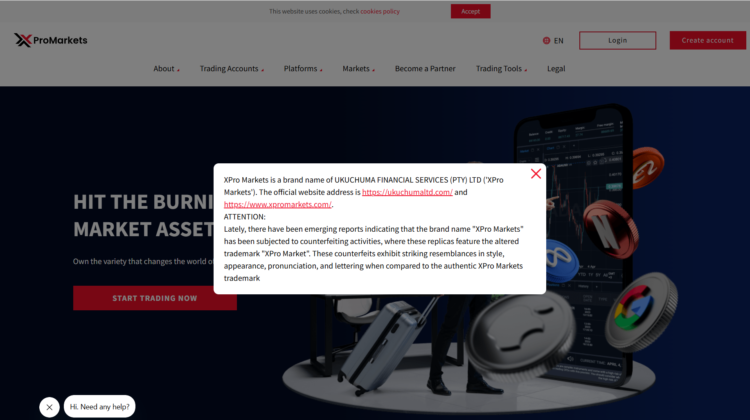

When evaluating any online trading service, especially one that operates in the high-risk world of forex and CFDs, it’s crucial to go beyond the marketing promises and take a careful look at user experiences, complaints, operational transparency, and overall business practices. XProMarkets.com is one such platform that has triggered heated discussions across various trading communities. Some individuals online describe negative experiences, express frustration with withdrawals, or raise concerns about platform behavior. Others remain uncertain, unsure whether their difficulties stem from the platform itself or simply the volatile nature of leveraged trading.

This review does not declare XProMarkets.com a scam; instead, it presents a comprehensive analysis of common grievances, structural risks, and warning signs that potential users should be aware of before depositing funds. Understanding these issues can help traders make informed decisions and protect themselves from avoidable financial stress.

1. Understanding the Appeal of Platforms Like XProMarkets.com

Many platforms catering to retail traders present themselves as modern, user-friendly gateways into global markets. XProMarkets.com appears to follow this pattern, highlighting features such as access to forex pairs, indices, commodities, and CFD-based instruments. The allure comes from:

-

Low entry requirements

-

High leverage options

-

Slick platforms that resemble professional trading terminals

-

Promises of market accessibility for “everyday traders”

For newcomers searching for their first trading venue, these features can be enticing. Yet the very elements that make such platforms attractive can also introduce significant risks if not backed by strong regulatory protections and transparent operational practices.

2. The Most Common Complaints Reported by Users

Across various online discussions, traders have shared a range of negative experiences. While individual stories cannot be verified universally, the consistency of certain complaint themes warrants attention. Below are the most common:

a. Withdrawal Difficulties

One of the most frequently mentioned red flags in negative reviews involves delayed withdrawals or confusion surrounding withdrawal procedures.

Typical user frustrations include:

-

Requests for repeated identity checks after funds are requested

-

Claimed “processing issues” extending for days or weeks

-

Unexpected fees or minimum withdrawal thresholds

-

Being asked to trade more before funds can allegedly be released

While delays can sometimes occur for legitimate regulatory reasons, the persistence of these complaints across many retail-trading platforms raises important consumer-protection questions. Legitimate brokers usually highlight clear withdrawal policies, maintain efficient timelines, and avoid imposing opaque conditions on accessing deposited funds.

b. Aggressive Account Management Tactics

Another reported pattern involves frequent contact by account managers or “trading consultants.”

Users often describe:

-

Persistent calls encouraging larger deposits

-

Pressure to upgrade account types

-

Suggestions to trade more aggressively

-

Emotional persuasion linked to market opportunities

In regulated environments, account managers are typically restricted from giving personalized trading advice or pressuring clients financially. Where such behavior is alleged, it can be a sign that a platform operates with sales-driven priorities rather than client-centric ones.

c. Sudden Losses or Unexpected Trades

Some traders claim that positions close unexpectedly or that stop-losses behave irregularly. Since leveraged trading is naturally risky, losses alone do not indicate wrongdoing. However, patterns of unresolved technical disputes may signal that a platform is not providing transparent execution or reliable reporting.

A credible trading service should offer:

-

Clear logs

-

Stable platform performance

-

Detailed explanations when traders request support

Complaints of vague or incomplete answers deserve scrutiny.

d. Difficulty Contacting Customer Support

A trustworthy financial service prioritizes responsive communication. Yet many negative reviews mention:

-

Long queues

-

Slow email replies

-

Inconsistent answers between different support agents

-

Support teams redirecting questions rather than resolving them

While occasional support delays happen, ongoing communication issues can significantly erode trust—especially when money is involved.

3. Issues With Regulatory Clarity and Consumer Understanding

One of the biggest risk indicators for any online trading platform is the clarity and strength of its regulatory status. Users should always know:

-

Which regulatory authority oversees the broker

-

Where the company is legally headquartered

-

Whether client funds are protected

-

How complaints can be escalated

If a platform’s regulatory information is difficult to locate, inconsistently presented, or confusing, that lack of clarity itself becomes a red flag. Even when a trading service claims to operate under a regulator, users should verify what that regulator covers—some jurisdictions offer minimal investor protection compared to others.

Platforms that serve traders in multiple countries without clear licensing for each region increase risks further. When regulatory ambiguity exists, consumers may have limited recourse if disputes arise.

4. Understanding High-Risk Trading Environments

Even in the best-case scenario with reputable brokers, trading CFDs and leveraged forex products is inherently risky. Losses can accumulate quickly, and inexperienced traders often underestimate the speed at which margin calls can occur.

Platforms sometimes promote these products as accessible or beginner-friendly, which can create a mismatch between user expectations and actual risk exposure. Negative experiences described online may partly stem from this misunderstanding.

However, when these high-risk environments combine with:

-

Poor communication

-

Pressure tactics

-

Withdrawal difficulties

-

Unclear pricing or fee structures

…the overall experience can feel predatory, even if the platform does not explicitly break laws.

5. Behavioral Red Flags to Watch for When Evaluating Any Platform

Below is a list of widely recognized indicators that consumers should examine when evaluating any online broker—not just XProMarkets.com. These red flags appear frequently in negative reviews across the entire trading industry:

a. Overly Persistent Sales Communications

Numerous unrequested calls, pushy agents, and pressure to deposit larger sums are indicators of a sales-first operation.

b. Lack of Transparent Terms

Withdrawal rules, fee structures, margin policies, leverage levels, and bonus conditions should be clearly spelled out. Vague or shifting rules may signal trouble.

c. Bonuses Linked to Withdrawal Restrictions

Some platforms offer trading bonuses. These often come with fine print requiring users to meet unrealistic trading volumes before funds can be withdrawn.

d. Confusing Platform Behavior

Unexplained losses, slippage without documentation, or inconsistent chart data may raise concerns.

e. Customer Support Evasion

If basic questions lead to conflicting answers or delays, it’s a sign that the platform does not prioritize user trust.

f. Difficult Account Closure

Some reviewers note challenges when trying to close their accounts or stop communications. A legitimate service should allow this easily.

6. How Traders Interpret These Red Flags With Respect to XProMarkets.com

People posting online about XProMarkets.com often point to one or more of the red flags above. The most emotionally charged reports typically revolve around withdrawal tensions and aggressive contact from representatives.

Consumers tend to perceive these issues as signs of unreliability, even if the platform disputes those characterizations. Once trust erodes—especially when money is locked up—users understandably become suspicious.

It’s worth noting that some traders also mention neutral or even positive experiences, illustrating that outcomes can vary widely. Nevertheless, when numerous complaints repeat similar themes, prospective users should take those patterns seriously.

7. Why Platforms With These Issues Continue to Attract New Users

Despite complaints, platforms with mixed reputations often continue to grow due to:

-

Attractive marketing and promotions

-

Lower entry barriers than traditional brokers

-

High leverage appealing to speculative traders

-

Outreach to regions where financial literacy resources are limited

Many novice traders underestimate the complexity and risk of CFD markets. Some assume losses or complications are “normal,” only later realizing that not all brokers offer the same level of fairness or transparency.

8. A Balanced Conclusion: Proceed With Caution and Informed Awareness

XProMarkets.com, like many online trading platforms that attract controversy, exists in a space where regulation, technology, and user expectations collide. While not every negative review is necessarily accurate or complete, the patterns of reported issues—withdrawal frustrations, communication concerns, and alleged pressure tactics—should not be ignored by potential users.

Before depositing with any platform, traders should:

-

Research regulatory details thoroughly

-

Understand all fees and conditions

-

Avoid decisions driven by pressure or urgency

-

Evaluate the transparency of customer support

-

Start with small amounts if they choose to proceed

The purpose of this review is not to label XProMarkets.com with definitive judgments but to highlight the risk signals and complaints frequently noted in public discussions. Anyone considering this platform, or any similar service, should do so with caution, skepticism, and a full understanding of the high-risk nature of leveraged online trading.

Conclusion: Report XProMarkets.com Scam to AZCANELIMITED.COM?

Based on all available data and warning signs, XProMarkets.com raises multiple red flags that strongly suggest it may be a scam. From its unregulated status to its anonymous ownership and unrealistic promises, this platform lacks the transparency and trustworthiness expected from a legitimate financial service provider.

REPORT THIS PLATFORM TO AZCANELIMITED.COM

If you’re thinking of investing through XProMarkets.com , extreme caution is advised.